Finance Minister Matia Kasaija has frequented Parliament seeking approval of several loans

Government has been urged to consider debt cancellation but Government has rejected the advise, saying if undertaken, the move would reduce Uganda’s chances of getting further loans approved yet the nation is still in need of loans to deal with the infrastructure deficit.

Seruwagi Nalunga, the Executive Director at SEATINI-Uganda led the calls to the International Monetary Fund to approve the issuance of Special Drawing Rights to assist developing countries to contain the economic and social impacts of Covid-19 pandemic in particular and to enable their economic recovery.

She added that debt write off if approved would enable Uganda to borrow at lower interest rates and engage in more affordable emergency fiscal stimulus spending as well as purchase vaccines for Covid-19.

“African nations are borrowing more money to finance economic recovery stimulus packages including the bill for the rollout of the Covid-19 vaccine. Borrowing will increase public debt and present further a debt sustainability challenge,” said Nalunga.

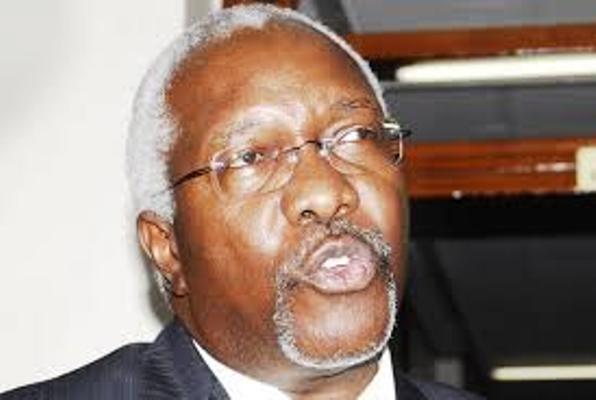

While responding to the call, to have Uganda’s debt written off, Samson Muwanguzi, Principal Economist (Domestic Debt Office) at the Ministry of Finance said the best option would be to improve the way Uganda uses and manages the debt because at the moment, Uganda has an infrastructure deficit that needs to be funded through loans yet Uganda isn’t raising enough revenue to finance it.

“In my opinion, I am against the idea of writing off the debt because debt cancellation sends a bad signal to lenders that you aren’t credit worthy. In the eyes of the lender, it will be difficult in future to borrow. At our level of development, you don’t want to be seen asking for total debt cancellation. It will affect our position and donors will lose trust and that isn’t the way to go,” Muwanguzi said.

He made the remarks during a dialogue held today at Fairway Hotel in Kampala to discuss Uganda’s skyrocketing debt.

The developments comes at the time when the Auditor General in his February 2021 report to Parliament warned about Uganda’s skyrocketing public debt warning it is likely to leave no room for future Governments.

The Auditor General’s report highlighted that although the International Monetary Fund recommended 50% debt to GDP ratio as the point of safety for developing countries and currently, Uganda has reached 41% despite rebasing its GDP last year.

He added that, the percentage of interest to domestic revenue has reached 13.69% which is above the recommended cap of 12.5%, and recently, Uganda’s credit rating outlook was revised from stable to negative.

“The above have had a resultant effect of higher cost of borrowing high may deny future generations to sustainably borrow. Although Government has attributed the debt increment to the need to cover for both the revenue shortfalls and the rising expenditure needs, I have advised Government to advise a comprehensive strategy to align revenue moblisation and fiscal policy management as well as reducing Government expenditure,” Muwanga said.

The December 2020 Monetary Policy Report by Bank of Uganda placed Uganda’s total public debt stock at Shs63.3Trn. This was after Uganda’s debt increased by 21.7 percent in FY2019/20 with External debt increasing from US$8.35 to US$10.45 billion approximately Shs38.458Trn while domestic debt increased from Shs 16.2Trn to Shs19.1Trn.

Currently, there are 10 loans up for consideration in Parliament’s National Economy Committee, seven of which tot