Uganda Revenue Authority (URA)’s tax societies in Universities and tax clubs in Secondary Schools are inculcating a taxpaying culture into the students who are the future of Uganda.

This is done through debates that generate ideas that are useful to tax compliance. Considering the fact that youth make the biggest population of Uganda, it is hoped that tax clubs in Universities will help create a tax alert generation.

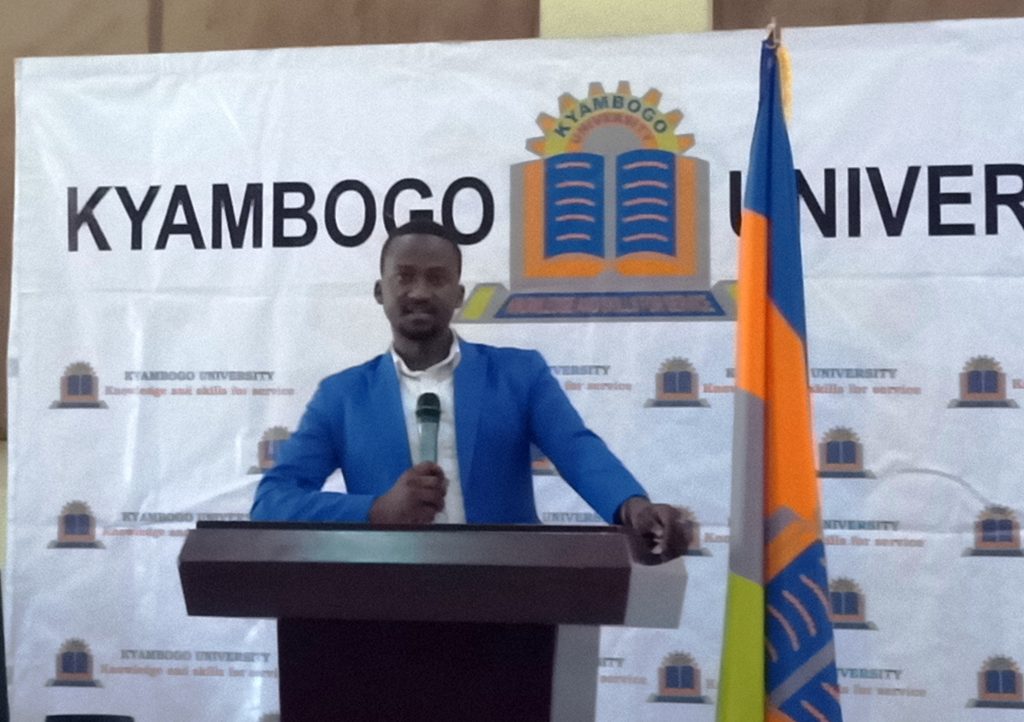

Speaking at a tax debate at Kyambogo University held on Thursday afternoon, Ian Rumanyika, the Manager- Public and Corporate Affairs at URA, said the tax body’s domestic revenue mobilization takes into account the youth who are projected to be future business leaders.

He said that as they engage students as potential taxpayers, they sensitize them on issues of tax compliance.

“The potential majority of taxpayers are the young people; the domestic revenue mobilization includes the young people who are the future king makers in business. The debates in universities have amazing tax solutions that can shape policy. These students do research and compare with other universities,” Rumanyika (pictured above) said.

He added that URA has got 24 University societies and 53 secondary school clubs where they are reaching out to students and teachers whom, he says have become tax Ambassadors in their communities.

The President of Kyambogo University Debate Society, Joseph Tahinduka, said that after URA formed the Kyambogo University Debate Society, Kyambogo University together with other universities in Uganda and the East African region like Kiisi University in Kenya, initiated the inter faculty tax debates aimed at educating the youth about tax issues so as to change their mind sets to own their tax obligations in future.

“The main objective of the debates is to make the youth know that tax is their own obligation not the government. The youth need to understand that aid from donor countries is not enough and that it has conditions attached. Therefore we have to generate more income locally,” Tahinduka said.

The theme of the tax debate was “Harnessing the tax potential of the digital economy”.

In the debates, issues discussed include whether government should tax online companies who have a physical presence locally and whether youth led businesses should be exempted from paying tax.

By Drake Nyamugabwa