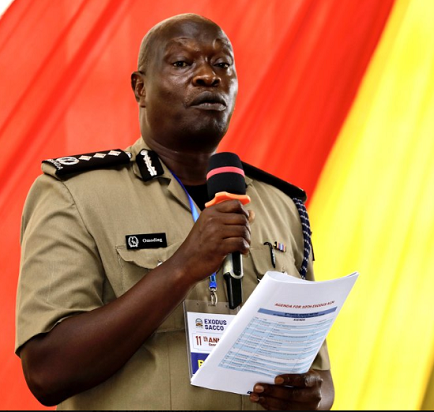

Panelists who spoke during dfcu Bank’s engagement meeting with customers for financial opportunities in the Oil and Gas sector in a group photo

dfcu Bank has held an engagement for its customers and key stakeholders in the oil and gas sector to share insights into the opportunities in the US$15 billion Oil and Gas sector post the Final Investment Decision.

Following the signing of oil agreements between Uganda and Tanzania, on 11th April 2020, and with the Final Investment Decision (FID) for oil production now imminent, the project execution phase is expected to kick off shortly thereafter with significant expenditure upstream, midstream, and downstream.

Speaking during the customer engagement session, dfcu Bank’s Chief Executive Officer Mathias Katamba said: “With the planned East African Crude Oil Pipeline, it is expected that the East African region will be transformed into a major oil player. While the $3.5bn oil deal will see the 1,443 kilometre pipeline pump Uganda’s oil from the Albertine region to Tanzania’s Indian Ocean Seaport of Tanga, it is important to note that about 80% of the pipeline will be on Tanzanian territory. So, as a country, we must make the most of the benefits from the work that will be carried out on the 20% of the Pipeline on the Ugandan side. It will take businesses such as the ones in this room to see the possibilities, to seize the opportunities and be part of Uganda’s oil and gas success story.”

“As a Bank whose history is intertwined with the success stories of many businesses across different sectors in Uganda, it is our objective to provide financial solutions that will position our customers to fairly compete and win some of the contracts that will be available once the FID is signed,” added Mr. Katamba.

Speaking as the Keynote speaker, Jimmy D. Mugerwa who is the CEO Zoramu Consulting Group and, Board Chairman, dfcu Bank noted that; “The Final Investment Decision (FID) for oil production offers vast and massive possibilities for Uganda. Harnessed correctly, various sectors including; Banking, Legal, Construction, Logistics and aviation, Environment and Industrial area development stand to reap benefits from the country’s Oil and Gas Industry. If you’re a participant in the Agriculture sector, you stand to gain from commercial agriculture, machinery, storage or food processing. If you’re in Housing, you can profit from provision of office or warehousing space. This industry offers stakeholders a multibillion stake. As a service provider, you must also understand the Expression of Interest process. There are legal, regulatory, resourcing and financial requirements that you must meet. Vendors need to ensure that they meet them before embarking on this journey.”

James Musherure, the Senior National Content Officer in charge of Contracts at the Petroleum Authority of Uganda said; “We have 600km of roads being done right now. We have an international airport which is almost 40% underway. The vision is to bring people to work and fly out to take the Uganda products abroad. But we need certified people. Government through a legal framework is giving preference to Uganda companies. But Ugandan companies need to participate in supplier bids, and we encourage them to register to the National Supplier Database.”

Representing his community, Stephen Biraahwa Mukitale, the area Member of Parliament for Bulisa County was among the speakers and he remarked; “I hope dfcu Bank can sensitize the people in Bulisa not only on how to get loans but also on how to save their earnings. This will go a long way in strengthening the financial capabilities of the people of Bulisa. Also, as government, we are working to ensure that the local communities in the East African Crude Oil Pipeline (EACOP) area are fully reimbursed.”

Other speakers included Mathew Kyaligonza, National Content Manager, CNOOC Uganda urged businesses to start writing proper national content plans if they are to stand a better chance at winning contracts in the EACOP.

The event brought together customers in the logistics, transport, construction, waste management sectors and NGOs with an interest in interest in Environment Conservation and Protection.

dfcu’s financing to the sector includes a broad range of financial solutions including; Contract Financing of up to 70%, Unsecured up to UGX 500m, Guarantees, Invoice/ Certificate Discounting of up to UGX 200m, LPO Financing, Letters of Credit, Import Loans and Asset Financing.

Previously, dfcu Bank has held similar sessions on opportunities for customers in different sectors including Road and Power sectors.

By Francis Otucu