Uganda Revenue Authority (URA) registered impressive and improved performance during the fiscal year 2018/19 on the back of a higher than projected economic growth.

During the FY 2018/19, the economy grew by 6.1% against the projected growth of 6%.

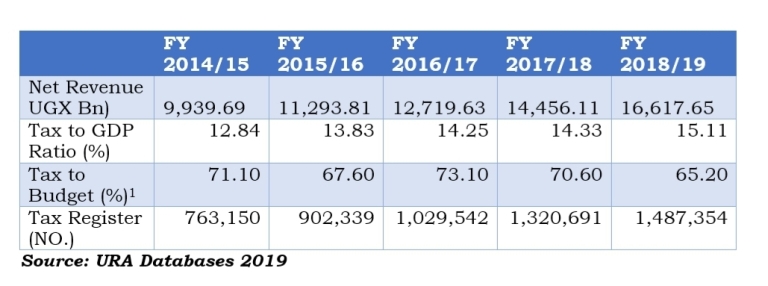

In 2018/19, the tax body was given a net revenue target of Shs16, 358.76 billion grounded on a set of macro-economic assumptions.

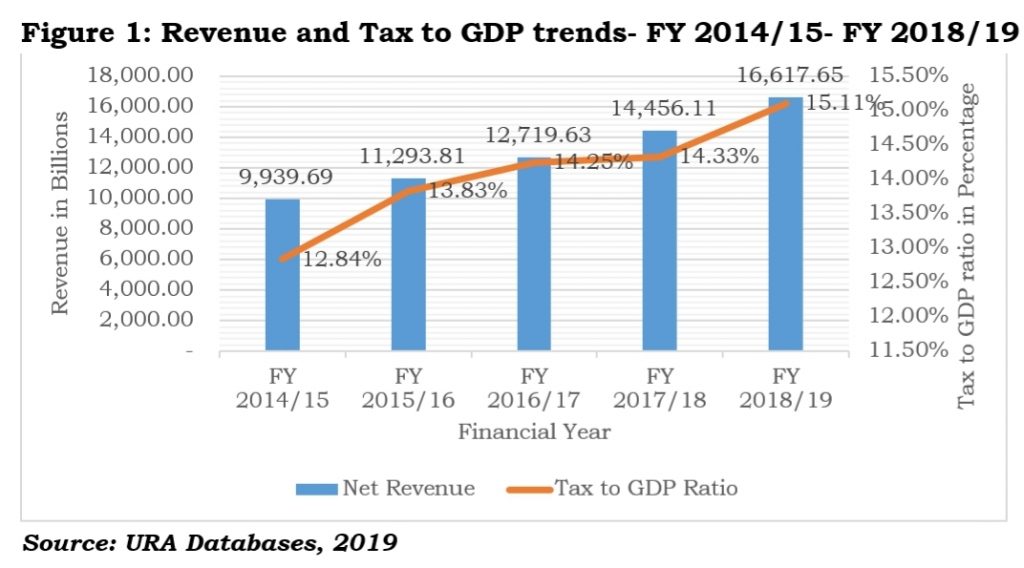

Addressing the press today at URA headquarters, Nakawa about the tax body’s performance for the period July 2018 to June 2019, Doris Akol, the URA Commissioner General said the net revenue collections for FY 2018/19 were Shs16.617.65billion, registering a growth rate of 14.95% (Shs2,161.53 billion) compared to last financial year.

“This was Shs258.89 billion above the target, posting a performance level of 101.58%,” Akol (in featured photo) said.

Her presentation was based on the theme: Transparency and Accountability for Effective Service Delivery.

Akol revealed that the average net revenue collections growth over the five year period was at 15.72%.

“The tax to GDP ratio has increased from 12.84 % in FY 2014/15 to 15.11% in FY 2018/19 above the National Development Plan II target of 14.90% for FY 2018/19 .Over the five year period, the tax to GDP ratio increased by 2.27 percentage points and specifically, the tax to GDP ratio in FY 2018/19 has grown by 0.78% higher than the IMF target of 0.5%,” Akol said.

She added that the tax agency registered good performance in domestic tax revenue collections.

Domestic taxes net collections during the FY 2018/19 were Shs9,749.29 billion, registering a performance of 102.80% and Shs265.59 billion above the target. A growth rate of 17.68% was realized compared to FY 2017/18, she said.

“The major tax heads that recorded gross surpluses during the year were majorly direct taxes that include; corporation tax; that registered a surplus of Shs331.37 billion mainly attributed to the transport, storage and communication sub sector as well as the financial intermediaries and PAYE; that registered a surplus of Shs148.60 billion mainly attributed to the public sector that performed at 127.96% of target,” Akol revealed.

On the other hand, she said, the net international trade tax collections during the FY 2018/19 were Shs6, 875.41 billion, registering a performance of 100% and Shs0.34 billion above the target. A growth rate of 10.85% was realized compared to FY 2017/18.

The major tax heads that registered good performance during the financial year were; import duty that performed at 100.71% of the target and VAT on imports performed at 102.62%.

The major import items that registered increase in tax yield during the FY 2018/19 compared to last year include; worn clothing (Shs42.25 billion), cigarettes (Shs29.27 billion), motor vehicles (Shs28.36 billion), Foot wear (Shs27.00 billion) among others.

“This enhanced international trade tax revenue collections leading to a surplus of Shs8.91 billion,” Akol added.

Good performance in the tax policy measures

During the budget speech for the fiscal year 2018/19, several new tax policy measures were proposed for implementation to facilitate the achievement of the identified result areas.

The proposed tax policy measures were majorly under; Income tax, Local Excise Duty, VAT, Customs-NTR, Customs, CET Adjustments and Excise-Customs. Key among the tax policies measures introduced under the Local Excise Duty; daily levy of Shs200 on Over the Top services (social media access) and levy of 1% on mobile money transactions.

According to Akol, net estimated revenue from approved measures was Shs779.5 billion and a total of Shs1, 095.29 billion were collected during the financial year, registering a performance of 140.50%.

“Generally, the tax policies from the different tax heads had an average achievement at 111.82%,” Akol noted.

She added that major revenue contributing sectors registered positive growth during the year.

For example; mining and quarrying sector (17.6%), trade and repairs (6.6%), construction (5.7%), Manufacturing (4.4%), financial and insurance activities (8.3) and public administration (10.6%) among others. “This also contributed to our estimated revenue surplus of Shs258.89 billion,” Akol said.

Increase in imports volumes

She revealed that Uganda’s dry cargo import volumes in shillings grew by 28.54% during the FY 2018/19 compared to 16.30% last financial year FY 2017/18.

“The growth in import volumes led to the growth in goods that attract VAT on imports by 8.17%%, goods that attract import duty by 1.62%. This explains the surplus registered in VAT on imports by Shs69.25 billion, import duty by Shs9.57 billion and international trade tax collections by Shs8.91billion,” she said, adding that during the FY 2018/19, the demand for private sector credit increased to 12% from 6.8% in FY 2017/18.

Major sectors that registered growth in private sector credit during the year were; mining and quarrying (44.37%), electricity and water (20.78%), manufacturing (15.25%), trade (13.03%) and business services (13.17%) among others.

“The increase in private sector credit in these sectors increased the level of economic activities as reflected in their GDP growth rates and hence increases in revenue collected and leading to the surplus,” Akol said.

Regional Performance Comparative

Considering the EAC region, Akol said Uganda Revenue Authority (URA),Burundi Revenue Authority (OBR) and Rwanda Revenue Authority (RRA) performed above target in revenue collections.

Revenue Authority and Tanzania Revenue Authority performed below target at 96.2% and 86.30% respectively during the FY 2018/19.

Administrative Achievements in FY 2018/19

Akol said FY 2018/19 was particularly the third year of the implementation of the current URA Corporate Plan 2016/17-2019/20 which is premised on three major pillars of cultivating a tax paying culture through provision of reliable services, leadership development and building strategic partnerships.

She said Uganda’s tax base has expanded thanks to a number of initiatives including the Taxpayer Register Expansion Program.

“In order to expand the tax base, URA together with local governments, Kampala Capital City Authority (KCCA) and the Uganda Registration Services Bureau (URSB) implemented the Taxpayer Registration Expansion Project (TREP) to penetrate the informal sector that accounts for 48% of the economy. Furthermore, URA also implemented the Block Management System (BMS) in greater Kampala. This helped to map out taxpayers in Blocks and the unregistered taxpayer is brought onto the tax register,” she said, adding: “Because of the above initiatives, Ugandans have voluntarily registered for taxes and a total of 166,663 new taxpayers have been added onto the URA tax register.”

She added that tax education, creation of more service centres, improved payment platform, deployment of scanners to curb smuggling and reduce on tax revenue loss, compliance management initiatives, prosecution of errant and non-compliant measures, recoveries from the Debt Collection Unit, Customs enforcement, investigation of fraudulent schemes and people management are other things URA did to register impressive performance.

Outlook For F/Y 2019/20

The net revenue collection target for the financial year 2019/20 is Shs20,344.13 billion.

This is inclusive of all revenue collected by URA, other Non-Tax Revenue (NTR) from MDAs and Aid in Appropriation (AIA).

On how URA intends to achieve this target, Akol said: “URA will focus on the implementation of; Digital tax stamps, electronic physical devices /e-invoicing solutions, taxpayer education and facilitation, establishing an integrated government to foster DRM efforts, leveraging data on revenue intelligence, improved boarder management, improved staff capacity and productivity, strengthening science investigations and legal service function.”

She added: “The investments already made in the previous years will be supported to ensure sustainability. Effort will also be placed on the implementation of key tax administrative measures as spelt out in the background to the budget to generate the revenue.”

To successfully implement the above focus areas and strategies to realize the annual revenue target, Akol said it will require a deliberate and concerted effort from all stakeholders involved in revenue collection.

“On the part of URA, we will continue to invest in efficient systems, quality people, non–bureaucratic processes and building strategic partnerships to ensure smooth expeditious service delivery,” she said.