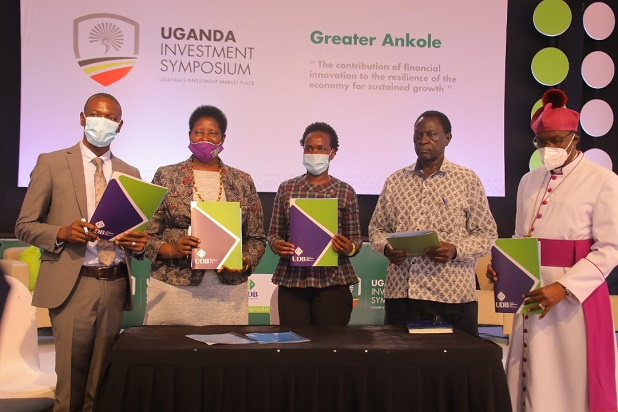

About six firms signed financing deals with UDB

Six companies have signed financial support deals with Uganda Development Bank (UDB).

The firms signed the deals during the Greater Ankole Investment Symposium at Kakyeka Stadium, Mbarara city on Wednesday.

Kazire Health Products, and Bishop Stuart University, were among the six lucky local innovators and business entities from Ankole sub region whose projects impressed UDB officials, thus selecting them to kick start the process of accessing funding from the government financial institution.

“I will describe it as a once in a life time opportunity! #KazireHealthProducts as a family benefited through numerous connections and partnerships. Tonight, we entered an MOU with UDB,” an excited Edward Kazire, a bio scientist and the brain behind Kazire products, said on Wednesday at the closure of the 3-day symposium.

The well attended symposium organized by Uganda Development Bank (UDB) and Operation Wealth Creation (OWC) under the theme “the contribution of financial innovation to the resilience of the economy for sustained growth” attracted not only local innovators, farmers and businessmen, but also heavy weights in the government finance and trade agencies such as Uganda Revenue Authority, Bank of Uganda, Uganda Investment Authority, National Planning Authority, Uganda Registrations Services Bureau among others.

The event sought to bring together Ankole business and innovation community, aimed at identifying business opportunities and building linkages that can enable a sustainable entrepreneurial ecosystem for Ugandans.

The Permanent Secretary in the Ministry of Finance, Planning and Economic Development Ramathan Ggoobi, who represented President Yoweri Museveni revealed that government intends to employ various modalities in order to revamp businesses ailed by drastic effects of Covid-19.

Mr Ggoobi told businessmen and women during the closure of the third Uganda Investment Symposium that President Museveni had asked him to remind Ugandans that he declared the 2021-2026 term ‘a kisanja’ of socioeconomic transformation”.

However, he said to end the Covid-19 impact on business activity and livelihoods, Government was investing in widespread vaccination to ensure the economy stays open.

“To support business and economic recovery, we are implementing a stimulus package to boost aggregate demand…”

Mr Ggoobi outlined various business entities and individuals that will reap big from government post Covid-19 recovery programmes mainly directed to farmers and other key innovators.

He said the stimulus package includes:

➡️Package for micro-businesses (sh260bn through Emyooga)

➡️Package for small businesses (sh200bn through small businesses recovery fund)

➡️Package for medium and large scale businesses (UDB)

➡️Package for households in subsistence (Parish Development model)

“Our efforts are targeted at ending the pandemic and supporting businesses to a quick recovery. We are investing in widespread vaccination so that the economy remains open.” Ggoobi said.

The coordinator of OWC General Salim Saleh had earlier said, “We (OWC) value our partnership with UDB, local government, civic and political leaders as it helps deliver solutions through a consultative and deliberate process that implements President #Museveni’s agenda and government policies to revive the economy.”

UDB Managing Director Patricia Ojangole stated that her bank’s objective at the symposium is intended to explore the investment environment in the Greater Ankole region and find solutions for the emerging markets, opportunities, and challenges that investors face.

“Stakeholder engagement and mobilisation remain crucial in the advancement of government initiatives to realise the much needed benefit for the people of Uganda. As UDB we are very deliberate about growing stakeholder value and financing key growth sectors of the economy while ensuring efficiency in our operations. This is one of the reasons why we have committed ourselves fully to this symposium,” Mrs Ojangole said.

Dr Robert Mwesigwa Rukaari, one of the key organisers of the symposium said the event has opened a window to revolutionise Agriculture, Manufacturing and tourism sectors in greater Ankore. He added that government greatly invests in such symposiums to raise public awareness of what is vital in fighting poverty and promoting societal transformation.

Government financing strategy:

UDB is a government-owned development bank, and with a mandate to facilitate social economic development in the country, through sustainable financial interventions.

Consistent with the mandate, the bank supports projects within the private sector that demonstrate potential to deliver high social-economic value in terms of job creation, increased production output, tax contribution and foreign exchange generation, among other outcomes.

Various farmers attested to obtaining funding from UDB, through following correct procedures, which was vital in their successful ventures and mitigating production challenges.

Claire Kabakyenga, the chairperson for Manyakabi Area Cooperative Enterprise, a women run business entity dealing in grain processing, situated in Isingiro district said the loan obtained from UDB helped them to increase input and crop finance, increasing productivity from 300kgs to 1000kgs of maize per acre, turnover increased to 68.4, and post-harvest losses reduced.

Mr Ggoobi said the government was determined to reorganize its priorities including focusing on education, finance and security. He said the first batch of government recovery funds are directed towards the youth, the Vulnerable and the active poor, who will access money through SACCOS, and other government initiatives like Emyooga.

He said through Emyooga, the government was targeting the financially excluded vulnerable groups and active poor, whose funds are channeled through Micro finance support centre.

“That’s the first package in our plan. To youths, the Emyooga funds, as well as the capitalisation of SACCOS to reach out to those who are usually excluded,” said Ggoobi.

He further explained that the government has put in place a small business recovery fund, of sh 200 billion shillings, which is accessible by small businesses, employing between 5 and 49 people.

He reiterated that the business to benefit are the ones with annual turnover of sh10 million and sh100m. “They must have been operational before Covid-19 hit,” the PSST emphasized.

He cautioned the congregation that it is not a fund for startups, rather a fund to support recovery of those businesses which were operational before March 2020, but were devastated by Covid-19, and now need to recover.

He also advised operators in the nighty economy, as well as those of small businesses engaged in agro-processing, and other value addition that were operational before Covid-19 to lobby for these funds, accessible through commercial banks.

He said the government wants to encourage formalization of businesses, as well as support companies that create jobs.

“Those who create jobs deserve to be supported, so this fund is there to support them, and you will access the money at 10% interest per year,” added Ggoobi.

He asked the medium and large scale businesses to embrace UDB funds. But demystified the thinking that the government has free money in its banks.

“People think they should go there and get the money, without proper books of accounts, or without due process, the due diligence taken, or being undertaken.”

Ggoobi underlined the fact that UDB has been capitalised and that the government shall continue capitalising it, to lend firms operating in the sectors of manufacturing, commercial agriculture, Agro-industries, tourism, human capital development, health and education, as well as infrastructure including ICT.

In this year alone, calendar 2020/ 2022, the permanent secretary revealed that they are trying to disburse over sh612 billion, to these businesses.

He further informed Ugandans that Bank of Uganda is also managing the agricultural credit facility, accessible by those engaged in commercial agriculture, as well as agro value addition.

“This money is disbursed through banks, and the total loan book has grown to over sh625 billion shillings, as at the end of last year. In addition, Uganda Development Corporation has also been capitalised, with nearly sh200 billion, in recent past, to co-invest with companies, operating in strategic businesses, in agro-industry, manufacturing as well as mineral beneficiation. This is an indirect way of bailing out such companies that have been hard hit by the pandemic,” he emphasized.

Lastly, he uncovered package 4 as one for the households that are in subsistence. Beginning with next year, 2022-23 the Parish development Model, that is being piloted in Bukedea Sub-region, will be fully implemented to support the 39% of Uganda households still in subsistence to join the monetized economy, according to Ggoobi.

The implementation of this model, he said, will Kickstart the full monetization of the economy.

Earlier during the day, Director credit for UDB Samuel Edem-Maitua joined the entity’s Chief Executive Officer Patricia Ojangole in highlighting how to access funds from the entity, without much difficulty.

He said following correct procedures, various entities can easily get funding from UDB.

Requirements:

1. Facility Application letter (on official company letterhead) and board resolution to borrow.

2. A copy of a detailed business plan and or a feasibility study with cash flow projections and projected financial settlements.

3. A copy of each of the last 3 years audited / drafted accounts from an ICPAU/BOU listed audited firm) for existing business

4. Full details of security proposed for the facility sought (where applicable)

5. Bank and Loan statement for the last 12 months (facility agreements for any existing facilities, with status)

6. Copy of National Environmental Management Authority (NEMA) certificate of Application and an environmental impact assessment report) where applicable.

7. Credit reference bureau report of the company and all its shareholders/ directors (where applicable) and / or CRB numbers.

8. Proof of NSSF compliance for companies employing more than 15 people.

9. Copy of investment license (where applicable).

10. Latest returns of Directors and shareholders.

11. Statutory licenses from relevant ministry/ GOU agency where applicable (schools, universities, mining, extraction, exporters, hospitals, power plants.