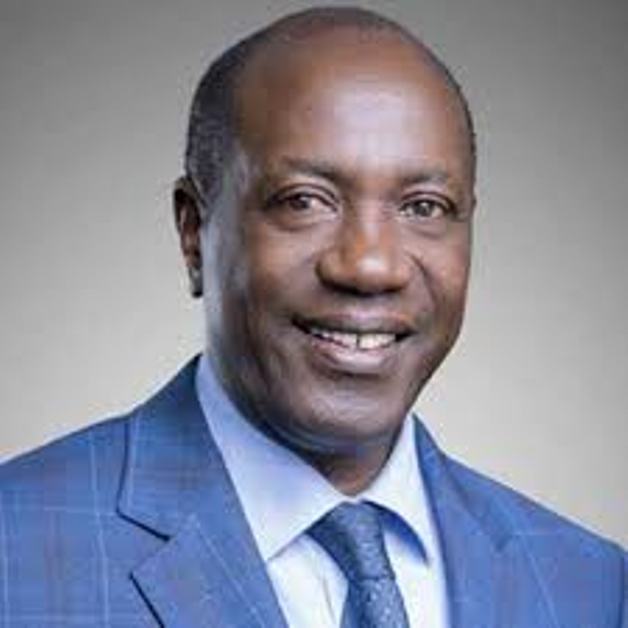

Minister of State for Microfinance, Haruna Kasolo making remarks at the launch

State Minister for Finance Haruna Kasolo has instructed the Uganda Microfinance Regulatory Authority (UMRA) to stop issuing operating licenses to online money lenders until the government establishes a mechanism to regulate them.

The instruction was part of the minister’s response to questions and concerns raised in a meeting by money lenders in Kampala on Tuesday. The response was based on an increase in complaints against operational procedures by online Money Lenders who are allegedly infringing on borrower’s privacy and the exorbitant interest rates that are charged by online lenders.

“If you are to issue a license, make sure you can supervise and regulate that business, don’t just issue a license. Until I finish with the consultation leave the online lenders alone, for now, we can just wake up and throw new things to the public,” Kasolo said.

He added that it is very risky to issue licenses to lenders who cannot be easily traced under the tier-four microfinance institutions in case of abuse. However, Kasolo says that the government is considering amendments to the tier-four Microfinance Institutions and Money Lender’s Act to solve such challenges.

UMRA Executive Director, Edith Tusuubira says that regulation of online or digital lenders remains complicated because many of them are operating illegally and charging exorbitant rates from desperate borrowers. She, however, cautioned Ugandans against dealing with anonymous lenders.

Ben Kavuya, the chairperson of the Uganda Moneylenders’ Association, says that money lenders are a crucial part of the economy since they cater to up to 52 per cent of Ugandans who can not access credit from other institutions due to various reasons.

He adds that the new breed of online money lenders has disoriented the industry, and taken advantage of the uninformed Ugandans and exploited them, to put an end to this, he called for more empowerment of UMRA such that it can effectively supervise the sector.

According to Kavuya, there is a stereotype about money lending businesses where there is a Bundling of every participant in the sector those who are operating legally and the illegal one. There is a need to differentiate between the two categories if the problems in the sector are to end.

-URN