Montage of CEOs heading banks with highest NPLs

Banking industry Non-Performing Loans (NPLs) increased significantly in 2020, an exclusive analysis by Business Focus reveals.

In our previous articles about the performance of banking industry in 2020, we revealed the most profitable and loss making banks as well as the largest banks by assets.

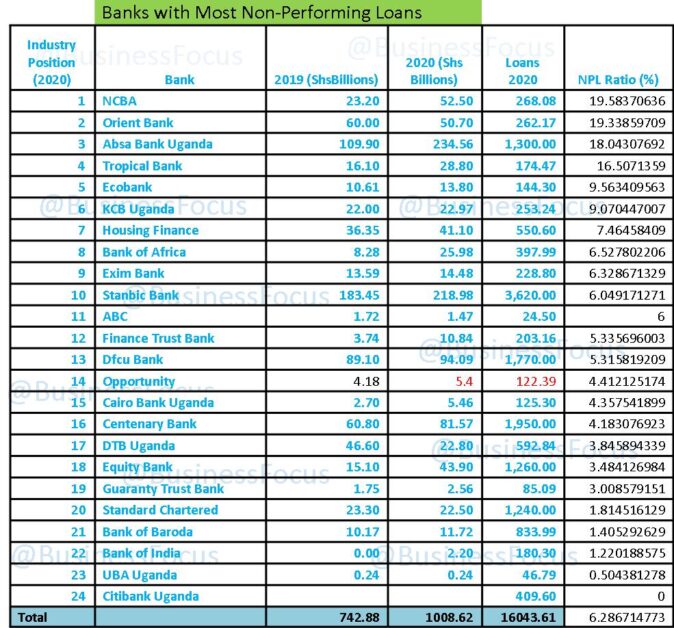

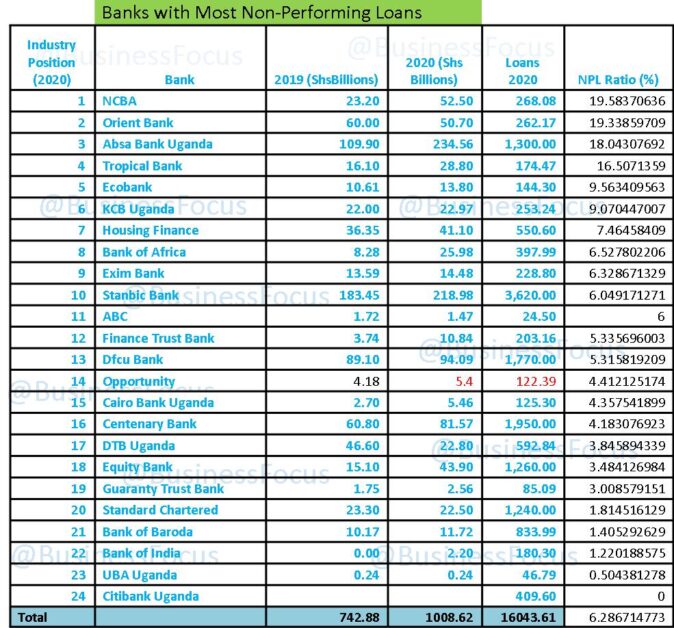

In this article, we focus on NPLs that increased to Shs1 trillion in absolute terms and 6.28% in NPL ratio.

NPLs are bank loans that are subject to late repayment or are unlikely to be repaid by the borrower in full.

On the other hand, Non-Performing Loan (NPL) ratio is the ratio of the amount of nonperforming loans in a bank’s loan portfolio to the total amount of outstanding loans the bank holds.

The NPL ratio measures the effectiveness of a bank in receiving repayments on its loans. Therefore, the ranking of banks with highest/biggest loan defaulters is based on NPL ratio rather than absolute NPL figures. NPLs are considered high and worrisome when the NPL ratio is above 5%.

Banks With Highest NPL Ratio

NCBA leads this category with an alarming NPL ratio of 19.58% as of December 2020. This is after the bank’s NPLs increased to Shs52.5bn in 2020, up from ShsShs23.2bn in 2019. Headed by Anthony Ndegwa as Managing Director, NCBA which came into existence in 2019 after NC Bank and Commercial Bank of Africa merged, advanced loans totaling to Shs268.08bn to customers in 2020.

This is perhaps one of the reasons why the bank made a loss of Shs4.53bn in 2020. After the successful rebranding, Ndegwa and his team will have no excuses but work to improve the bank’s performance in the country.

NCBA is followed by Orient Bank with NPL ratio of 19.33%. Headed by Kumaran Pather as Managing Director, Orient recorded Shs50.7bn in NPLs as of December 2020. Its loan book stood at Shs262.17bn.

Absa Bank Uganda headed by Mumba Kalifungwa as Managing

Director is also finding hard time in recovering Shs234.56bn compared to Shs109.9bn in 2019. This gives the bank NPL ratio of 18.04% considering the fact that its loans to customers stood at Shs1.3 trillion in December 2020.

In 4th place of banks with highest NPLs is Tropical Bank with NPL ratio of 16.5%. This is after it registered an increase in NPLs to Shs28.8bn in 2020, up from Shs16.1bn in 2019 yet the bank’s loans advanced to customers stood at Shs174.47bn as of December 2020.

Tropical Bank appointed Abdulaziz Mansur as Managing Director in 2019 to turnaround the bank after years of poor performance. Although the bank’s NPLs increased, it made a profit of Shs3.57bn in 2020 compared to Shs23.95bn loss recorded a year earlier.

Ecobank is 5th in as far as banks with biggest loan defaulters is concerned. Its NPL ratio is 9.56% after its NPLs increased to Shs13.8bn in 2020, up from Shs10.61bn a year earlier. As of 31st December 2020, Ecobank’s loans advanced to customers stood at Shs144.3bn. Ecobank is headed by Annette Kihuguru as Managing Director (in acting capacity).

Notably, Ecobank fell back into a loss making position after recording Shs5.95bn loss in 2020 from Shs4.1bn profit in 2019.

KCB comes 6th with NPL ratio of 9.07%. Headed by Edgar Byamah as Managing Director, KCB’s NPLs increased to Shs22.97bn in 2020, up from Shs22bn in 2019.

This was against Shs253.24bn in loans advanced to customers.

It is followed by Housing Finance Bank whose NPL ratio is 7.46%. The bank’s NPLs stood at Shs 41.1bn as of December 2020 against total loans of Shs550.6bn.

In 8th position of banks with highest NPLs is Bank of Africa whose NPLs increased from Shs8.28bn in 2019 to Shs25.98bn in 2020.

With total loans of Shs397.99bn, Bank of Africa’s NPL ratio is 6.5%.

Exim Bank is the 9th bank with highest NPLs in Uganda. Headed by Henry Lugemwa Kyanjo, Exim bank’s NPL ratio is 6.04%. This is after its NPLs increased to Shs14.48bn against loans advanced to customers of Shs228.8bn.

Stanbic Bank completes the top 10 banks with highest loan defaulters in Uganda. Headed by Anne Juuko as Chief Executive Officer, Stanbic’s NPLs increased to Shs218.98bn in 2020 from Shs183.45bn recorded a year earlier. This is against the total loans of Shs3.62 trillion, giving the most profitable bank in the country NPL ratio of 6.04%.

Other banks whose NPL ratio is above 5% include ABC (6%), Finance Trust Bank(5.33%) and Dfcu Bank (5.31%).

NPL Ratio Below 5%

Banks whose NPL ratio is below 5% include Opportunity (4.41%), Cairo Bank (4.35), Centenary (4.18%), Diamond Trust Bank (3.845%), Equity Bank (3.48%), Guaranty Trust Bank (3%), Standard Chartered (1.8%), Bank of Baroda (1.4%), Bank of India (1.2%) and UBA (0.5%).

For further details on Uganda’s banks with highest Non-Performing Loans, check the table below.

For tips, advertising or feedback, reach out to us via staddewo@gmail.com/0775170346/0705888301, follow us @BusinessFocusug, @TaddewoS for further unmatched analysis on Uganda’s banking sector and the economy at large.

It’s indeed an accurate analysis