Shareholders of Tropical Bank Uganda Ltd will not be smiling to the bank again after their bank posted losses for the third consecutive year.

According to the bank’s financial statements for the year ended 31st December 2018, Tropical Bank losses increased by 4.9% to Shs5.78bn in 2018, up from Shs5.52bn recorded in 2017.

In 2016, the troubled financial institution made a loss of Shs13.4bn.

A critical look at Tropical bank’s results for the last five years indicate that the financial institution still has a long way to go in as far as recording profits sustainably is concerned.

Most of the bank’s key performance indicators in 2018 weren’t positive.

It wrote off bad loans amounting to Shs17bn in 2018, up from Shs12bn in 2017.

Considering the fact that the bank has been grappling with high Non-Performing Loans (NPLs), Tropical bank was cautious with lending in 2018.

This saw loans advanced to customers reduce to Shs128.73bn in 2018, down from Shs139.14bn registered in 2017. This represents a reduction of 7.48%.

However, the bank’s total assets increased slightly to Shs289.54bn in 2018, up from Shs283.1bn in 2017.

Customer deposits also increased to Shs182.6bn in 2018, up from Shs166.6bn recorded a year earlier.

Additionally, NPLs reduced to Shs21.9bn in 2018, down from Shs28.73bn in 2017.

The loss can also be attributed to increased expenditure that increased to Shs48.96bn in 2018 up from Shs44.69bn in 2017.

Total income also reduced to Shs39.73bn in 2018, down from Shs41.1bn recorded a year earlier.

In terms of capital position, Tropical Bank’s core capital reduced to Shs27.75bn in 2018, down from Shs43.97bn.

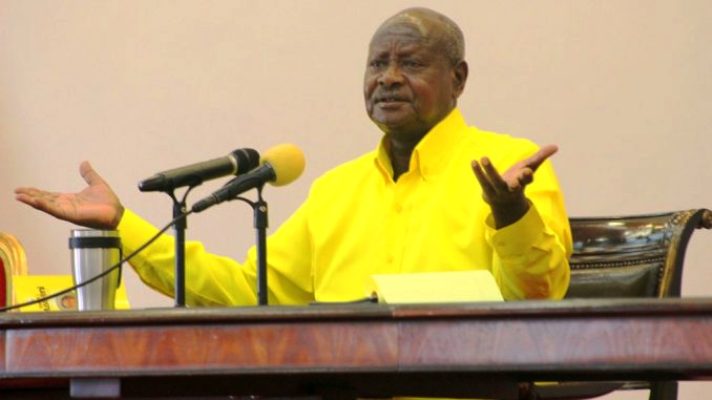

Tropical Bank is currently headed by Dennis M. Kakeeto (in featured photo) in Acting Capacity as Managing Director.

Kakeeto replaced Sameh M. Krekshi, who was fired last year on orders of Bank of Uganda.

According to the termination letter dated October1, 2018, Gerald M. Ssendaula, the Bank’s Board Chairman accused Krekshi of overdrawing his account contrary to BoU regulations.

“It is within your knowledge that during the on-site examination of Tropical Bank Ltd for the year 2017, Bank of Uganda established that your account was continuously overdrawn,” the termination letter read in part.

It added: “The Central Bank recently conducted a follow up examination and established that the anomaly was never rectified as the overdrawn position was only regularized as recently as 12th September 2018, three months after the same was highlighted to the Board of directors.”

Kakeeto has an arduous task of turning around this financial institution this financial institution that is apparently plagued by many problems.

Our detailed analysis on Tropical Bank’s performance to follow…