The domination of the financial sector by the banking industry has for the last 15 years faced an onslaught by digital financial innovations, especially the mobile money platforms. But over the years, banks have also tried to embrace digital innovations and make transactions easier for the public, extend services closer to more people, but also to make business operations cheaper for themselves.

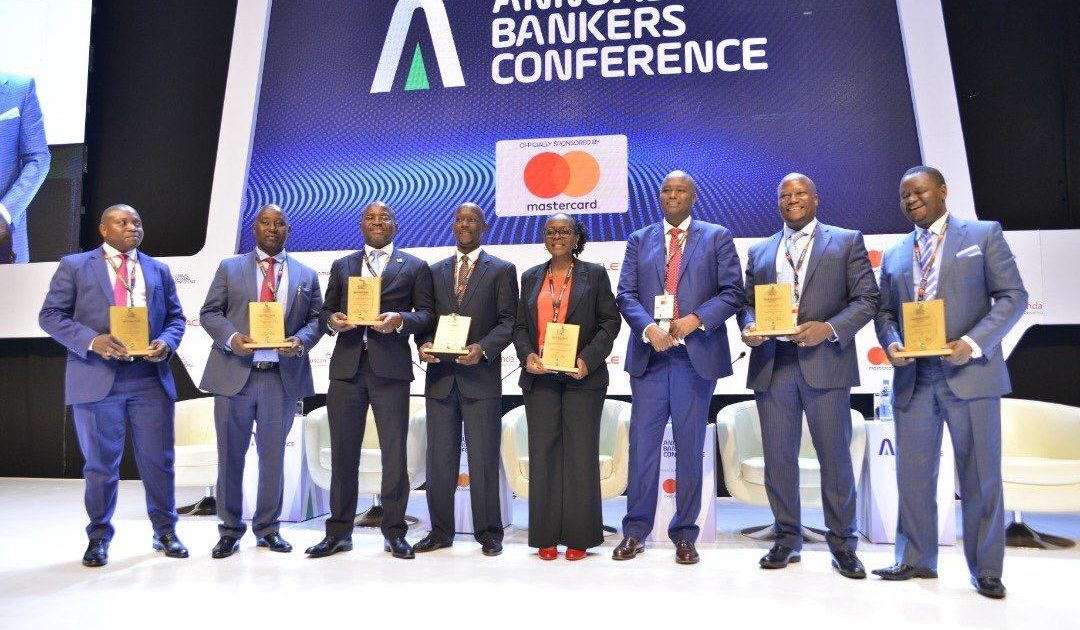

However, Banks are still worried about how they will survive in the rapidly evolving economic situation especially due to what they call the fast-paced digital revolution or the 4th Industrial Revolution. For this, the annual Bankers Conference of the Uganda Bankers Association was themed: Bend But Don’t Break: How the financial sector can thrive in the era of the 4th Industrial Revolution.

The bankers say that much as a lot has been done in the field of innovation, they have not done much, because people, still find it hard to access the services. Finca Uganda Chief Executive Officer, James Onyuta says that even where services are taken closer, things as essential as opening a bank account is still problematic especially to the semi-literate and illiterate Ugandans.

He admits that the financial institutions still have much to do to make access easy and affordable.

According to Uganda Communications Commission, there are 30 million mobile money accounts, while total transactions amount to Shillings 10 trillion. On the other hand, according to the Deposit Protection Fund, bank accounts had grown in number to 17 million by June 2020.

But Onyuta says the main determinant of a good customer is the key driver of the cost of access, especially to credit, by the customer. He proposes that the sector works more towards sharing infrastructure and information, which should make it easier for them.

There is however growing public concern about the safety of personal information, which is surrendered to a service provider, with the possibility of it being further shared with other users. Last year, the banking industry started a process that would see the institutions share data of the customers, as a way of making the services safer, but also easier to confirm the trustworthiness of an individual.

The ‘Electronic Know You Customer’ (eKYC) platform allows the banks to access the data bank at the National Identification Regulatory Authority (NIRA), as a way of verifying the authenticity of the data presented by the customer. The platform was developed by fin-tech firm Laboremus Uganda and NIRA, which says that so far half of the financial institutions are connected to the system.

Laboremus Uganda CEO, Timothy Musoke assured that NIRA never shares data presented to it with any person.

But as the industry leverages digital innovation to stay in business, it will also need to do more convincing the public especially about the safety of the individual and safety of the money in the transaction. According to a survey by the Financial Sector Deepening Uganda, there are many Ugandans who have refused to embrace digital or non-physical contact transactions, unsure of the safety of their money.

According to the report, many Ugandans prefer to deal with a person physically because this apparently makes them feel safer. The Head of Programs at the FSDU, Joseph Lutwama also criticizes the regulatory framework, which has many regulators, each for an industry like banking, insurance, capital markets, retirement benefits, and others.

He proposes that this be bundled into one regulatory system to make it easier as is happening in other countries, citing the Twin Peaks regularity system The Twin Peaks approach, first adopted in Australia in 1998, increasingly being adopted by other countries.

Under Twin Peaks two regulators are established, with one charged with maintaining the stability of the financial system – called prudential regulation; and the other is responsible for market conduct and consumer protection. This system is aimed at addressing weaknesses in the other models commonly used to regulate banks and the financial services sector, or the sectoral model which separates the sector into different industries, as is the case in Uganda.

Lutwama says instead of creating new regulatory authorities, Uganda should be going for the integration of regulation, so that players and customers will immediately know where to run to in case of a problem.

-URN