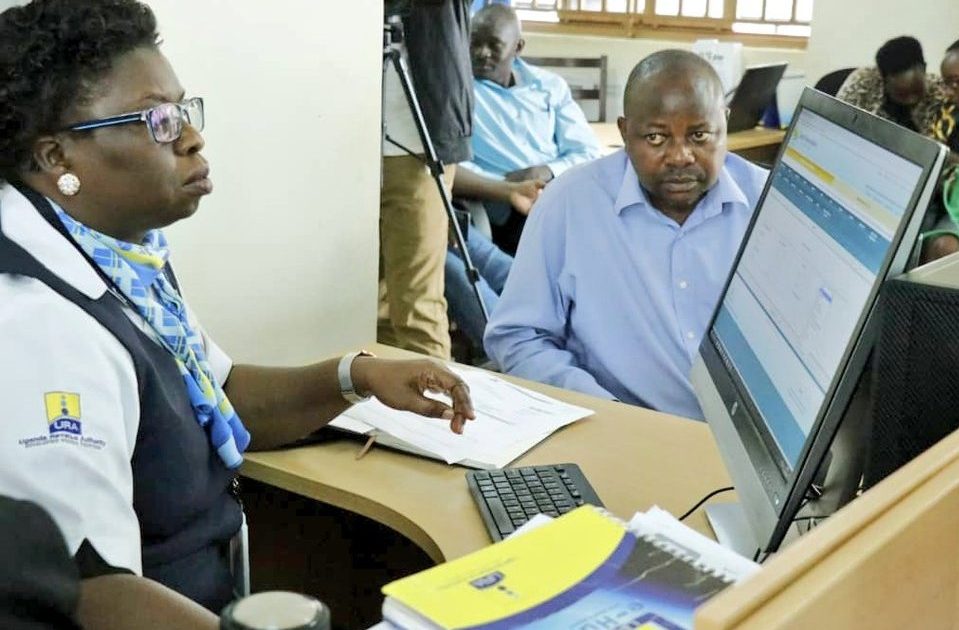

URA Commissioner General, Doris Akol processing a TIN for John Bulega Ssalongo, a teacher and businessman

The Tax Identification Number (TIN) is a unique ten-digit identifying number allocated by the Uganda Revenue Authority (URA) to prospective Taxpayers to enable them to meet their tax obligations. The TIN is a legal requirement and it applies to all taxpayers regardless of their tax transactions.

Who requires a TIN?

Everyone who is employed or involved in any type of income producing or economic activity, where customs duties, Income tax, VAT, excise duty, stamp duty, withholding tax or any other tax is due. This involves any person running a business in Uganda, persons seeking trading licenses to run any business in Uganda, importation of goods in Uganda among others.

Why do you need a TIN?

It enables you to: Import or export goods within and outside Uganda, Claim tax benefits that accrue to you e.g. tax refunds etc, Access bank loans for amounts above 50 Million shillings, Acquire a license from any Government Agency, Register your Motor Vehicle First-time (Motor Vehicle Rregistration) and Process land transactions above 50 Million Shillings.

How to apply for a TIN number

TIN applications are Cost FREE. Applications are made online via the URA web portal. For those doing business as sole proprietors, it is important to note that the TIN is for the business owner, not the business. So, if an individual has more than one business, they are only entitled to one TIN. Nevertheless, you must register all other businesses with URA on your TIN account.

After picking the category of service you are acquiring the TIN for, you will have to download the form template appropriate to your Registration. After downloading the form, you will see a yellow menu with a security warning. When here, enable macros by clicking ‘Enable Content’.

Enabling the macros helps in completing the form in that there are a number of self-populated fields which you will not need to individually fill in, such as names of districts and sub-counties.

Failure to enable macros will lead to futility in filling the form. You will notice that the forms are spreadsheets in Excel format with a number of worksheets.

The last worksheet titled “Help” is a guide on how to fill the form. Read it before attempting to fill the Application Form. It is imperative to know that while filling in the TIN application all mandatory fields must be completed.

The TIN application form requires information that helps URA to accurately maintain the taxpayer’s account.

Have the following information ready before you start to fill in the form:

Individual registration: Birth and citizenship identification documents, sources of income, type of business activity and alternative contact.

Non-individual registration: Name and address, subsidiary details if any, type of applicant, tax type, sources of income, type of business activity, primary authorized contact person and persons associated with entity, such as the directors.

Identification documents (IDs): The applicant is expected to provide at least two copies of valid identification documents to help URA validate the information given in the applications. Where possible, these should include one Government issued ID such as Passport, national ID or Voter Card.

Contact Details: These include email addresses and telephone numbers. These are crucial for taxpayers who apply for TINs for purposes of obtaining services that require them to have an account on the URA portal e.g. importation of goods, the filing of returns and motor vehicle-related services etc.

They are also key in supporting the online registration process and are needed to validate the information given by the applicant as opposed to physical interviews. These details are also very important in managing the security of your account with URA.

This implies that whoever has access to your contact details, can get access and transact through your account genuinely or fraudulently.

Email addresses are particularly important because, after approval of your TIN application, your TIN, along with a default password, are sent to your email address to help you access your account on our web portal.

Address: This should be stated clearly to help the tax body easily locate the taxpayer in case of any need for; delivery of physical communication, tax education & sensitization and/or routine inspections to validate and update the information given in the application form.

Income sources: The applicant is required to clearly indicate all their sources of income. This is important for URA to ensure that they register a client for all the applicable tax types. For example, an applicant may be employed, but also with some rentable properties/houses and a shop.

One TIN will apply for all these income sources. In case of business income, the applicant is expected to give a clear description of the business they are dealing in to allow URA to classify them in the respective industry/ business sector.

As such descriptions like businessman, businesswoman, and investor are not accepted by the system. URA also has Service Centers spread across the country where taxpayers can seek assistance with applying for and obtaining a TIN.

Expected Delivery Time

- URA will send an Auto notification of the receipt of your (online) application upon submission.

- For applications without VAT, URA aims to notify you of your TIN or a decision on your registration application within 2 working days of receiving all the necessary information.

- For applications with VAT, URA aims to notify you of the proposed inspection/interview date within 3 working days which you can consent to or defer to a more convenient one.

- After inspection, URA aims to notify you of your TIN or decision on your registration application within 21 working days.

Caution

- URA is not responsible for any monies paid for services indicated as FREE.

- Always submit necessary physical documents with relevant attachments to the selected service centre to avoid delays and inconveniences.

- URA will send your password and other communication to the email address provided on your application form.

- URA

is not liable to any fraudulent activities that may arise from:

- Sharing your email address passwords with other parties.

- Declaration of emails addresses that do not belong to the applicant.

- Always submit correct and accurate information on the application form to avoid delays or inconveniences.

For more details, visit URA website here.

I have forgotten my Tin number

TIN REMINDER.

I forgot my tin number; can I please be reminded.

Iam trying to register for my TIN but the forms have failed to upload due to expiry. what can I do?

I tried to open my account but I failed. I need help.

I have forgotten my TIN number how can I make it?

I would like to have TIN number

Please I want to recover my tin number i am called Samuel Bamulanzeki

i would like to recover my Tin Number

Requesting a TIN number

How can I apply for mine?