By John Rujoki Musinguzi

Last week, I together with my counterparts of the revenue authorities in the East African Community, met for the 48th East African Revenue Authorities Commissioners General meeting to share about our revenue performances especially during the Covid19 pandemic, and to address common challenges we face as tax administrators in the region.

The meeting, which was hosted by Kenya Revenue Authority (KRA) had in attendance Rwanda Revenue Authority (RRA) Zanzibar Revenue Board (ZRB), Tanzania Revenue Authority (TRA), Burundian Revenue Authority (OBR), and Uganda.

Indeed, we shared our respective revenue collections and growth during the period from July to September 2020 and compared it with the same period last financial year. We also shared about the compliance measures we have implemented and their impact on collections.

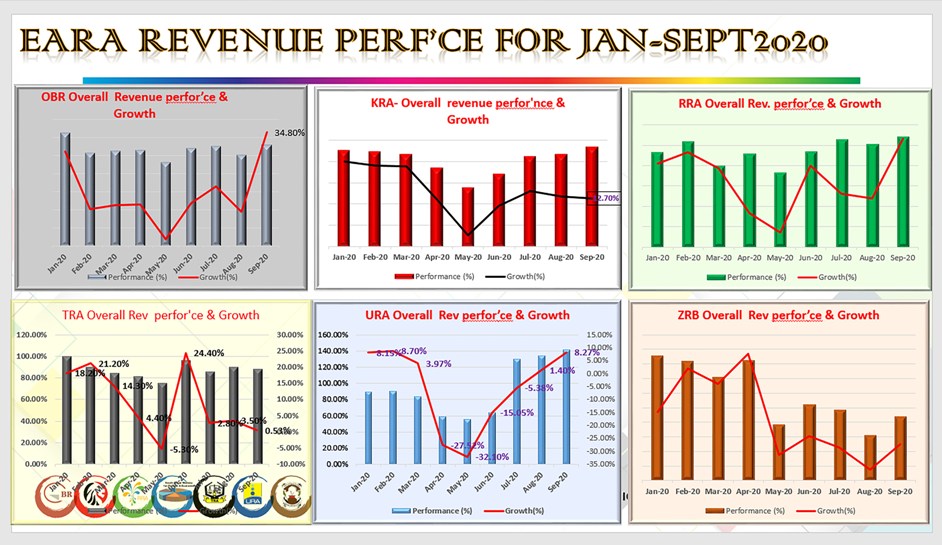

As a nation, Uganda’s overall performance against her target of the first quarter July-Sept this financial year was at 135% with a growth in revenue of 1.62% compared to the same period last year. OBR performed at 108% against their target and at a growth of 11.82%. Rwanda performed at 106% at a growth rate of 2.1%, Tanzania performed at 88.7%, and a growth of 1.5% while Kenya performed at 88.5% and a declined growth of revenue at -13.7%. Zanzibar performed at 41% of their target and registered a declined growth of revenue at -44.85%.

As indicated in the figure above, what came out strongly was that whereas all revenue administrations faced a steep decline in revenue growth due to the effects of Covid 19 lockdown, Uganda is the only country whose growth is steadily and consistently rising out of this slump (V-Shaped).For sure, God’s Grace and favor hasbeen upon our nation, but the steady recovery can also be attributed to two other factors and maybe more;

- The Government’s efficient management of the Covid19 pandemicsituation, which kept the economy hibernating even during the months of total lockdown. In particular,allowing the inflow of goods, especially raw materials for factories, allowing the factories and constructionsites that could accommodate workers to go on during the lockdown, encouraging food production and agriculture, public sensitization and observance of the SOPs and a range of other Covid mitigating measures (policy and administrative) helped navigate the nation forward.

- Re-organization at Uganda Revenue Authority

URA is currently collecting only about13% – 14% of our Tax to GDP ratio. The revenue target for this Financial Year 2020/21 is UGSh19.69 Trillion,which is only about 47% of the national budget. Our target is to double the Tax to GDP ratio and fund our national budget 100%. This is a long and ambitious journey but which we must embark on in order to develop our country.The Covid19 pandemic has re-emphasized the need to find ways to source our budgets internally, and URA is re-committing to this journey, to walk it with you.

Surplus has been registered in key tax heads of PAYE, Withholding tax, Corporation tax, Local Excise Duty on beer and mobile transactions. VAT is performing well, especially on cement and the sale of spirits. There is a high demand for cement due to the ongoing infrastructural developments in the country. International trade taxes also have performed above target due to the re-opening of the economies and supply chains.

As the economy gets back to normal, the top five performing sectors are wholesale and retail, manufacturing, Information and Communication, Finance and Insurance, and Public Administration.

Whereas we have noticed a decline of revenue in the other sectors like accommodation, education, and entertainment due to the lockdown, we are optimistic that as the Government gradually lifts the lockdown to re-open business, these too will contribute significantly in the coming months.

Compliance enhancement measures

This performance is due to several compliance measures adopted to unlock revenue. These include the use of Alternative Dispute Resolution to resolve tax disputes with taxpayers where we have collected Sh100Bn through amicable settlements.

We continue to encourage taxpayers to take up the voluntary disclosure avenue by doing a tax health check to clean their tax accounts with us without being penalized.

We have also leveraged the use of technology and data analytics to enhance revenue collection, compliance, and identification of potential revenue as well as enhancing support to taxpayers. For instance, we have rolled out Digital Tracking Solution and Electronic Fiscal Receipting and Invoicing System which are improving Local Excise Duty and VAT collections respectively.

Internally, we continue to strengthen the human resources function by advocating staff integrity through lifestyle audits and having a zero-tolerance for corruption. We are ensuring that staff are technically competent in core business areas in tax audit, tax investigation, taxing the digital economy, International tax, and data analytics.

We are also reaching out to various stakeholders in the private sector and government agencies to leverage each other’s strengths in achieving and even surpassing our revenue collections. Key areas of collaboration are in information exchange, system integrations, and tax register enhancement.

Given the prevailing measures and performance, URA is very optimistic that we shall maintain this trend until we achieve Uganda’s self-sufficiency.Therefore,the need for urgent borrowing andcash crisis recently reported in the media, can only be a result of extra expenditure pressures and not domestic revenue deficit.

I wish to thank every taxpayer who has continuously fulfilled their tax obligations, especially our top key taxpayers who we have published during this taxpayers’ appreciation season, whose revenue contribution and growth have consistently grown in the last 3 years. I also call upon other citizens to rise to the challenge of collective contribution towards our nation’s economic self-sufficiency.

The author is a Commissioner General – Uganda Revenue Authority