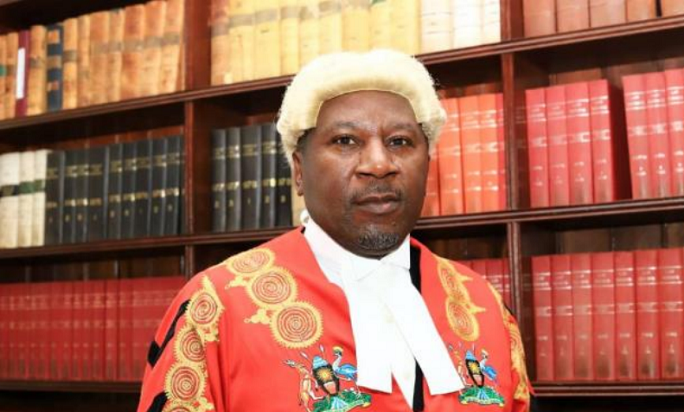

Musinguzi addressing Kikuubo traders

The Uganda Revenue Authority (URA) Commissioner General, John R. Musinguzi has resolved that spot checks on Electronic Fiscal Receipting and Invoicing Solution (EFRIS) and Digital Tax Stamps (DTS) should only be conducted on goods entering Kikuubo not every shop as has been the case in the past one week.

Musinguzi made the resolution after engaging traders in downtown- Kikuubo on EFRIS usage and DTS on Friday afternoon.

He also tasked the URA teams to ensure that traders are well sensitized before enforcement ensues, and added that DTS costs decrease as usage increases.

“Today, I had a heartwarming meeting with the business community of Kikuubo following an appeal from their leaders and complaints on social media about the enforcement of the Electronic Physical Receipting and Invoicing Solution (EFRIS),” Musinguzi said, adding: “EFRIS is not a new tax. It is an innovative technology that helps monitor Value Added Tax (VAT). During our meeting, we had a productive dialogue, and I explained that we are phasing in the enforcement of EFRIS. We have not yet enforced it for the Kikuubo traders because they are new to the technology.”

However, he said, they are enforcing EFRIS on the suppliers of Kikuubo, mainly manufacturers and big importers of goods from China, India, and Europe.

“The big taxpayers have used EFRIS for about two years and have the necessary implementation platforms. We are also conducting inspections on the usage of the Digital Tracking Solution (DTS) for goods that are subject to excise duty. Our team is verifying whether the distributors and suppliers of juices, spirits, and wines sold in Kikuubo are using both E-receipts and the digital tracking solution for their products,” he said.

The URA boss assured the taxpayers of Kikuubo that the tax body appreciates their contribution to the economy.

“They are the backbone of this nation’s distribution network, and we value their role. This enforcement exercise is not just for Kikuubo but for all the wholesale centres nationwide,” he said, adding: “As the Uganda Revenue Authority, we aim to ensure that all taxpayers are treated fairly and equitably. We have developed a strategy for sharing information to ensure everyone pays their fair share of taxes. There is no grace period for non-compliance.”

He said there was a misunderstanding of the operational orders that had been agreed upon.

“We intended to enforce the use of EFRIS on supplies going into Kikuubo, but an individual began enforcing it on sales out of Kikuubo. We are not yet at a point where we can enforce it on all for two reasons. Firstly, not everyone in Kikuubo has a computer, and secondly, knowledge of the technology is still limited among some individuals. Therefore, we have decided to focus our enforcement efforts on the supplies going into Kikuubo. After we have raised awareness and expanded the technology platforms, particularly with the launch of the mobile app, we will sensitise the Kikuubo traders and require everyone to issue EFRIS receipts,” he said.

He appreciated those who are already using EFRIS, but added “we will also give those who are not yet using it enough time to get up to speed with it. We have corrected the enforcement, and it will now only apply to supplies going into Kikuubo.”

He said taxpayers are the lifeblood of Uganda and URA is committed to ensuring that everyone pays their fair share of taxes. “We have a strategy in place for sharing information and ensuring that everyone is treated fairly and equitably,” he said.

He thanked the traders’ leadership for their unwavering support.