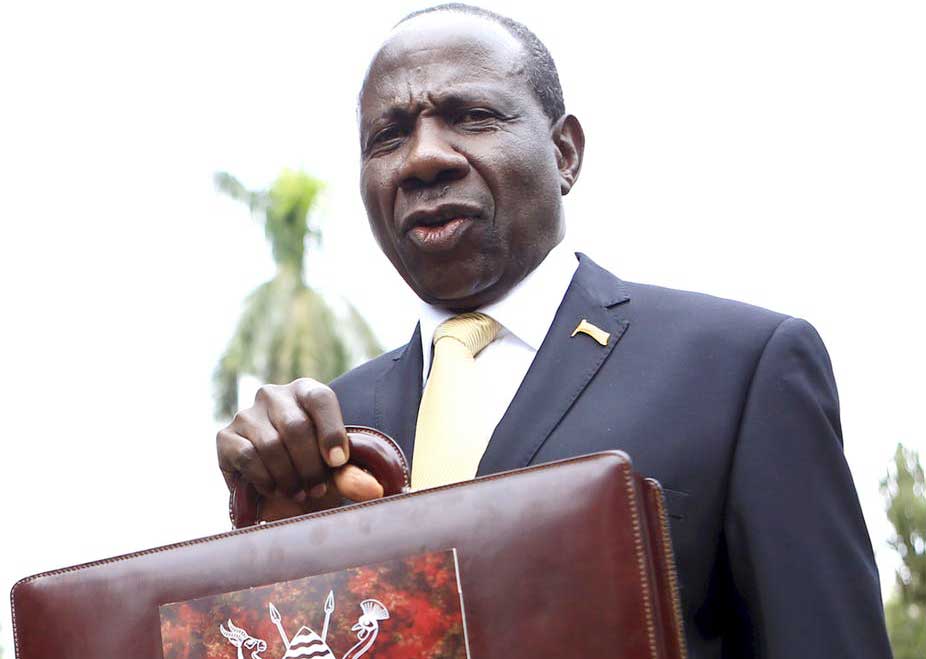

Uganda’s Finance Minister, Matia Kasaija (pictured) and his technocrats at Ministry of Finance, Planning and Economic Development are possibly facing the toughest year of their lives.

With the deadline to pass the 2020/21 National Budget fast approaching, Members of Parliament on Finance Committee have rejected several tax proposals that Kasaija and his team had come up with to fund the projected Shs29 trillion budget.

6% withholding tax on agricultural supplies rejected

MPs on the Parliament’s Finance Committee have recommended to Parliament to reject plans by Government to introduce withholding tax of 6% on payments for agricultural supplies which was introduced last Financial Year.

In 2019/20, Government had sought to remove agricultural supplies from the list of items that were exempted from the 6% withholding tax on purchase of goods and services by designated withholding tax agents.

However, Finance Committee again rejected the proposal, arguing that the proposal suffered from practical challenges when the 1% withholding tax was introduced on payments for agricultural supplies in 2018.

The Committee argued that the proposed rate of 6% withholding tax is even higher than 1% which failed to be implemented in 2018 and was scrapped and called on Government to maintain the current exemption enacted in 2019 until a clear, equitable and practical mechanism is developed to tax the SMEs in the agriculture sector.

Tax increment on fuel products also rejected

MPs on Finance Committee have also rejected the proposal by the Ministry of Finance to increase tax on fuel products.

In the proposed tax regime for 2020/2021, Government had proposed to increase Excise Duty on petrol by Shs150 per litre from Shs1,200 per litre to Shs.1350 per litre and diesel by Shs150 per litre from Shs880 per litre to Shs 1030 per litre.

Government had also proposed that Excise Duty on Kerosene be increased by Shs100 per litre from Shs.200 per litre to Shs.300 per litre.

However, the proposals were rejected by MPs arguing that an increase in excise duty on petrol and diesel will result in an increase of prices of commodities since most of them are transported from the producers to the markets as well as services as service providers will experience on increase in overhead costs.

“Similarly, salaried earners will have their disposable income reduce as they have or pay more to buy the some products. This will reduce excise duty from other products as a result of reduced spending. Kerosene is mainly used by the poor in Uganda and it is an essential commodity used by the

large majority of Ugandans as many homes are not yet connected to the national grid,” reads in part the report.

The Committee recommended, “The current Excise Duty rates should be maintained on fuel and kerosene to avoid an increase in prices of essential commodities.”

Tax Increase on alcohol, soft drinks rejected

Parliament’s Finance Committee has called on fellow MPs to reject the proposal by the Ministry of Finance to increase tax on alcohol and soft drinks, saying the move would affect consumption of the drinks and resultantly affect the contribution of these sectors to the economy.

Last month, Finance Minister, Kasaija tabled before Parliament a set of five tax bills among which was Excise Duty Amendment Bill 2020 and in the bill, Government had proposed to increase Excise Duty on malt beer by 60% or Shs2050 per liter whichever is higher); beer whose local raw materials content, excluding water is of least 75% by weight of its constituent (30% or Shs790 per litre, whichever is higher) and beer produced from barley grown and malted in Uganda (30% or Shs1115 per litre, whichever is higher).

However, MPs said in their report: “An increase in excise duty on the various beer categories does not guarantee additional tax revenue for the government. The current excise duty rates should therefore be maintained.”

Additionally, Government in the Excise Duty Amendment Bill also proposed to increase Excise Duty on beer made from local raw materials, a proposal that was also rejected by the Committee arguing that an increase will generally result into higher prices of beer for consumers.

The Committee also argued that the reduction in the volume of beer consumed will result in a reduction of taxes collected by government, further stating that the major objective of introducing affordable local raw material beers was to provide a product to the low income consumers that is hygienic and affordable as an alternative to illicit and informal local alcoholic

beverages that do not contribute to tax revenue but are also a health hazard to the people.

“If government prices formal beer or alcohol out of reach, the sector will revert to a worse situation with people opting to drink the harmful illicit brews that can result in death. This will have a negative effect on the locally produced raw materials like sorghum, barley, maize and cassava with decreased demand that will in turn affect household incomes negatively,” the report reads in part.

On the proposal to slap fresh tax on soft drinks, the Committee reminded Government that the same move was pulled on Excise duty on soft drinks in FY 2018/19 which saw Uganda emerge as the highest in the region.

As result, URA witnessed increased smuggling with the Committee stating that the high tax had encouraged smuggling of soft drinks from the neighboring countries which had lower excise duty rates.

“This will encourage smuggling from the neighboring countries and lead to revenue loss. The current rates on soft drinks and juices should be maintained to avoid loss of revenue through smuggling and reduced consumption as increase in excise duty would lead to increase in prices,” the Committee report recommends to Parliament.

The bill seeks to increase Excise Duty on wine made from locally produced raw materials from Shs2000 to 20% or Shs2300, whichever is higher. However, this will discourage domestic production in the small and medium enterprises especially in agro-processing in the fruit and vegetable sectors and specifically the processing of wine which is one sure way of fruit preservation and value addition.

The Committee stated that the new proposed excise duty will reduce the number of those engaged in processing fruits and vegetables hence reducing the returns to farmers and exposing them to few processors who will pay low prices because of reduced demand and lack of competition.

“This sector is still growing and needs to be protected as Uganda is still exporting raw fruits especially pineapples. There is need to maintain the current Excise Duty rates to encourage more investment in this sector, boost production and generate more revenue,” noted in part the Finance Committee report.

It remains to be seen where government will get tax revenue if Parliament adopts Finance Committee’s recommendations.