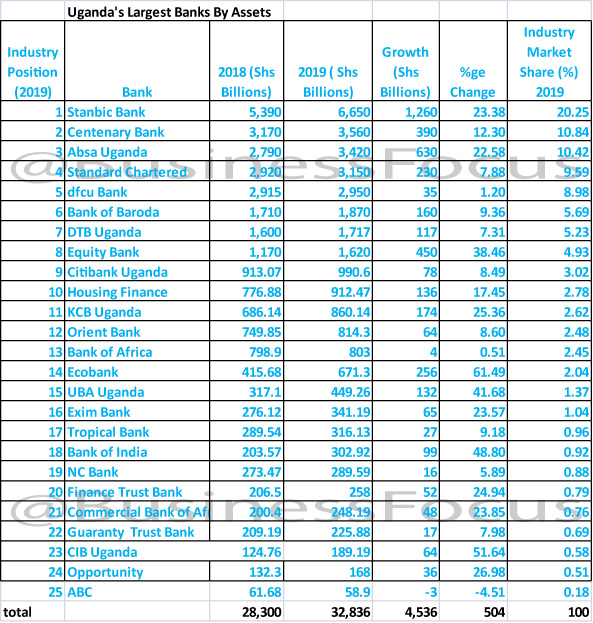

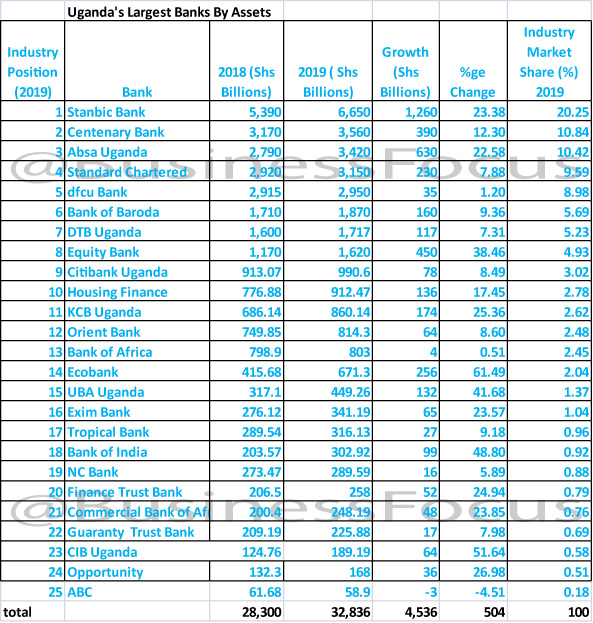

Uganda’s banking industry assets grew to Shs32.83 trillion in 2019, up from Shs28.3 trillion recorded in 2018, according to 2019 financial results.

This further signal that the sector had fully recovered from the toxic effects of the 2011 post election crisis but the gains are likely to be battered by the COVID-19 pandemic that has paralyzed business across the globe.

In this exclusive analysis by Business Focus based on 2019 financial statements released by banks between March and May 2020, you will know the share your bank has out of the Shs32.83 trillion worth of assets.

ALSO READ:

2019 RESULTS OUT: Most Profitable, Loss-Making Banks Revealed

40 Women In Top Banking Positions Named

Uganda currently has 26 banks but this analysis captures only 25 given the fact that Afriland First Bank Uganda Limited joined the Ugandan market effective September 12, 2019.

Top 10 largest banks by assets

According to the results, Stanbic Bank that is headed by Anne Juuko as CEO retained its number one position as the largest bank in Uganda by assets. Its total assets increased by 23.3% to Shs6.65 trillion in 2019, up from Shs5.39 trillion recorded in 2018, giving it an industry market share of 20.25%.

In second position is Centenary Bank whose assets increased by 12.3% to Shs3.56 trillion in 2019, up from Shs3.17 trillion recorded a year earlier. Its market share under this category is 10.84%.

Centenary that is now giving headache to Stanbic is headed by soft-spoken Fabian Kasi as CEO.

Absa Uganda (formerly Barclays) that is headed by Mumba Kalifungwa as Managing Director is Uganda’s 3rd largest bank by assets. It kicked Standard Chartered Bank out of this position.

Absa’s assets increased by 22.58% to Shs3.42 trillion in 2019, up from Shs2.79 trillion recorded the previous year. Its market share under this category is 10.42%.

Standard Chartered is now in 4th position. Headed by Albert Saltson as CEO, StanChart as it is commonly known saw its assets grow by 7.8% to Shs3.15 trillion in 2019, up from Shs2.92 trillion recorded a year earlier.

Consequently, its market share reduced to 9.59% from 10.42%.

In 5th position is dfcu whose assets increased slightly by 1.2% to ShsShs2.95 trillion from Shs2.915 trillion. Headed by Mathias Katamba as Managing Director, dfcu’s market share under this category is 8.98%.

What is shocking is that the top five boys on the table control more than half (60.08%) of the total industry assets.

The other five that complete the top 10 largest banks by assets in Uganda are; Bank of Baroda (Shs1.87 trillion), DTB Uganda (Shs1.71 trillion), Equity Bank (1.62 trillion), Citibank (990.6bn) and Housing Finance (Shs912.47bn).

From the above analysis, it’s clear that Centenary and Housing Finance Bank are the only indigenous banks that make it to the top 10 largest banks in Uganda by assets.

Housing Finance whose assets increased from Shs776.88bn in 2018 to Shs912.47bn in 2019 is headed by Michael K. Mugabi as Managing Director.

The top 10 banks control 81.7% of the total industry assets. This means the rest (15 banks) share the remaining 18.3%.

The other banks whose market is above 1% include KCB (2.62%), Orient (2.48%), Bank of Africa (2.45%), Ecobank (2.04%), UBA (1.37%) and Exim Bank (1.04%).

From the above six banks, Ecobank that is headed by Clement Dodoo as Managing Director registered the biggest growth of 61.49%. Its assets increased to Shs671.3bn in 2019, up from Shs415.68bn in 2018.

Banks whose industry market share under the assets category is below % include; Tropical Bank, Bank of India, NC Bank, Finance Trust Bank, Commercial Bank of Africa, Guaranty Trust Bank, Cairo International Bank, Opportunity and ABC.

Worth noting also is that out of the 25 banks, only three are headed by female CEOs; Anne Juuko of Stanbic, Sarah Arapta of Citi bank and Annet Mulindwa Nakawunde of Finance Trust Bank.

For more details, check our table indicating banks with largest and smallest assets in Uganda as of December 2019.

For tips, advertising or feedback, reach out to us via staddewo@gmail.com/0775170346, follow me @TaddewoS @BusinessFocusug for further unmatched analysis on Uganda’s banking sector and the economy at large.