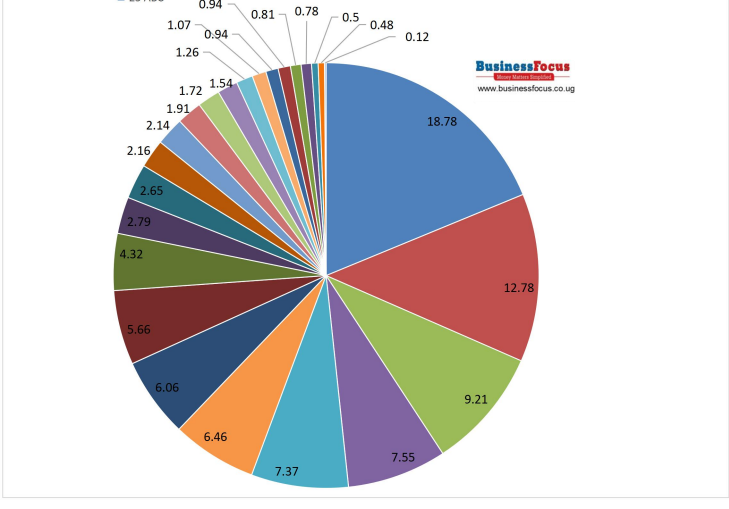

A pie chart showing banks with largest and smallest assets

Total assets for Uganda’s 25 banks increased by 342% to Shs49.51 trillion in 2023, up from Shs45.45 trillion recorded in 2022, Business Focus exclusively reports.

According to results exclusively analyzed by Business Focus, the top 10 banks control 80.98% of the total industry assets, leaving 15 banks to share a paltry 19.02%.

For the past eight years, this website has exclusively analyzed the performance of banks based on their financial statements.

This website interprets and reports these financial statements in a simple and easy-to-understand manner.

This helps customers, partners and stakeholders of these financial institutions to know how their banks performed and help them make informed decisions.

The analysis is also important for students with a bias in banking finance as well as policy makers.

ALSO READ: EXCLUSIVE: Uganda’s Banks Post Shs1.4 Trillion Profit As The Top 10 Control 92% Of The Market

Asset-Share

Largest Banks by Assets

Like on most key performance indicators, Stanbic Bank leads on this category.

This is after its assets grew by 2.67% to Shs9.3 trillion in 2023, up from Shs9.058 trillion recorded a year earlier. This gives the bank a market share of 18.78% under the assets category.

It’s closely followed by Centenary Bank, an indigenous bank headed Fabian Kasi as Managing Director.

Centenary’s assets grew by 10.66% to Shs6.33 trillion in 2023, up from Shs5.72 trillion in 2022. Its market share under the assets category is 12.78%.

In third position is Absa Bank whose assets grew by 7.8% to Shs4.56 trillion in 2023 from Shs4.23 trillion in 2022.

This gives the bank a market share of 9.21% under the assets category.

Equity Bank is the 4th largest bank by assets as of 31st December 2023. The bank’s assets grew by 10.98% to Shs3.74 trillion in 2023, up from Shs3.37 trillion in 2022. This gives the bank a market share of 7.55% under the assets category.

It’s followed by Standard Chartered in 5th position. However, its assets reduced by 3.69% to Shs3.65 trillion in 2023, down from Shs3.79 trillion in 2022. Its market share under this category is 7.37%.

Like on other key parameters, a few top banks continue to dominate the sector. Under the assets category, the top five banks control 55.69% of the market.

It’s important to note that the top five most profitable banks control a commanding 74.76% of the market under the profits category. This means the rest of the banks (20) share a paltry 25.24% of the market under the profits category.

dfcu Bank is the sixth largest bank by assets as of 31st December 2023. This is after its assets reduced by 2.44% to Shs3.2 trillion in 2023, down from Shs3.28 trillion in 2022. The bank’s market share under this category is 6.46%.

It’s followed by DTB Uganda in seventh position. This is after its assets grew by 23.97% to Shs3 trillion in 2023, up from Shs2.42 trillion in 2022. This gives the bank a market share of 6.06% under this category.

Bank of Baroda is the 8th largest bank by assets in Uganda.This is after its assets increased by 15.23% to Shs2.8 trillion in 2023, up from Shs2,43 trillion recorded a year earlier. Its market share is 5.66% under this category.

Housing Finance Bank, a another indigenous bank performing well, is the 9th largest bank by assets in Uganda as of 31st December 2023. Its assets grew by 32.92% to Shs2.14 trillion in 2023, up from Shs1.61 trillion in 2022. Its market share under the assets category is 4.32%.

Citibank Uganda completes Uganda’s top 10 largest banks by assets with a market share of 2.79%. This is after its assets reduced to Shs1.38 trillion in 2023, down from Shs1.45 trillion in 2022.

All the top 10 banks have assets above Shs1 trillion.

Other banks outside the top 10 with assets above Shs1 trillion include KCB (Shs1.31 trillion), PostBank (Shs1.07 trillion) and Bank of Africa (Shs1.06 trillion).

There are five banks with assets between Shs500bn and Shs950bn as of 31st December 2023.

These include I&M Bank (Shs944.48bn), NCBA (Shs853.9bn), Ecobank (Shs760.15bn), UBA (Shs623.09bn) and Exim Bank (Shs527.6bn).

Smallest banks by assets

ABC Capital Bank has the smallest assets in the market. Its assets reduced to Shs59.1bn in 2023, down from Shs62.14bn in 2022.

Second from the bottom is Opportunity Bank whose assets reduced by 25% to Shs237.03bn in 2023, from Shs261.95bn in 2022. It’s followed by Guaranty Trust Bank after assets reduced to Shs249.64bn in 2023, down from Shs251.1bn in 2022.

It’s important to note that some banks are struggling to meet Bank of Uganda’s new minimum capital requirements of Shs150bn. Three commercial banks including ABC Capital Bank (U) Ltd, Opportunity Bank and Guaranty Trust Bank (U) Ltd have already failed to meet the new capital requirements and will downgrade from a Tier I Commercial Bank License to a Tier II Credit Institution License effective July 1, 2024.

Guaranty is followed by Tropical Bank whose assets increased by 36.67% to Shs384.07bn in 2023, from Shs281.03bn in 2022.

Other banks with small assets include Cairo Bank (Shs403.01bn), Bank of India (Shs464.49bn) and Finance Trust Bank (Shs465.46bn).

Check for more details about banks with largest and smallest assets;

Assets

We’ll continue giving you unmatched analysis about the performance of banks in 2023 and beyond. For tips, opinions and advertising, Tel: 0775170346/0703828741/staddewo@gmail.com. Follow us on Twitter: @TaddewoS @BusinessFocusug