A civil Society group says

government should not award tax exemptions considered “harmful” to

the country’s economy, URN reports.

The Southern and Eastern Africa Trade Information and Negotiations Institute

(SEATINI) says harmful tax exemptions cost the tax payer over 1.4 trillion

shillings during the 2017/18 financial year.

The 1.4 trillion shillings is more than a half of the money the needed to

finance the construction of oil roads in the Albertine region.

The government is currently seeking a Parliamentary approval of 1.7 trillion

shillings from the Export-Import (Exim) Bank of China for the upgrade and

Construction of National Oil Roads.

Regina Nanvuga, a program officer with Southern and Eastern Africa Trade

Information and Negotiations Institute (SEATINI) says the amount of money lost

could have been more if there was transparency in tax exemption.

Nanvuga says the routine exemptions through executive orders and tax laws as

part of efforts to attract investment and to promote industries.

Tax exemptions are provided for under section 21 of the Income Tax Act, the

Value Added Tax Act and the East African Customs Management Act (EACMA)

Nanvuga was presenting findings of a report title “Impact of Harmful Tax

Incentives and exemptions in Uganda”

The report produced with funding from Democratic Governance Facility(DGF). It

details some of the areas in which the government loss billions of shillings

because of harmful tax exemptions. It says tax payers both public and private

have not complied with their tax obligations.

It is feared that about 200 billion shillings was not collected. “Efforts

to recover the money has been blocked by the government. By January 2018, there

were about nine companies under this category” reads part of the report.

It also questions the exemption of the Army shop from income tax, on

construction materials that are also VAT exempted. The report says the

exemption on Savings and Cooperative Organizations (SACCOs) operated by the

Army, Uganda Revenue Authority, Parliament. Ministry of Finance among other

could led to loss of over 10 billion shillings in 2017/2018 financial year.

Uganda Revenue Authority Responds

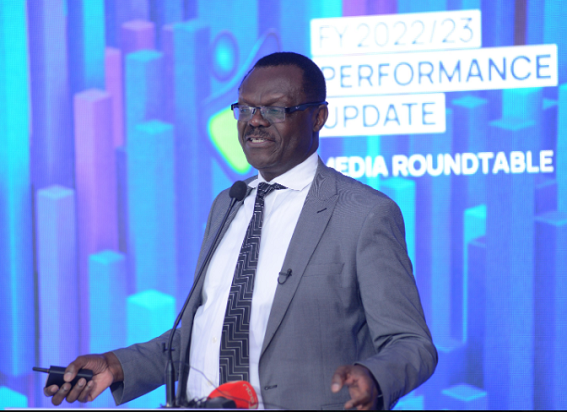

Nicholas Musoke, the Uganda Revenue Authority’s Supervisor in Charge of

Research and Policy Analysis says some of the exemptions have been

counterproductive to URA’s goals.

Part of the URA target has been to raise the tax to Gross Domestic Product

ratio to 18% but that has stagnated at about 14% over the years. Musoke says

the many tax exemptions have eroded the base for Uganda Revenue Authority to

collect taxes.

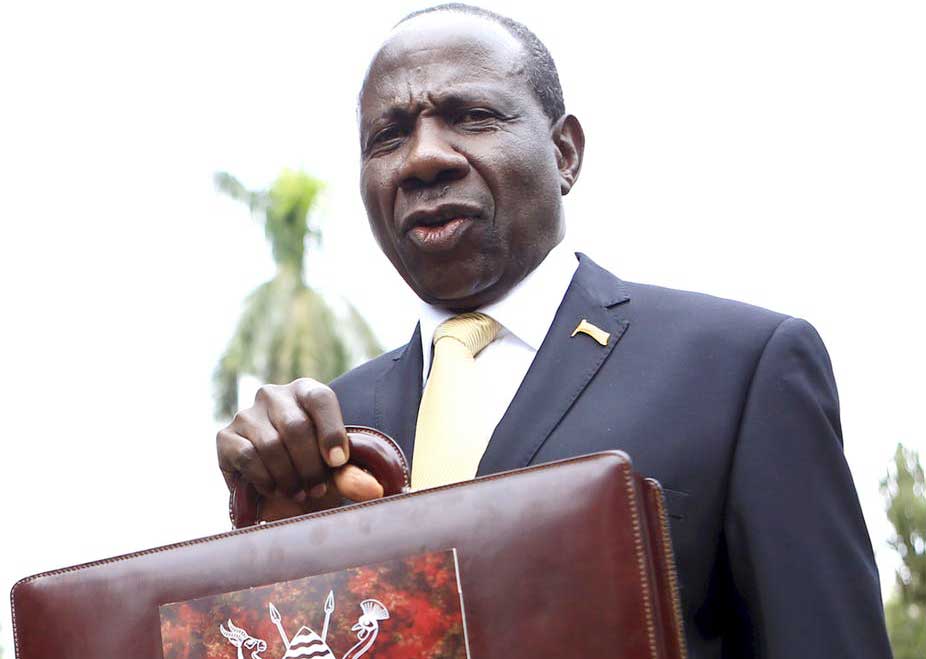

Ministry of Finance explains Moses Kaggwa, the Director of Economic Affairs says there is no way that

the government can do away with the tax exemptions saying it is one of the

incentives for attracting investments.

Uganda Manufacturer’s Association

Allan Ssenyondwa, the Manager Policy Advocacy at Uganda Manufacturer’s

Association. He says the question is not whether tax incentives are good or bad

but whether they are helping the country to develop. Ssenyondwa says the

problem why URA continues to collect law tax to the Gross Domestic Product (GDP)

He says thirteen million Ugandans contribute just one percent of the taxes of

the country while the industrial sector comprised of about two million people

contributes 24% of the taxes while the services sector with five million people

contributes 66% of the taxes.

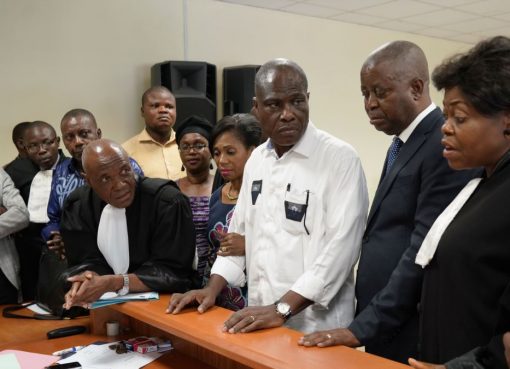

Parliament’s Role Ilukor Charles is representing Kumi County in Parliament. He also seats on

the Committee of Finance. He says sometimes Parliament has had a minimal says

about the tax exemptions because they are normally originated by the government

in consultations with Uganda Revenue Authority.

He agrees that the tax exemptions should be subject to clears scrutiny so as to

avoid their abuse by well-connected individuals and companies for tax avoidance

and planning purposes.

The findings come just after Parliament has authorized the waiver of over five

hundred billion shillings in tax exemptions. The waivers of tax lead to a

heated debate in Parliament and criticism among the civil society.

Some of the companies enjoying tax exemptions are Bujagali Power project,

Roofing Rolling Mills, Bidco Oil Refineries Ltd, Aya Investments Ltd, Steel and

Tube, Cipla Quality Chemicals, Uganda Electricity Generation Company Ltd, and

Uganda Electricity Transmission Company Ltd.

Also on the list tabled at Parliament’s Finance and National Economy Committees

include, Roofing Rolling Mills, Vinci Coffee Company Ltd, Liao Shen Industrial

Park, ASB Group of Companies, National Cement Uganda Limited, Southern Range

Nyanza among others.

Uganda Loses Shs1.4 Trillion In “Harmful” Tax Exemptions