John R. Musinguzi, the URA Commissioner General

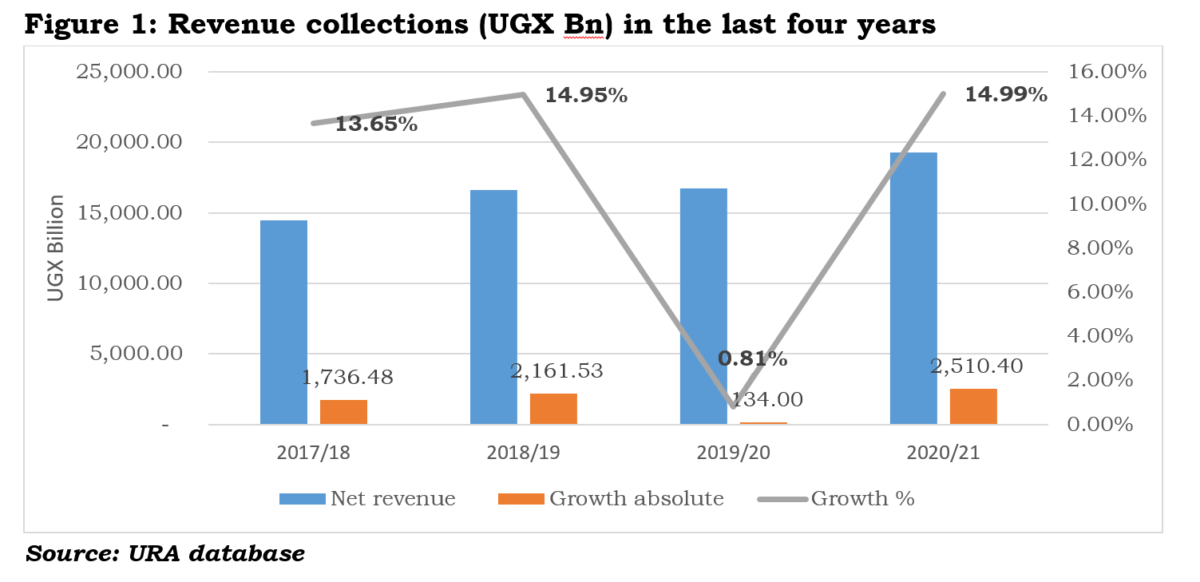

Uganda Revenue Authority (URA) collected net revenue of Shs19.263 trillion and posted a growth in revenue of 14.99% in comparison to the FY 2019/20 and an estimated tax to GDP ratio of 12.99 percent[ Tax to GDP = Net Tax Shs19,263 Bn / 148,278 Bn GDP at market prices].

This was revealed by John R. Musinguzi, the URA Commissioner General Thursday, July 15, 2021 at URA headquarters in Nakawa during the annual press briefing in which he highlighted revenue performance for the period of July 2020 to June 2021(FY 2020/21).

The annual press briefing was held under the theme “30years of Developing Uganda Together”.

“Compared to FY 2019/20 using new GDP from BB 2021/22, we have a growth of 1% in Tax to GDP from 11.99% to 12.99%. In real terms, this reflects a growth in revenue of UGX 2,511.36 billion and a growth in the Tax to GDP ratio by 1%. This the highest growth registered in the last four years,” Musinguzi said.

It should however be noted that, the outturn of the FY 2020/21 is short of the target of Shs21.638 trillion by Shs2.37 trillion.

It is important to note that this was the target approved by Parliament before the impact of Covid-19 set in and macroeconomic variables that affect revenue such as GDP growth were projected at 6% yet by the end of the financial year GDP growth was at 3%.

Domestic revenue performance

Musinguzi revealed that domestic revenue collections in the FY 2020/21 were Shs12.14 trillion, registering a growth of 13.71% (Shs1.46 trillion in real terms) in comparison to the FY 2019/20. However, the collections were below the target of Shs14.038 trillion by Shs1.894 trillion.

Pay As You Earn (PAYE) contributed Shs3.109 trillion, Value Added Tax (VAT) Shs2.992 trillion, Corporate Tax Shs1.567 trillion, Local Excise Duty (LED) Shs1.479 trillion and Withholding tax Shs1.118 trillion.

Others such as Rental income tax , tax on bank interest, treasury bills, casino tax , individual income tax , presumptive, non-tax revenue (NTR) contributed Shs1.875 trillion to domestic revenue.

Customs revenue performance

In the FY 2020/21, customs revenue collections were Shs7.505 trillion against a target of Shs8.001 trillion, registering a significant growth of 16.43% (Shs1.059 trillion) in comparison to FY 2019/20. However, the collections were Shs495.48 billion below target.

Under customs, VAT on Imports contributed Shs2.832 trillion, Petroleum Duty Shs2.453 trillion and Import Duty Shs1.403 trillion. Others such as Excise duty, withholding tax, temporary road licenses, infrastructure levy, hides & skin levy contributed Shs816.89 billion.

Sectoral contribution to revenue

In FY 2020/21, 71% of the revenue was generated from the top 4 sectors. The wholesale and retail trade sector had the biggest contribution, which amounted to Shs5.783 trillion (29.43%). The manufacturing sector followed with a contribution of Shs4.461 trillion (22.70%). The Information and communication sector contributed Shs2.059 trillion (10.48%), while Shs1.643 trillion (8.39%) was generated from the financial and insurance services sector.

There was a growth in revenue from key sectors like manufacturing which grew by 27.52%, Information and communication by 25.73%, wholesale and retail by 19.13% and financial and insurance services by 5.55%.

“On the other hand, there was a decline in revenue collected from some sectors in the FY 2020/21, compared to 2019/20. Revenue from Accommodation and food service activities declined by 37.38%, Education sector by 10.35%, Arts entertainment and recreation by 31.39%. The decline is attributed to slow down in business in these sectors resulting from COVID-19 pandemic impact,” Musinguzi said.

Regional comparison

In regards to the EAC region, URA had the highest year on year revenue growth (14.99%). Tanzania collection in FY 2020/21 was less that that collected in FY 2019/20 by 0.1%. Kenya, Burundi and Rwanda Revenue Authorities met their targets in the FY 2020/21, but it should however be noted that these were set in consideration of the Covid-19 impact.

Reasons for Revenue Performance in the FY 2020/21

URA notes that he significant growth of 14.99% in revenue can be explained by a number of factors including debt recovery of Shs1.024 trillion, mainly attributed to Alternative dispute resolution (ADR) which contributed over Shs365 billion, the voluntary disclosure initiative, close monitoring of Memorandum of Understanding (MOUs) for installment payment, and enforcement mechanisms among others.

“The implementation of the Digital Tracking Solutions (DTS) and the Electronic Fiscal Receipting Solution (EFRIS) boosted performance. DTS contributed to the 16.89 percentage growth in Excise Duty collections by aiding the enforcement and tracking of locally manufactured and imported goods. EFRIS contributed to the 14.73 percentage growth in VAT collections, through relaying real-time taxpayer transaction details to URA, thereby minimizing underreporting of VAT collected from consumers. It should be noted that both technologies are still being rolled out and not yet fully enforced,” Musinguzi said.

He added: “Further on the tax administration front the growth in revenue is attributed to the quick response by revamping the online services to taxpayers such as different payment modes, online taxpayer education campaigns ( KAKASA), improved contact center (IVR), faster clearance of refunds, introduction of a bonded warehouse information management system (BWIMS), simplification of the TIN application process, automation of the WHT exemption and Tax clearance certificate (TCC) issuance and many others.”

He added that Customs revenue collections grew by 16.43% mainly due to a growth in imports by 37.38% in the FY 2020/21 compared to FY 2019/20. It should also be noted that only about 23% of total imports are dutiable. In the FY 2020/21, there was global re-opening of economies and supply chains.

URA further says new tax administration measures announced through the budget speech of FY 2020/21 that included EFRIS, DTS, scanners, debt recovery, use of GPS and data analysis among others yielded revenue of Shs1.111 trillion against a target of Shs548 billion, performing at 202.74%.

“While new tax policy measures implemented in the FY 2020/21 yielded net revenue of Shs260.35 billion, the measures were majorly under; Income tax, Local Excise Duty, VAT, and Customs,” the URA boss said.

Shortfall Explained

On the other hand, URA says the shortfall in revenue is mainly attributed to the adverse impact of COVID-19 pandemic, which led to a slowdown in activities in some key sectors like education, accommodation and food services, among others.

“PAYE was one of the major tax heads affected leading to shortfall of Shs315.51 billion, mainly due to scale down in number of employees by some organizations. The corporate tax collections were also below target by Shs239.93 billion, owing to losses made in the adversely affected sectors,”Musinguzi said.

He added that the tax administration interventions such as audits, taxpayer compliance visits, debt enforcement were all slowed down and for some months stopped because of the observation of SOPS.