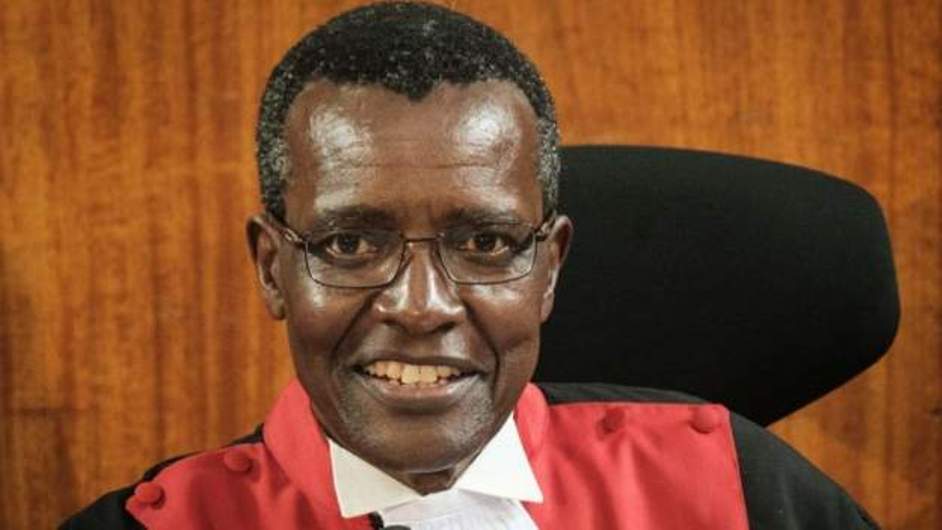

John R. Musinguzi, the URA Commissioner General

Uganda Revenue Authority (URA) needs only Shs2 trillion to attain the Shs24.4 trillion revenue collection target for the Financial Year 2021/22.

The revelation was made by John R. Musinguzi, the URA Commissioner General in his keynote address at the Post Budget Conference 2022 held at Hotel Africana on Monday.

The Conference comes after the recent reading of the National Budget for 2022/23 under the Theme: Full Monetisation Of Uganda’s Economy Through Commercial Agriculture, Industrialization, Market Access And Digital Transformation’

There are 10 days left to end the Financial Year 2021/22.

Musinguzi appreciated taxpayers for honouring their tax obligations amidst the global economic hardships.

“Our target was UGX 22.4 Trillion and we are optimistic that together, we are going to achieve it come June 30th 2022. As of today we are 20.5 trillion, we need only about 2 trillion to finish the year successfully,” Musinguzi said.

The URA boss said unregistered traders and undeclared employment dominate Uganda’s economy.

“The current tax register has about 2.4 million taxpayers out of a population of 45 million Ugandans. There are over 7 million people engaged in income-generating activities, but many are not contributing to the tax basket,” he said.

Last week, Matia Kasaija, the Minister of Finance, Planning and Economic Development unveiled UGX48trillion budget for FY 2022-23.

Of this figure, UGX 25,550.8B (UGX 25.5 Trillion), which is about 53% of the budget, is to be financed from tax and non-tax revenue sourced internally, and the rest from aid and grants.

Musinguzi says much as Ugandans are to contribute 53% towards this budget, URA’s ultimate national aspiration is to attain economic independence where national expenditure is fully funded domestically – by all of us.

“No Nation attains true sovereignty without the ability to fully fund its expenditure without relying on external help,” Musinguzi said.

“Our hope of getting external support is dwindling by the day because even our lenders are focusing on themselves. To raise the revenue sufficient for our country, we must do much more than what we are doing today,” he said.

The URA boss Uganda’s current tax to GDP ratio has stagnated at 13%, below the average 16% of Sub-Saharan Africa.

“This has placed us in a position where we must turn to external borrowing, which often comes with unfavorable terms and conditions. Developed countries collect more than 30% of their tax on GDP. Research has shown that for any country to develop, it must collect at the very least 20% of its GDP, and we, at URA, are convinced that it is possible if every tax-eligible citizen plays their civic duty,” he said.