Trading taking place at the bourse/USE

There are 17 companies listed on the Uganda Securities Exchange (USE). Nine of the companies are locally listed while eight of them are cross listed from the Nairobi Securities Exchange.

The local companies listed on USE include Uganda Clays Ltd (UCL), Cipla Quality Chemical Industries Ltd (CQCIL) National Insurance Company (NIC), Umeme, Stanbic Bank Uganda (SBU), Bank of Baroda Uganda (BOBU), New Vision Ltd (NVL), dfcu and British American Tobacco Uganda (BATU).

The cross-listed companies are Nation Media Group, Equity Bank, KCB, Centum, Jubilee Holdings, Kenya Airways, East African Breweries Ltd and Uchumi Supermarkets Ltd.

This article will mainly focus on local companies listed on USE, highlighting their performance over the years in terms of profitability, Return on Equity (ROE), Return on Assets (ROA) and Dividends Per Share (DPS). This will help potential investors who want to buy shares in these companies make informed decisions.

This analysis is based on the Capital Markets Industry Report for 2019/20 released recently by Capital Markets Authority (CMA).

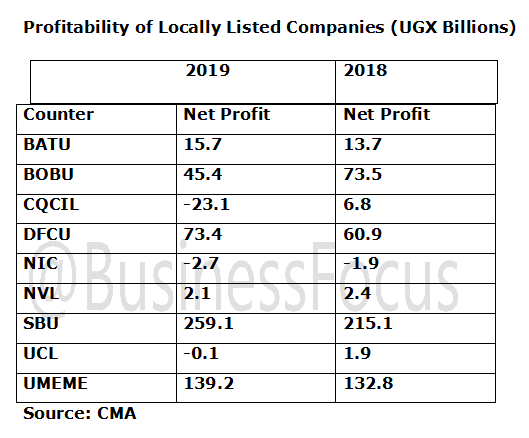

Profit

SBU registered the highest profit after tax of Shs259bn in 2019. It was followed by UMEME with Shs139bn. On the other hand, CQCIL registered the highest loss after tax of Shs23.1bn. For more details, check our easy to understand table below. It’s important to note that companies are listed in the table not according to their performance.

Return On Equity

Return on Equity is net income expressed as a percentage of total equity used to measure returns to shareholders.

According to CMA inaugural report, BATU recorded the highest Return on Equity (ROE) of 35.7% in 2019 implying that the company’s management is effectively using the company’s equity to create returns for shareholders. On the other hand, CQCIL had the lowest Return on Equity of -15.9%.

More details in the table below;

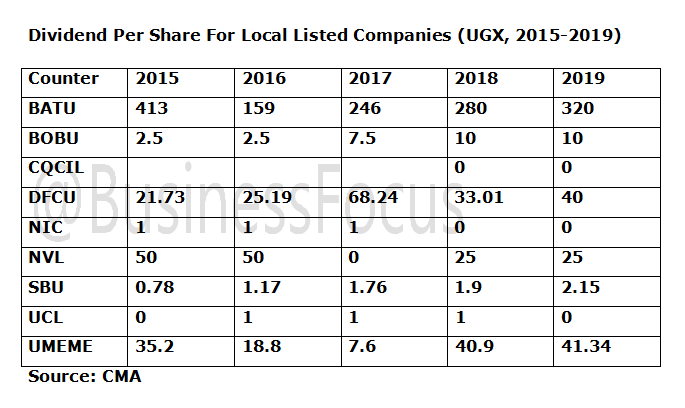

Dividend Per Share (DPS)

Dividend Per Share is the sum of declared dividends issued by a company for every ordinary share outstanding. According to CMA report, BATU posted the highest DPS of Shs320 in 2019. It was followed by Umeme and dfcu at Shs41.34 and Shs40 respectively. UCL and CQCIL had Shs0.

The table below shows DPS of listed companies over the last five years.

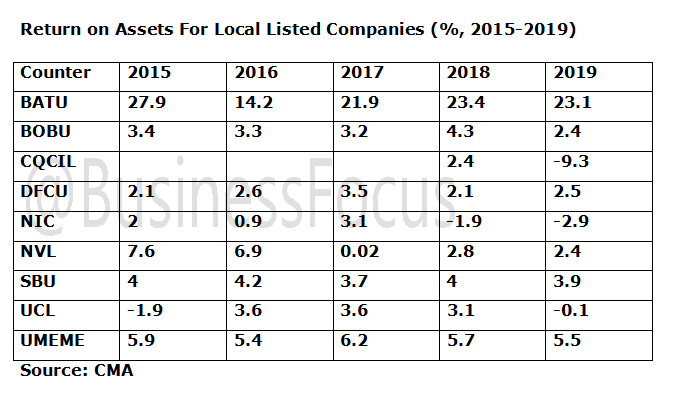

Return On Assets

Return on Assets (ROA) is net income expressed as a percentage total indicating how efficiently a company is using its assets to generate income.

BATU had the highest ROA of 23.1% in 2019 implying that the management is efficiently using its assets to generate earnings for providers of resources such as shareholders. It was followed by Umeme with 5.5%. CQCIL registered the lowest ROA of -9.3%.

The table below shows ROA of listed companies over the last five years.