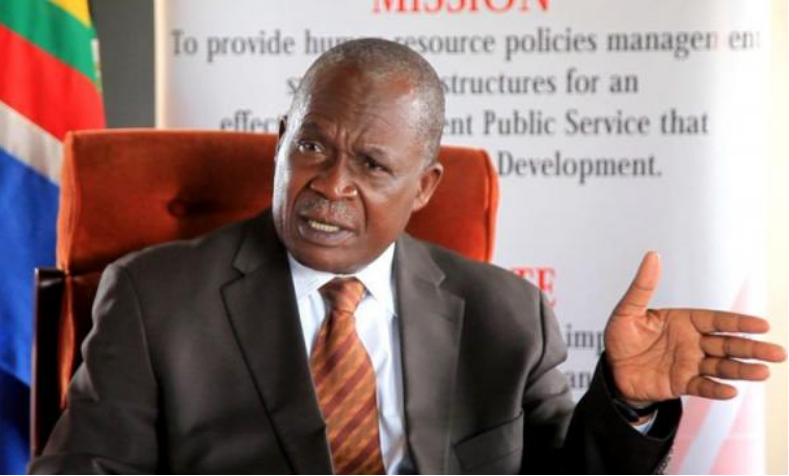

NSSF Acting Managing Director, Patrick Ayota

The National Social Security Fund – NSSF Uganda is on track to achieve its key performance targets for the Financial Year 2022/2023 after its contributions collections and realized income grew by 22% and 17% respectively for half year as at the end of December 2022, the acting Managing Director Patrick Ayota announced Wednesday.

According to Ayota, the half year contributions collected by the Fund increased to Shs 786 billion, compared to Shs 643 billion over the same period last Financial Year. Ayota says the growth is driven by higher interest rates on fixed income investments.

While addressing the media in Kampala on the Fund’s half-year performance at Workers House in Kampala, Ayota said: “This half-year performance, which is better than what we achieved over the same period in the previous Financial Year puts us in a very good position to achieve out 2022/2023 targets. It also shows that our members – both employers and workers have trust in the Fund as their social security and savings partner.”

During the period under review, the Fund registered 2, 078 employers and 67, 277 contributors respectively over the last 6 months.

The fund asset size also increased from Shs 17. 65 trillion in July 2022 to Shs 17. 88 trillion in December 2022. Although the rate of growth reduced compared to the same period last Financial Year, Ayota says the reduction is attributed to increased benefits payout.

Figures show that the NSSF paid Shs 712 billion over six months in December 2022 compared to Shs 364 billion over the same period in the previous Financial Year.

“The increase in benefits payments does not surprise us because this is the trend in the first half of the year because qualifying beneficiaries tend to wait for interest rate declaration at the end of September every year before they submit benefits claims. That is why in the month of October and November following interest declaration, we paid Shs 217. 9 billion and Shs 208.6 billion respectively,” Ayota added.

He allayed savers’ fears following recent reports of probe in the Fund saying savers’ money is as safe as it was 2, 3 , 4 or 5 years ago.

“Despite the on-going noise, members were still keeping their money with us,” Ayota said.

NSSF’s 2022/23 Financial Year projections stand at 1.6 trillion growth and expects to earn Shs 1.9 trillion in realized income (a form of direct cash flow from the underlying assets, while unrealized income is in the form of appreciation in the value of the assets) with a targeted asset base of 18.9 trillion by the end of 2023 FY.