Uganda Revenue Authority (URA) collected net revenue of Shs9.042 trillion during the period July to December 2019 and posted a growth in revenue of 11.15 percent in comparison to the same period in the FY 2018/19, URA Commissioner General, Doris Akol (pictured), has said.

She made the remarks during the Thursday press briefing held at URA headquarters in Kampala about the half year FY 2019/20 revenue performance.

“In real terms, this reflects a growth in revenue of Shs907.05 billion,” Akol said.

However, the outturn is short of the projected figure of Shs9.739 trillion by Shs697.38 billion.

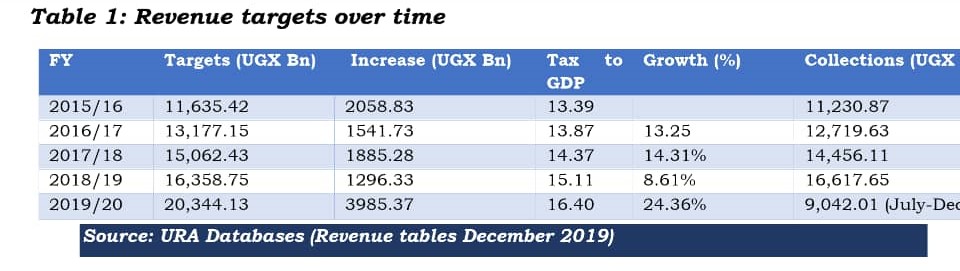

URA’s net revenue collection has consistently increased in absolute terms over the five-year period.

Total domestic revenue collections during the period July to December 2019 were Shs5.673 trillion against a target of Shs6.109 trillion.

“This outturn in domestic revenue reflects a growth of Shs831.91 billion (17.18 %) compared to the period July to December 2018,” Akol said.

She added that they have witnessed underperformance in VAT attributed to a lower than expected outturn of Shs92.02 billion on phone talk time, Shs38.27 billion on sugar, Shs28.62 billion on beer and Shs41.32 billion from the wholesale and retail trade.

However, Akol said. URA registered positive growth in corporation tax of Shs195.35 billion attributable to Capital Gains tax, which supplemented the collections from normal flows and arrears.

Withholding tax also registered a positive outturn of Shs13.40 billion.

“The International trade tax collections during the period July to December 2019 were Shs3.537 trillion reflecting a suppressed growth in customs tax revenue of 2.80%. In real terms, this is an increase of Shs96.33 billion compared to the period July to December 2018,” she said, adding that this performance was mainly attributed to low outturn in import duty of Shs82.98 billion on VAT on imports of Shs135.80 billion on petroleum duty of Shs8.64 billion and in excise duty of Shs27.21 billion.

The URA boss further added that compared to earlier years, the target for FY 2019/20 a year to year growth of 24.4%, or an increment of approximately 1.4% Tax to GDP ratio is higher than the usually projected annual increase of 0.5% tax to GDP ratio.

On factors behind this performance that saw URA register a shortfall of Shs697.38 billion for the period under review, Akol gave a number of reasons including the delayed implementation of planned policy and administrative measures that were targeted to start 1st July 2019 like; Digital Tax Stamps (DTS), Electronic Fiscal Devices (EFD) and gazzetting of withholding VAT agents, rental tax rates and the implementation of a specialized rental income tax collection solution which did not take off.

“This affected domestic tax collections leading to a deficit of Shs38.60 on Spirits and waragi and Shs37.93 billion on rental taxes. We projected to collect Shs49.46 billion from withholding VAT agents after gazetting but only collected Shs2.98billion,” Akol said.

“Overall, the policy measures yielded total revenue gain of Shs52.41 billion by the end of December 2019 against an annual target of Shs847.00 billion,” she added.

Akol noted that majority of the policies and legislative changes introduced for this financial year were revenue reducing and erosion on the existing tax base, especially the corporation income tax base.

“Examples include changes made to Section 21(1) (ae), (af), (ag) of the Income Tax Act introducing income tax exemptions for selected strategic investments. As a result of this measure, we anticipate to fore go about Shs500 billion tax revenue in this financial year,” Akol said, adding that under International Trade taxes, as a result of the policy changes, import duty is collected from only 23% of goods imported and this figure is projected to worsen with the implementation of regional trade agreements especially the African Continental Free Trade Area Agreement.

“This therefore calls for us to focus on domestic sources to mobilize revenue,” she said.

She added that during the period July to December 2019, the tax waiver on imported brown husked rice led to revenue foregone of $ 5.8 million.

“Further, other policy measures that have led to revenues forgone include; steel billets, cement clinkers, ban on importation of cars above 15 years old among others,” she said.

More stories about URA’s half year revenue performance to follow

There is an improvement big up to the ugandan government