The Uganda Shilling weakened in early part of week as corporate demand picked up, but later the unit gained strength towards close of the week 16th March 2018 supported by strong dollar inflows from commodities exporters. The closing range was 3655/3665 compared to the opening of 3660/3670. In the interbank money market, overnight funds traded 6.50% and one week traded at 8.50%

In the fixed income market, 160 billion was on offer, yields were mixed with 91 day and 364day dipping to 8.357% and 9.530% while 182 day went up to 8.764%. The auction was oversubscribed with average bid to cover ratio of 1.80%.

In the regional markets, the Kenya shilling was steady against the dollar trading at 101.20/40 supported by increased remittances but was forecast to weaken due to excess liquidity in the money markets.

In international currency markets, the US dollar rebounded and gained against a basket of peers as recent concerns about the currency arising from changes of the key US administration and trade tensions eased slightly and markets turned their focus on the Federal Reserve Policy meeting which is expected to raise interest rates for the first time this year.

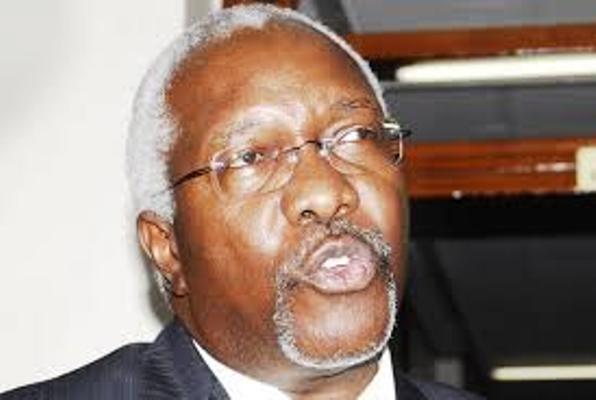

Stephen Kaboyo, an analyst and Managing Director at Alpha Capital Partners says: “In the coming week, the shilling is likely to be under depreciation pressure as markets expect a surge in demand from mainly telecoms, energy, banking and manufacturing sectors.”