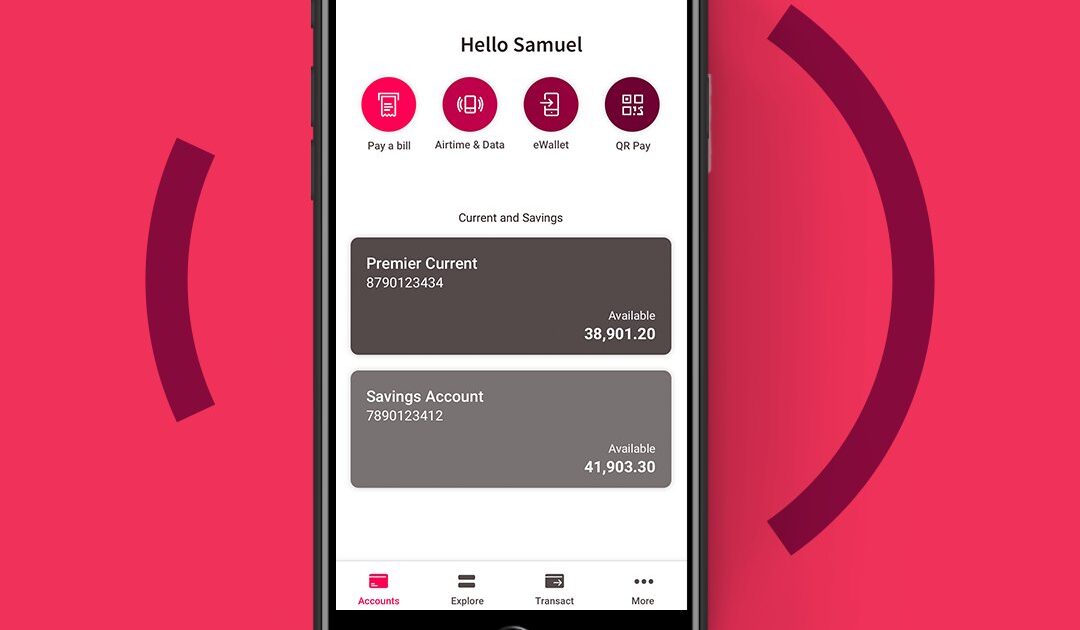

Absa Bank Uganda has launched Business Banking capabilities on their Mobile Banking App, empowering business owners to perform multiple business-related transactions on their smartphones.

Without having to visit a branch, users can approve transactions, view statements and complete various other self-service tasks using their smartphones at any time of the day or night.

Speaking about the application, Albert Byaruhanga, Absa Bank Uganda’s Acting Head of Business Banking, said, “The COVID-19 pandemic caused a massive disruption to the country’s business environment, and this has amplified the need for unique digital solutions that can aid recovery, drive growth and in turn improve livelihoods.”

Perhaps the most affected businesses in the country have been small and medium-sized enterprises (SMEs), which, according to the Uganda Business Impact Survey 2020, account for approximately 90% of the entire private sector, over 80% of manufactured output and contribute about 75% to the gross domestic product (GDP).

The sector, having felt the setbacks brought on by the Coronavirus, has had to adapt to the new normal, which has been largely characterised by the evolution to online banking solutions that adhere to global health and safety guidelines while offering cost-effective business solutions.

As such, the government and the private sector have simultaneously promoted the uptake of e-payments and fintech solutions to accelerate economic recovery following the crisis.

Byaruhanga adds, “As a bank, Absa’s focus remains on bringing forth relevant innovation through key digital and other insight-led initiatives. We understand that entrepreneurs need speed and flexibility to grow their business portfolios and the Business Banking capability on our app serves as another digital solution that offers convenience, safety and cost-effectiveness.”

The bank also recently unveiled a ChatBanking function for the bank’s customers to make instant transactions 24/7 on the WhatsApp messaging app.

The function, called “Abby”, is available to all the bank’s account holders with non-business, transactional accounts and allows them to conduct transactions like making payments to beneficiaries, performing transaction search and history and making inter-account transfers.