dfcu bank has recorded an impressive Shs127.6bn net profit in the year ended 31 December 2017, up from Shs46.2bn registered in 2016. This means that the profit increased by a record Shs81.4bn.

According to the bank’s financial statements released Thursday, dfcu bank registered impressive results on all key performance parameters save for the high Non-Performing Loans (NPLs) and bad loans written off. NPLs increased by Shs38.3bn to Shs96.6bn in 2017, up from Shs58.3bn in 2016, while bad loans written off rose to Shs27.2bn, up from Shs5bn in 2016. The high NPLs could have been inherited from Crane Bank.

The bank’s total expenditure also increased to Shs350.8bn in 207, up from Shs197.6bn in 2016.

Riding on Crane Bank acquisition that brought more high net customers, dfcu bank’s loans advanced to customers increased to Shs1.3 trillion, up from Shs834.8bn.

Customer deposits also increased to Shs1.98 trillion in 2017, up from Shs1.13 trillion a year earlier.

The bank’s total assets increased to a record Shs3 trillion, up from Shs1.7 trillion in 2016.

On a further positive note, dfcu’s core capital increased to Shs362bn in 2017, up from Shs188bn in 2016.

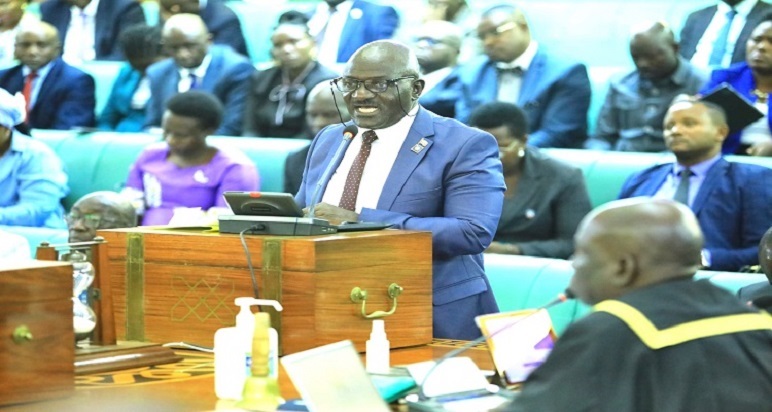

Headed by Juma Kisaame as Managing Director, dfcu acquired Crane Bank, the then 4th largest bank on February 27, 2017-at an undisclosed fee.

It should be noted that on October 20, 2016, BoU announced that it had taken over the management of Crane Bank Ltd after the bank became “a significantly undercapitalized institution.”

This followed Crane bank’s unexpected loss of Shs3.1bn in 2015, down from a net profit of Shs50.6bn in 2014.

The loss was attributed to high NPLs that increased by 122.9% in 2015. Crane Bank’s NPLs increased to Shs142.3bn in 2015, up from Shs19.36bn in 2014.

Late last year, dfcu indicated that certain assets and liabilities acquired from Crane Bank had been successfully integrated into their operations, a development that has seen the bank become one of the three top banks in Uganda.

Tough 2nd Half Of The Year

dfcu bank must have had a challenging 2nd half of the year. This is because it posted an impressive Shs114bn net profit in its half year results for 2017, up from Shs23.3bn in June 2016. This means that in the six months to December 2017 dfcu only made a net profit of Shs13.6bn.

The bank’s shareholders will soon be smiling to the bank after proposed dividends increased to Shs51bn, up from Shs18.5bn in 2016.

As of October 2017, the major shareholders of dfcu bank are; Arise BV (majority shareholder with 58.71% ownership), CDC Group of the United Kingdom (9.97%), National Social Security Fund (Uganda)-7.69%, Kimberlite Frontier Africa Naster Fund (6.15%), SSB-Conrad N. Hilton Foundation (0.98%), , Vanderbilt University (0.87%), Blakeney Management (0.63%), Bank of Uganda Staff Retirement Benefits Scheme (0.59%), Retail investors (11.19%) and two undisclosed Institutional Investors (3.22%).

Note: Business Focus will soon bring you deep analysis on dfcu’s high NPLs and what the results mean to the bank, its customers and the industry at large.