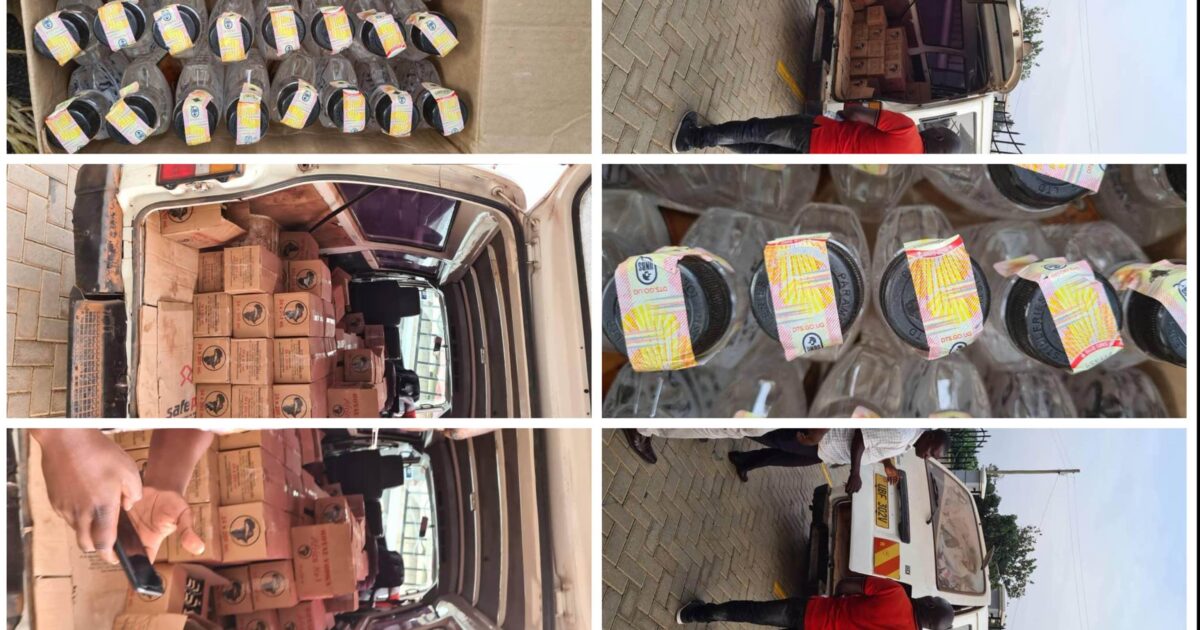

Parambot Distilleries’ products with fake digital stamps. Flouting Digital stamps guidelines is criminal

The Ministry of Finance is proposing an amendment into the Tax Procedures Code Act, 2014 and provide a 10- year jail term or fine of Shs30M for individuals found liable of tampering with digital tax stamps.

Government’s proposal is contained in the Tax Procedures Code Amendment Bill that was recently tabled by Amos Lugoloobi, State Minister for Planning where he revealed that the recent amendments to the Tax Procedures Code Act, 2014 is intended to provide for a penalty for the unauthorised interference or tampering with a digital tax stamps machine; to cap the recovery of interest on unpaid tax and to provide for a penalty for fixing and activating a tax stamp on a wrong good, brand or volume.

“Amendment of Tax Procedures Code Act, 2014 The Tax Procedures Code Act, 2014 in this Act referred to as the principal Act is amended in section 19B by inserting immediately after subsection (6) the following— “(6a) A person who makes an unauthorised interference to, or tampers with, a digital tax stamps machine commits an offence and is liable, on conviction, to a fine not exceeding one thousand five hundred currency points or imprisonment not exceeding ten years,” read in part the bill.

With each currency point being equivalent to Shs20,000 this would translate to Shs30m.

Government is also proposing to insert a new clause in section 62H of principal Act The principal Act to read, “Fixing tax stamp on wrong goods, brand or volume A taxpayer who fixes and activates a tax stamp on a wrong good, brand or volume other than a good, brand or volume for that tax stamp commits an offence and is liable, on conviction, to a fine not exceeding five hundred currency points or imprisonment not exceeding three years or both.”

It should be recalled that in 2019/2020 Financial year, Government introduced digital tax stamps on goods that attract excise tax in a move aimed at minimise underreporting and misclassification by manufacturers of excise goods.

The introduction of digital tax stamps required the manufactures and importers of the gazetted goods to affix digitally traceable tax stamps on their goods and the new tax measures was part of the recommendations in the Domestic Revenue Mobilisation Strategy as a mechanism to improve tax compliance and revenue collections.