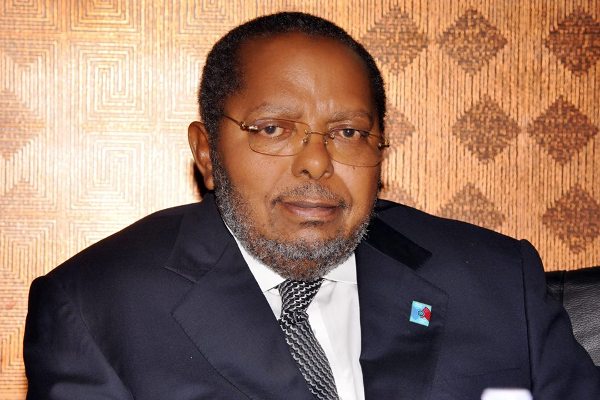

The Bank of Uganda (BoU) Governor, Prof. Emmanuel Tumusiime-Mutebile has expressed concern over the high interest rates charged by commercial banks even when the Central Bank Rate (CBR), a benchmark lending rate for the banks has been below 10% for a long time.

Currently, the average lending rate charged by commercial banks is 19%.

“… we have experienced a major problem where the interest rates charged by financial institutions remain stubbornly high. Commercial banks’ lending rates have remained high even when the BoU successfully keeps the rate of general price increases tightly controlled and goes further to reduce the official interest rate – the Central Bank Rate – that should influence the direction and level of lending interest rates in a bid to make loans from banks cheaper,” Mutebile said.

The Governor made the remarks on Thursday during Fort Portal Town Hall Meeting held at Kalya Courts.

He however said there are some measures that have been undertaken by the Government together with BoU, and even among the financial institutions, which are aimed at reducing the costs of loans.

He mentioned the introduction of National Identity Cards and financial cards, which enable the banks to identify the good borrowers who deserve lower interest rates based on their good reputation of paying back borrowed funds.

Also, the BoU requires that all borrowers are fully aware of the costs and conditions of the loans; and that customer complaints are resolved well by the banks.

He further revealed that Government established a fund for supporting farmers who significantly improve their products, keep good records, and have a sound banking relationship with a financial institution to access money at a low interest rate thatis considerably below those charged by commercial banks. The fund is known as the Agricultural Credit Facility (ACF).

“It is administered by the BoU, but farmers who wish to access this facility must apply through their commercial banks,” he said.

Furthermore, he said, the banking laws were recently amended to cater for Islamic banking and agent banking, both of which are ways to making financial services more affordable and much easier to access.

“Specifically, agent banking offers a lot of promise in broadening access to banking services in this region, which has less bank branches than other urban areas,” he said.

Also, the Government has encouraged the development of other financial institutions such as savings and credit cooperatives (SACCOs), accumulating and savings credit associations (ASCAs), rotating and savings associations (ROSCAs), and several other micro finance institutions, by establishing cabinet level oversight of the sector, instituting a support centre, enacting an enabling law together with a regulatory regime under the Uganda Microfinance Regulatory Authority (UMRA).

“All these initiatives are intended to improve access to financial services for people at different levels. Nevertheless, there remains room to work on reducing the high interest rates that are prevailing,” he said.

Mutebile further noted that the BoU is mandated to promote and maintain the stability of the value of the currency of Uganda.

“This means that it’s our duty to preserve the purchasing power of money by ensuring that the rate at which prices of the things that the average household buys changes across time, which we call the rate of inflation, is low and stable,” he said.

He explained that the Central Bank strives to ensure that prices in the markets and shops do not jump up and down in a manner that makes it hard to predict the amount of money required to buy things in the shops and markets tomorrow or in the near future.

“If the money required for buying things from their markets and shops keeps going higher and higher from one day to another, then those who earn less or fixed amounts of money would soon fail to afford a living,” he said.

He added that the average rate of change of general prices across the country has been maintained at levels that are comfortably below 10 percent for several decades now; and the Bank will ensure that the average rate of price changes from one year to another is maintained at around 5 percent in the future.

“We are committed to ensuring that the rate of price increases is so low and stable for so long that our people do not worry about sharp price increases when making decisions related to their money,” he said.