Private sector credit to agricultural sector has increased from Shs562 billion in 2013 to Shs1.53 trillion in 2018, figures from the Bank of Uganda (BoU) show.

The increased lending from commercial banks is attributed to the introduction of Agricultural Credit Facility (ACF) in 2009 to provide medium to long term financing to the sector.

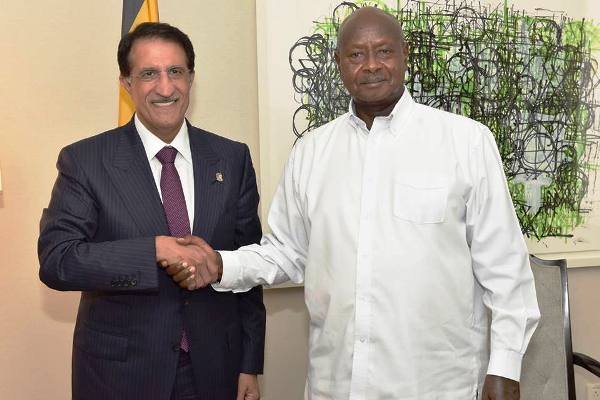

This was revealed by Matia Kasaija, the Minister of Finance, Planning and Economic Development while officiating at for the inaugural Agricultural Credit Facility Participating Financial Institutions (ACF-PFIs) Awards held at Sheraton Hotel, Kampala on Thursday, May 30, 2019.

He however said the Shs1.53 trillion is still small compared to the country’s GDP.

“Nonetheless, this is only 1.52 percent of the national income that stood at Shs100.53 trillion for Financial Year (FY) 2017/2018 for a sector that contributes 24.2 percent to the Gross Domestic Product (GDP). This implies that we must build on the lessons learned from ACF and develop agricultural financing further. Innovations in this space that we need to support include agricultural insurance schemes and the Warehouse Receipt System,” Kasaija said.

He noted that a decade after ACF, its portfolio has grown to Shs331.53 billion disbursed to 551 projects.

“The growth of the ACF would not have been possible without the support of the various stakeholders such as Bank of Uganda, Participating Financial Institutions, and the Farmers who have utilized the ACF funds,” he said.

The Minister added that the success of ACF has partly contributed to government’s decision to design an Agricultural Financing Policy. The purpose of the policy is to “increase the diversity, depth, quality and absorption of financial products and services for all levels and sizes of actors along the agricultural and financial value chains in Uganda to thrive and grow”.

“I encourage our Financial Services Providers (FSPs) to be proactive and engage with the agricultural value chain to identify business opportunities. As the competition intensifies in the financial services sector partly driven by technological innovations, success will come to those who tap into sectors with the high turnovers. Agriculture despite its risky nature is one of those sectors,” he concluded.

Speaking at the same event, Dr. Louis Kasekende, the Deputy Governor, BoU said in the Ministry of Finance’s report issued in April 2019 assessing performance of the programmes as at December 2018, the ACF was rated at a score of 76.2 percent compared to the overall agriculture sector rating of 61.8 percent.

“In fact, only the Uganda Coffee Development Authority (UCDA) attained a higher score. The many good stories of the firms and farms that have been expanded in terms of size and output and whose productivity has improved are testament to the impact of the ACF,” Kasekende said.

He added that there is “ need to de-risk the agricultural sector so as to encourage the private lenders to consider increasing their lending to the sector. This requires the provision of a holistic set of support mechanisms dealing with the entire production and value chain from land rights, quality control and timely provision of inputs, provision of information and extension services to post harvest handling and marketing of the produce. “

He explained that commercialising the agriculture sector will also require improving the financial literacy of the small holder farmer to keep proper books of accounts that can be relied upon by prospective lenders.