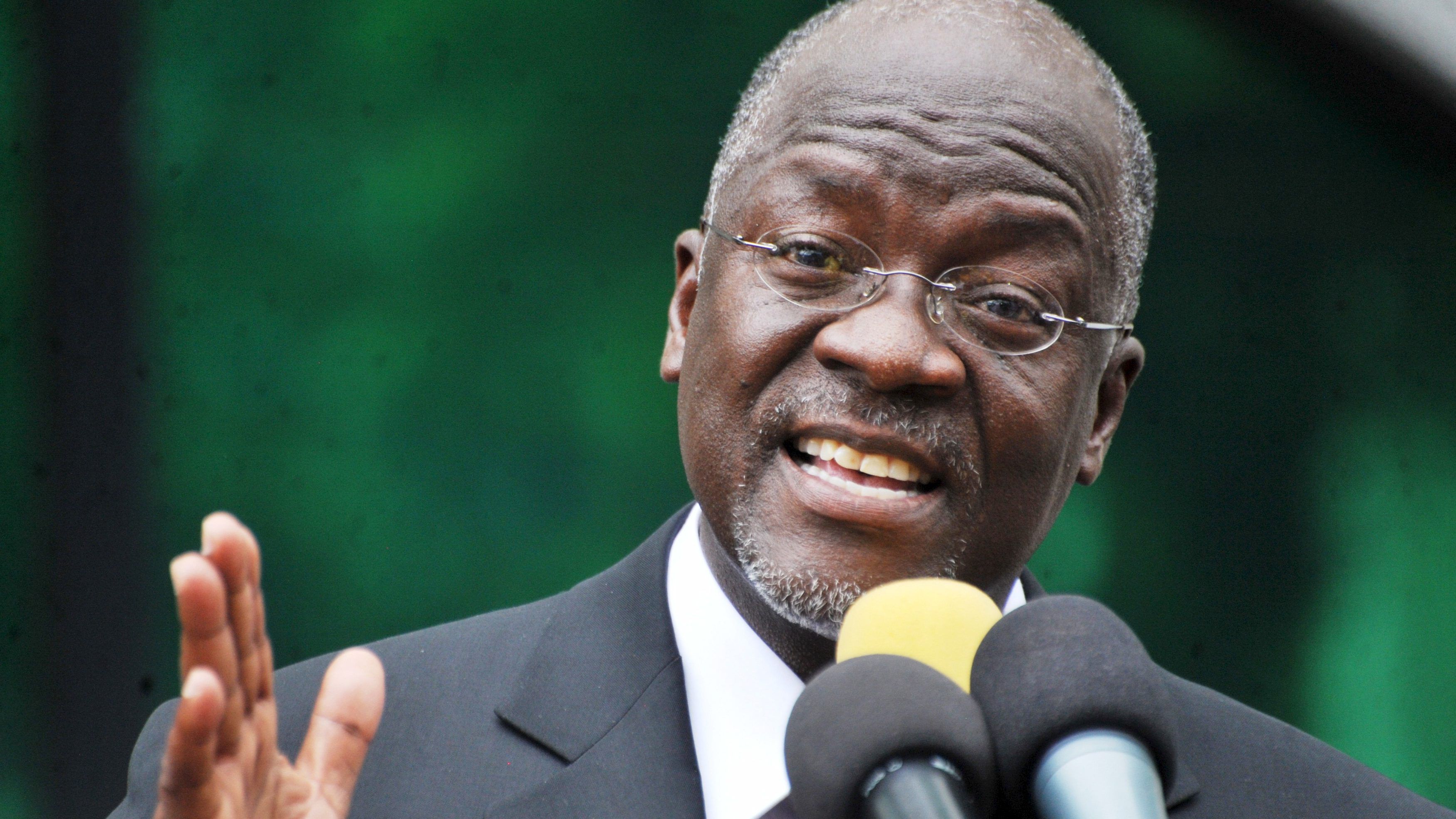

The International Monetary Fund (IMF) Managing Director Kristalina Georgieva (pictured) said during her speech going into the IMF’s 2020 Spring Meetings yesterday that the Fund is working 24/7 to support our member countries—with policy advice, technical assistance and financial resources. In this FAQ: The IMF’s Response to COVID-19 , you will find the Fund’s response to COVID-19 in more detail.

What is the Fund doing to help countries during the coronavirus crisis?

The Fund’s priority has been to respond to the extraordinary spike in requests for emergency finance, so countries can implement the necessary policies to protect the health of their people as well as their economies. The IMF has the following facilities and instruments to help countries respond to the economic impact of the coronavirus.

– Emergency financing. The recent increase in access limits on its emergency financing facilities will allow the IMF to meet the expected demand of $100 billion. The Rapid Credit Facility (RCF) and Rapid Financing Instrument (RFI) provide emergency financial assistance. The RCF is interest-free and available to low-income members, while the RFI is available to all Fund members. Financing under the RCF and the RFI can be disbursed very quickly to assist member countries in implementing policies to address emergencies such as the coronavirus.

– Grants for debt relief. The Fund also has a Catastrophe Containment and Relief Trust (CCRT), which provides upfront grants to cover, on behalf of eligible low-income countries, their debt service obligations to the IMF. This facility was used to support Guinea, Liberia, and Sierra Leone during the 2014 Ebola outbreak. In a direct response to the COVID-19 pandemic, the CCRT was recently enhanced to provide urgent debt service relief to the world’s poorest and most vulnerable countries, thereby freeing up scarce resources for medial spending and health-related and other immediate needs during the pandemic. A fundraising effort is underway to replenish the CCRT so that it can provide debt service relief for up to two years.

More broadly, IMF member countries can also draw on the Fund’s overall firepower of $1 trillion by requesting new financing arrangements or augmenting existing financing arrangements. Working closely with its development partners—World Bank, World Health Organization, and many regional institutions —and other health officials, the Fund continues to provide timely policy advice, technical assistance, and financial support to its member countries.

What economic policy actions can countries take to address this crisis?

The IMF welcomes the decisive actions countries have already taken to address this health crisis and to cushion its impact on the economy. Countries around the world have put in place fiscal measures amounting to about $8 trillion.

Fiscal policy actions taken by several countries could serve as a useful guide for others. For instance: households and businesses hit by supply disruptions and a drop in demand could be targeted to receive cash transfers, wage subsidies and tax relief, helping people to meet their needs and businesses to stay afloat. For those laid off, unemployment insurance could be temporarily enhanced, by extending its duration, increasing benefits, or relaxing eligibility. Where paid sick and family leave is not among standard benefits, governments should consider funding it to allow unwell workers or their caregivers to stay home without fear of losing their jobs during the epidemic.

Another encouraging sign has been the rapid pace with which central banks moved to ease monetary policy. Providing ample liquidity to banks and nonbank finance companies—particularly to those lending to small- and medium-sized enterprises, which may be less prepared to withstand a sharp disruption—is critical at this stage. Governments could also offer temporary and targeted credit guarantees for the near-term liquidity needs of these firms. Similarly, financial market regulators and supervisors could also encourage, on a temporary and time-bound basis, extensions of loan maturities.

To support information exchange and international cooperation, the Fund recently launched a policy actions tracker that provides updates on fiscal, monetary and financial policy actions taken by countries around the world in recent weeks.

The pace of economic recovery will depend on policies undertaken during this crisis. If policies ensure that workers do not lose their jobs, renters and homeowners are not evicted, companies avoid bankruptcy, and business and trade networks are preserved, the recovery will occur sooner and more smoothly. For countries that do not have the fiscal space to undertake these measures, the Fund stands ready to support these countries through different lending facilities (as noted above).

What is the impact of coronavirus on the global economy?

The Fund will provide its updated assessment of the global economy when it launches the World Economic Outlook report on April 14. What has become clear, however, is that we have entered a recession as bad or worse than in 2009. The extent and the impact of this recession and the nature of the partial recovery expected in 2021 will depend crucially on two things: our collective ability to contain the spread of the virus and the measures put in place to support households and business to stay afloat and to prevent a liquidity issue from turning into a solvency problem.

Many countries have taken extraordinary steps and far-reaching measures to save lives and safeguard economies, and to set the stage for recovery. Countries around the world are estimated to have implemented fiscal support amounting to about $8 trillion. These measures include increased health outlays and targeted fiscal support. Central banks have also moved rapidly to ease monetary policy and provide essential liquidity.

Supporting emerging market and developing countries is an urgent priority. They are already more economically vulnerable that the advanced economies—and now particularly hard hit by a lack of medical supplies, a sudden stop of the world economy, capital flight and, for some, a sharp drop in commodity prices.

How many countries have requested assistance?

The Fund has received over 90 emergency financing requests or expressions of interest as of April 9, 2020. Roughly 60 percent of which are low-income countries and 40 percent are from emerging markets.

Our current estimates of the countries that could potentially need emergency financing suggests demand for emergency financing of around USD 100 Billion of which USD 50 billion is already under active consideration. This estimate of demand is subject to considerable uncertainty. In particular, demand for new IMF financing arrangements involving Fund-supported programs (rather than emergency financing involving outright purchases and disbursements) could lead to rapidly higher demand in the months ahead.

How fast can you provide emergency financing?

After a country has formally requested support, staff assesses qualification requirements, work with the authorities to prepare a letter of intent, and prepare a staff report for the IMF Executive Board. We have streamlined our internal review processes and expect to be able in many cases to make financing available within weeks after a request for emergency financing.

What do countries need to do to qualify for emergency assistance?

Any IMF member may apply for emergency assistance. There are some requirements for support under the Rapid Credit Facility (RCF) and Rapid Financing Instrument (RFI), including that the county’s debt is sustainable or on track to be sustainable, that it has urgent balance of payments needs, and that it is pursuing appropriate policies to address the crisis. We also take into account any debt restructuring operation underway and its prospects for success, which underscores the importance of every stakeholder making an effort to support countries in distress.

For countries that have existing Fund arrangements in place, it may be appropriate to augment and/or rephase access under the arrangements, or in cases where that may not be feasible to do on a timely basis, they may request support under the RCF or RFI.

How is the IMF helping low-income countries struggling to service their debt?

The IMF Managing Director, along with the President of the World Bank, recently called on official bilateral creditors to temporarily suspend debt payments from the world’s poorest countries. The Managing Director also re-emphasized this at a recent G20 call .

At the IMF itself, the Catastrophe Containment and Relief Trust (CCRT) provides the Fund’s poorest and most vulnerable members with grants for relief on IMF debt service. The Fund recently took action to enhance the CCRT to provide debt service relief to our poorest and most vulnerable members while they combat the current COVID-19 pandemic, thereby freeing up financial resources to prioritize medical spending and health-related as well as other immediate needs in the challenging economic environment. A fundraising effort of IMF members is underway so that the CCRT could provide grants for debt service relief for up to two years. In this context, we have already received a several contributions from donors to replenish the CCRT and are calling for other members to contribute as well.

What is the IMF’s total lending capacity? Is it sufficient?

The Fund remains adequately resourced with a lending capacity of US$ 1 trillion to support members in managing the economic and social fallout of COVID-19. So far only 1/5th of the Fund’s capacity has been committed.