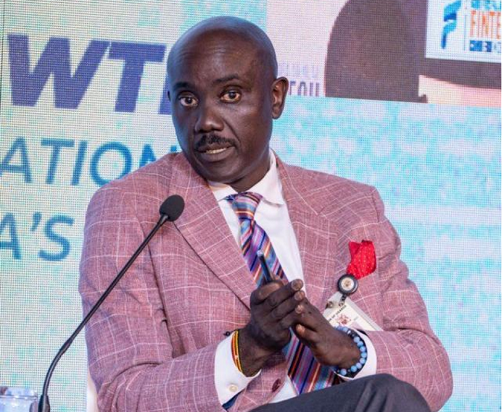

Tumubweine speaking about regulation of innovation

The Executive Director, National Payments at the Bank of Uganda has called on regulators to go slow in their regulatory mandate especially on technology, to enable space for progress.

Twinemanzi said strict regulation of any sector slows down progress and can end up being a bottleneck for development if not handled well.

He was speaking at the 6th FITSPA Annual Fintech Conference, on the topic: Leveraging Partnership and Collaboration to Drive Innovation and Growth in Uganda’s Fintech Sector, which was aimed at bringing together financial technology sector players.

Tumubweine, who is directly responsible for the regulation of financial technology firms like money transfer services, said regulators should work towards getting out of regulation by building a sector that can regulate itself, then there will be no need for regulation.

Speaking on the topic, “Unpacking the power of collaboration to deliver a robust digital economy,” Dr Tumubweine reasoned that regulators should not fight to stay ahead of innovation but follow closely.

According to him, it is prudent to recognize that regulation should follow innovation, rather than the other way round, adding that disruptions are normal for any development process because no economy “grows on order”.

He based his reason on the fact that creating a regulatory regime for any sector takes a long process and yet innovations cannot wait until all laws, regulations and policies are in place to commence.

“Regulators tend to be risk averse but “no one ever progressed by being orderly, for something new to come up, something old must be destroyed,” he said, adding that regulators ought to know that they must give support to innovation.

He said there is a risk that many regulators are not willing to adjust – either intentionally or out of lack of knowledge of the sector they are supposed to regulate – to the demands of the innovators, and this causes problems for them.

“The theme is a call to action, embodies everything we have learned over the years; that growth and innovation are fueled by strong private, public and social partnerships,” said Zianah Nyramanza, the Team Lead at the Financial Technologies Service Providers Association (FITSPA).

The organisation prides itself in bringing women into the innovation space though it is still heavily dominated by men, however, this is part of their plans to ensure women and youth are not left out.

As part of its 2024-2028 Strategic Plan, the Association vows to continue advocating for a progressive regulatory environment, enhance infrastructure and open doors to strategic funding opportunities.

“We will also continue to expand our programs for women and youth, ensuring that the Fintech leaders of tomorrow are as diverse and dynamic as the challenges they will face,” said Josephine Olok, the FITSPA Board Chairperson.

David Birch, a renowned writer and author of “The Currency Cold War” warned that innovations will continue to displace humans, with the narrative: “Employing people to work like robots” changing to “employing robots to work like humans”.

Birch, also a columnist in financial and economic publications like Forbes Magazine, The Financial Times and the Guardian says the financial sector will be the most affected, though this will help the companies cut costs of operations.

“The AI (Artificial Intelligence) period is unpredictable and the destruction is going to be big in the banking context, the future of banking is robots running everything,” he said, adding that banks will have to convince robots rather than humans that their deal is the best in the market.

-URN