Uganda Revenue Authority (URA) has rescinded its earlier directive ordering all banks and Forex bureaus to ensure that persons sending money outside Uganda in excess of Shs50m are cleared by the tax body.

In a letter dated 25th October 2019 to bank CEOs, Henry Saka, the URA Commissioner Domestic Tax, said that the move was aimed at implementing Section 134 (d) and regulations number 164 of the Income Tax Act that stipulates that a tax payer transferring in excess of 2500 currency points from Uganda to a place outside Uganda shall obtain a tax clearance certificate from the Commissioner.

“…The requirement is that before transferring any funds in excess of Shs50m from Uganda to a place outside Uganda, the above tax clearance certificate should be presented by your clients and verified for authenticity by yourselves,” URA’s letter to one of the bank CEOs read in part.

URA warned bankers that failure to comply with the obligations of the law is an offense.

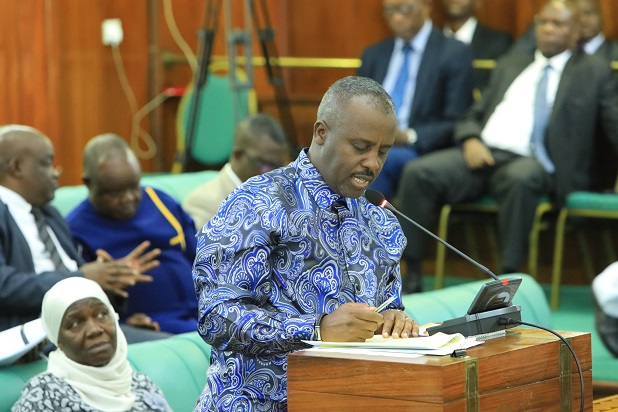

However, in a latest communication to banks, Doris Akol (pictured), the URA Commissioner General withdraws the earlier circular.

In a letter dated 31st October 2019 to banks, Akol says: “On further consideration and consultations, I hereby advise that compliance with the circular will no longer be a requirement at this time.”

The letter that is copied to the Minister of Finance, Governor Bank of Uganda, Director Supervision Bank of Uganda, Secretary to the Treasury and Uganda Bankers Association adds: “This communication supersedes the earlier one issued by the Commissioner Domestic Taxes.”