There is panic among traders and investors who transact in millions after Uganda Revenue Authority (URA) ordered all banks and Forex bureaus to ensure that money going abroad in excess of Shs50m is cleared by the tax body.

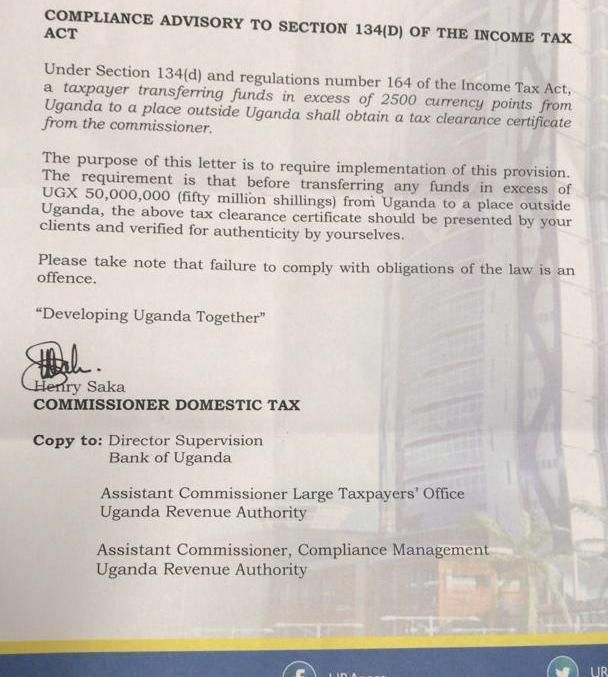

In a letter to bank CEOs, Henry Saka, the URA Commissioner Domestic Tax, says that the move is aimed at implementing Section 134 (d) and regulations number 164 of the Income Tax Act that stipulates that a tax payer transferring in excess of 2500 currency points from Uganda to a place outside Uganda shall obtain a tax clearance certificate from the Commissioner.

“…The requirement is that before transferring any funds in excess of Shs50m from Uganda to a place outside Uganda, the above tax clearance certificate should be presented by your clients and verified for authenticity by yourselves,” URA’s letter to one of the bank CEOs reads in part.

ALSO READ: Fury As URA Asks Banks To Reveal Customers’ Account Details

URA warns bankers that failure to comply with the obligations of the law is an offense.