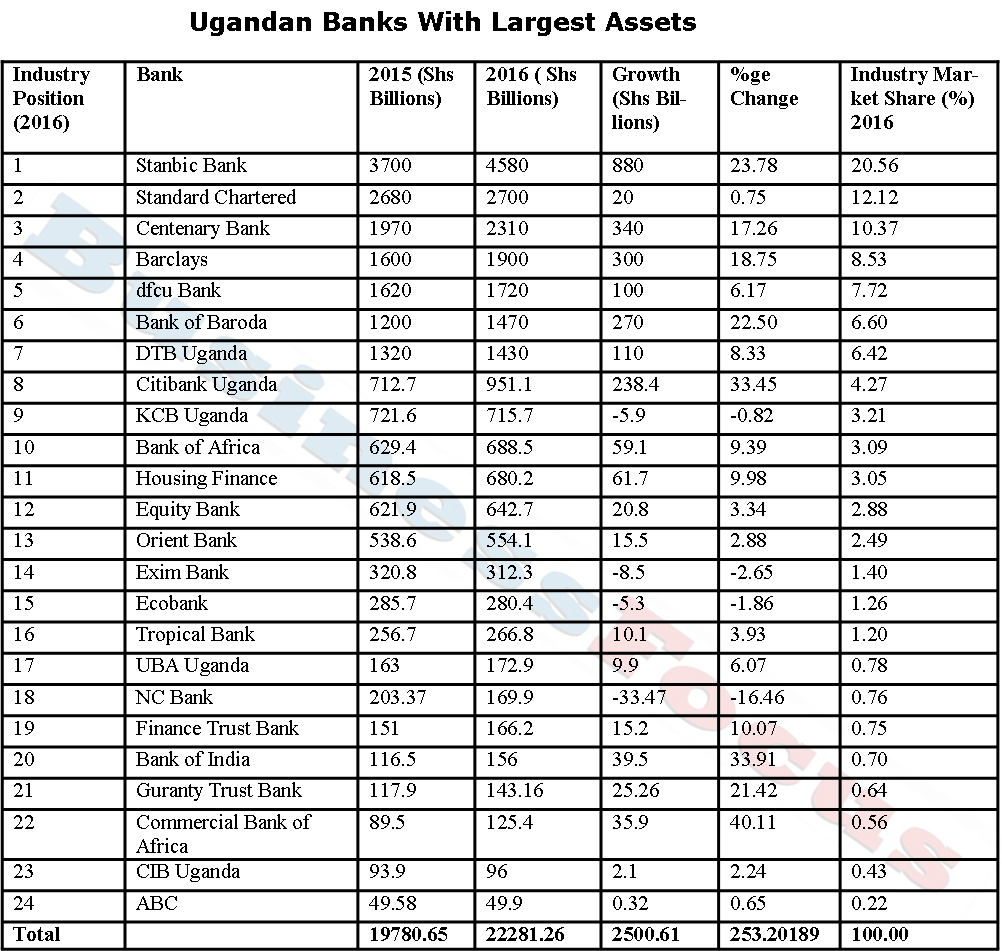

Assets are one of the key parameters that determine how strong a financial institution is.

And having obtained the 2016 financial results for Uganda’s 24 banks that have been released in the past few months, Business Focus exclusively reveals Uganda’s largest banks by assets. This will help you know how strong in terms of assets your bank is.

Although Uganda’s economy struggled in 2016, with many top companies collapsing, banks continued to accumulate assets.

Total banking industry assets increased to Shs22.28trn in 2016, up from Shs19.78trn recorded in 2015.

Stanbic Bank tops with its assets valued at Shs4.58trn in 2016, up from Shs3.7trn in 2015. This represents 20.56% of the industry market share.

It is followed by StanChart with assets worth Shs2.7trn in 2016, up from Shs2.68trn in 2015. This constitutes 12.12% of the total industry market share.

Centenary’s total assets increased to Shs2.31trn in 2016, up from Shs1.97trn in 2015, making it the 3rd largest bank by assets in Uganda.

Barclays comes 4th with total assets of Shs1.9trn in 2016, up from Shs1.6trn the previous year.

Dfcu completes the top five largest banks by assets in Uganda with its total assets valued at Shs1.72trn in 2016, up from Shs1.62trn in 2015.

What is shocking though is that the top five banks control 59.3% of the industry market share.

In the 6th place is Bank of Baroda with assets worth Shs1.47trn in 2016, up from Shs1.2trn in 2015. It is followed by Diamond Trust Bank whose assets increased to Shs1.43trn in 2016, up from Shs1.32trn in 2015.

In the 8th place is Citibank whose assets increased to Shs951.1bn in 2016, up from Shs712.7bn in 2015.

KCB comes 9th with assets worth Shs715.7bn in 2016, up from Shs721.6bn in 2015.

Bank of Africa completes the top 10 biggest banks by assets in Uganda. Its assets increased to Shs688.5bn in 2016, up from Shs629.4bn in 2015.

It is worth noting that the top 10 banks control 82.89% of the total industry share.

ABC Capital Bank has the smallest assets in the market.

Its assets are valued at Shs49.9bn as of 2016, slightly up from Shs49.58bn recorded in 2015.

On the bottom table, Cairo International Bank comes 2nd with its assets valued at Shs96bn in 2016, up from Shs93.9bn in 2015.

Commercial Bank of Africa also has small assets at Shs125.4bn, up from Shs89.5bn in 2015.

Guaranty Trust Bank follows with assets worth Shs143.16bn as of 2016, up from Shs117.9bn in 2015.

Bank of India is 5th from the bottom with its assets valued at Shs156bn in 2016, up from Shs116.5bn in 2015.

Below is an easy to interpret table detailing Uganda’s largest banks by assets: