Uganda’s public debt has increased by 22 percent, rising from 33.99 trillion Shillings as at June 30, 2017, to 41.51 trillion Shillings as at June 30, 2018, according to the 2018 Auditor General’s report released this morning.

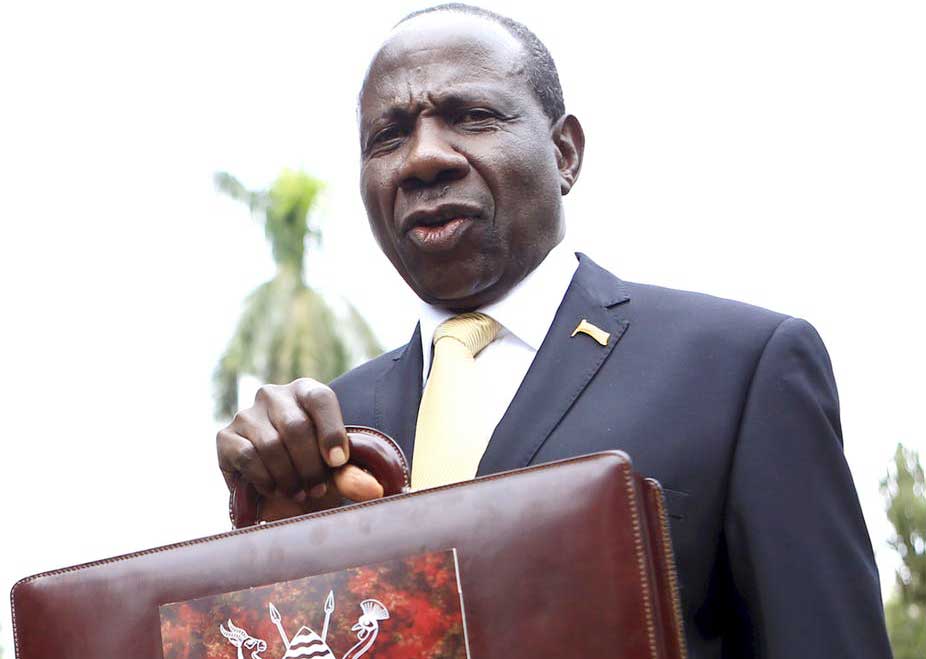

Handing over the report to the Speaker of Parliament Rebecca Kadaga, the Auditor General John Muwanga said that payment of loans worth 3.9 trillion Shillings which are 50 percent of those he has studied, expire in 2020.

Muwanga said that if the government is to service loans as projected in the next financial year 2019/2020, it would require more than 65 percent of the total revenue collections which is over and above the sustainability levels of 40 percent.

“Although Uganda’s debt to GDP ratio of 41 percent is still below the International Monetary Fund (IMF) risky threshold of 50 percent and compares well with other East African countries, it is unfavorable when debt payment is compared to national revenue collected which is the highest in the region at 54 percent”, reads the summary of the audit report.

He noted that the interest payments on domestic and external debt during the financial year 2017/2018 amounted to 2.34 trillion shillings, 17 percent of the total revenue collections, which is above the limit set in Public Debt Management Framework, 2013 of 15 percent.

“Although absorption of external debt has improved compared to last financial year, I noted some loans with absorption levels as low as 10 percent and below. An example is the USMID project with over 95 billion Shillings (95 percent) still on the various accounts of Municipal Councils by close of the year, despite various incomplete and abandoned works due to non-payment to contractors,” further reads the summary report.

Another project cited by the Auditor General is the Mbarara-Nkenda and Tororo-Lira transmission line which he said has delayed for almost 8 years resulting into the cancellation of the loan by the funder with a disbursed loan amount of 6.5 million US Dollars.

Muwanga also noted that significant value loans have stringent conditions which could have adverse effects on Uganda’s ability to sustain its debt.

He says that conditions include a waiver of sovereign immunity by the government over all its properties and itself from enforcement of any form of judgment, adoption of foreign laws in any proceedings to enforce agreements, requiring the government to pay all legal fees and insurance premiums on behalf of the creditor.

Keto Nyapendi Kayemba, the Deputy Auditor General said that their office carried out a special audit on public debt management saying that it is worrying. She said that the government needs to pay more attention to the indebtedness.

Government should create income business

Like where they can get good taxes.