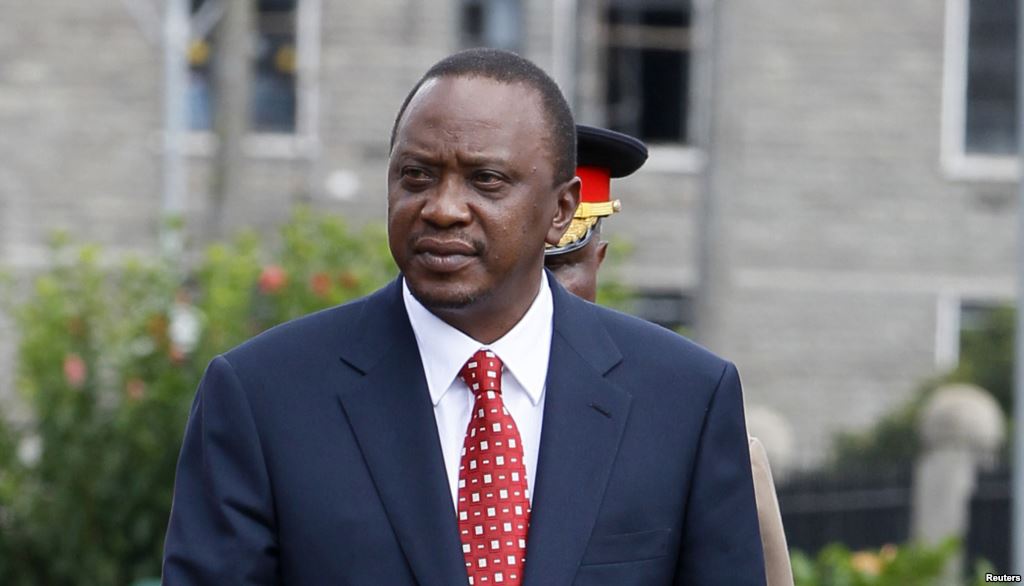

President Uhuru Kenyatta has put on notice high net worth individuals who evade tax, directing the Kenya Revenue Authority (KRA) to employ technology to fish out those not paying their dues to the State, Kenya based Business Daily reports.

Mr Kenyatta ordered the taxman to link its iTax system to the proposed National Integrated Identity Management System that will collect citizen biometric data like ear, eye and voice patterns along with satellite details of their homes.

“”High net worth individuals whose lifestyles are not reflective of the taxes they pay must be compelled to demonstrate the source of their wealth and to contribute their share of taxes accordingly. Towards this end, the use of technology is a necessity…KRA must incorporate cutting edge technology,” he said in a speech during KRA’s 2018 Taxpayers’ Day today.

Under the plan contained in proposed amendments to the Registration of Persons Act of 2015 under the Statute Law (Miscellaneous Amendments) Bill 2018, the Interior ministry will require Kenyans to provide their personal data in order to centrally manage identification documents.

Ahead of the proposed new electronic system, it was revealed in August that the government will conduct a fresh mass registration of people starting this year that will capture the biometric data.

Lifestyle audits

While speaking at the Times Tower in the city centre Wednesday, the president also revisited the matter of lifestyle audits for KRA staff saying it will help weed out rogue employees.

Mr Kenyatta had previously ordered a similar audit at KRA in 2015.