Kikagati hydro power project is a 14 megawatts venture located along River Kagera at the Uganda-Tanzania border.

The project attained financial closure last week, meaning that investors have agreed to invest a total of $87m (about sh320b) into development of the project.

Robert Kasande, the Permanent Secretary in the Ministry of Energy and Mineral Development has described Kikagati as a ‘special project’.

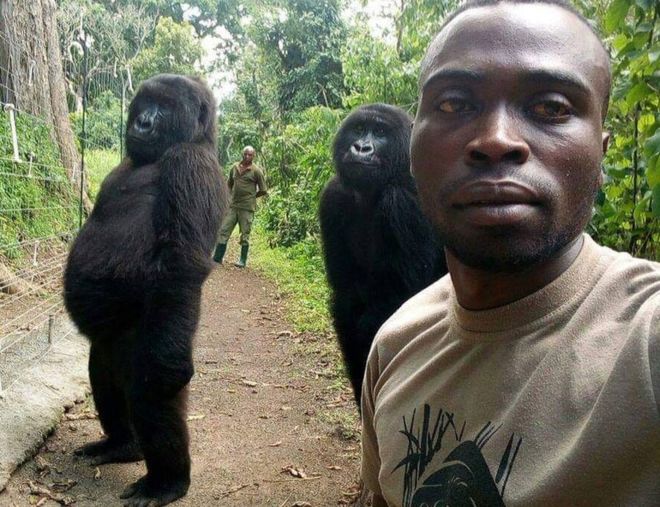

According to Aisha Naiga (in featured photo/Photo by Ronnie Kijjambu), a partner at ABMAK Associates and the project’s legal advisor on why it is special, the project’s logical conclusion was complex given the different laws and regulations governing Uganda and Tanzanian electricity industries.

Below are the excerpts of the interview with Naiga:

How special is this project?

Being located on a shared river, the project has contributed to better understanding of a shared river resource. Once commissioned, the power will be sold to Uganda Electricity Transmission Company Limited (UETCL) which will in turn sell half of the power to Tanzania Electric Supply Company (TANESCO).

This is because project infrastructure is located in both countries. As a result, regulatory framework in both countries has to apply on the project.

From an investor’s perspective, complying with laws from both countries means that the project is more risky than any other hydro power project in the country. This explains why a number of investors have previously abandoned the site.

Having signed mutual agreements in June, 2015, this was the first infrastructure project shared between Uganda and Tanzania. There had never been any incidence where these governments were negotiating terms of any infrastructure project and it was new experience for both countries.

You also have each of these countries catering for its people’s interests. You find that this project has to comply with local content policies both in Uganda and Tanzania.

During construction, there are challenges of moving labour across the borders. This is experienced in visa fees and permits.

What was your role in negotiating this project?

As a lawyer, our role was to facilitate the negotiation of the project documents from power purchase agreements, generation license, and the bilateral agreement between Uganda and Tanzania, among others.

These agreements were negotiated between agencies from both Uganda and Tanzania like Uganda Electricity Transmission Company Limited (UETCL) and TANESCO, Electricity Regulatory Authority in Uganda and Energy and Tanzania’s Water Utilities Regulatory Authority (EWURA). The generation license was issued by ERA in consultation with EWURA. This explains why this is a complex project.

The legal negotiations were led by ABMAK Associates and this is in line with the recent statement made by Simon Peter Kinobe, the president of the Uganda Law Society, that Ugandan lawyers have the capacity to negotiate these projects.

As Ugandan lawyers, we are ready to provide lead counsel on these infrastructure projects. There are many projects that we have worked on without international counsel like Achwa project of 83MW capacity, one of the biggest privately developed projects in Uganda.

How will the project be financed?

The project will be financed by both equity and debt. The African Renewable Energy Fund, the project owners, have equity (internal funding) worth $33m while creditors of East African Infrastructure Fund (EAIF) and FMO, a Dutch development bank are each providing $27m to make a total cost of $87m.

Currently, the project developers have been employing their equity. Now that they have achieved financial close, we believe it is going to move even faster. The project is expected to be commissioned in September next year.