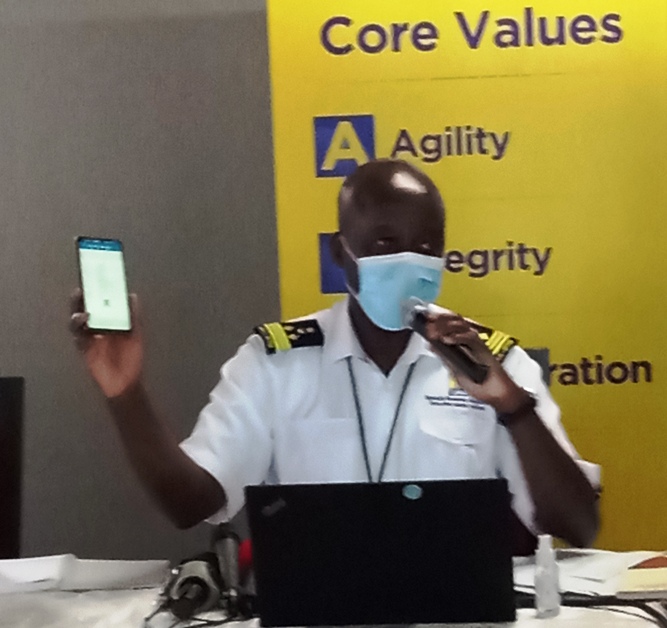

Assistant Commissioner, Process Management at URA, James Odong addressing the press

Uganda Revenue Authority (URA) will January 2021 fully enforce the Electronic Fiscal Receipting and Invoicing System (EFRIS), a self-enforcing solution that will enable taxpayers to integrate their billing and accounting systems to the solution.

This follows expiry of the grace period given to businesses to embrace the solution.

URA has since July 2020 rolled EFRIS but it was extended on request of many taxpayers.

E-invoice and E-Receipt is a new application that allows one to safely, easily and at no cost issue electronic tax documents and check their validity, by registering with URA’s EFRIS solution.

The solution has been embraced by Business to Business (B2B) and Business to Government (B2G) categories.

According to the Assistant Commissioner, Process Management at URA, James Odong, the system is designed to improve business efficiencies and reduce the cost of compliance through improved record keeping among taxpayers, truck and authenticate transaction in real time, fast truck payment of refund claims among other benefits.

“The purpose of this initiative is to put in pace a framework for the implementation of a solution that will manage the issuance of e-receipts/invoices and enforce the usage by tax payers required to do so and to promote a platform to facilitate the pre-filling of returns,” Odong said during a press briefing at URA headquarters on Friday, 17th December 2020.

He said that EFRIS will curb issuance of after sale invoices for final customers to third parties to claim false input tax credit, claims of non-existing import and exports, fictitious purchases with no physical movement of goods and unverifiable claims by taxpayers due to loss of records among others.

While demonstrating how the system works when issuing e-invoice/receipt, Hassan Wassajja from the EFRIS Domestic Tax Department explained that when a sale is made, transactional details will be captured in the seller’s system invoicing system (ERP), encrypted and transmitted to URA in real time to generate e-receipts and e-invoices.

He cautioned taxpayers on the EFRIS solution to use software from URA accredited Software vendors before starting to issue e-invoices/receipts. He for instance demonstrated that in order to verify the authenticity of an e-invoice, a mobile app known as “kakasa EFRIS” can be used to scan the QR Code on a physical invoice.

“Every purchaser or consumer is advised to check the validity of an e-invoice or receipt. For verification of an e-invoice, a mobile app on Google play “kakasa EFRIS” can be used to scan the QR Code. If it’s not genuine it will not be verified and issued and will report no-compliance option,” he said.

According to URA, there are over 18,000 already VAT registered on EFRIS with URA to update their details on the stock account to know their transactions easily. Over 4,000 users have been trained in the use of EFRIS for the last 4 months while other training manuals are available on the URA portal, and Youtube. URA have also engaged stakeholders especially business networking business owners including UMA, KACITA, CHADA, USOA, Free zone authority among others.

By Drake Nyamugabwa