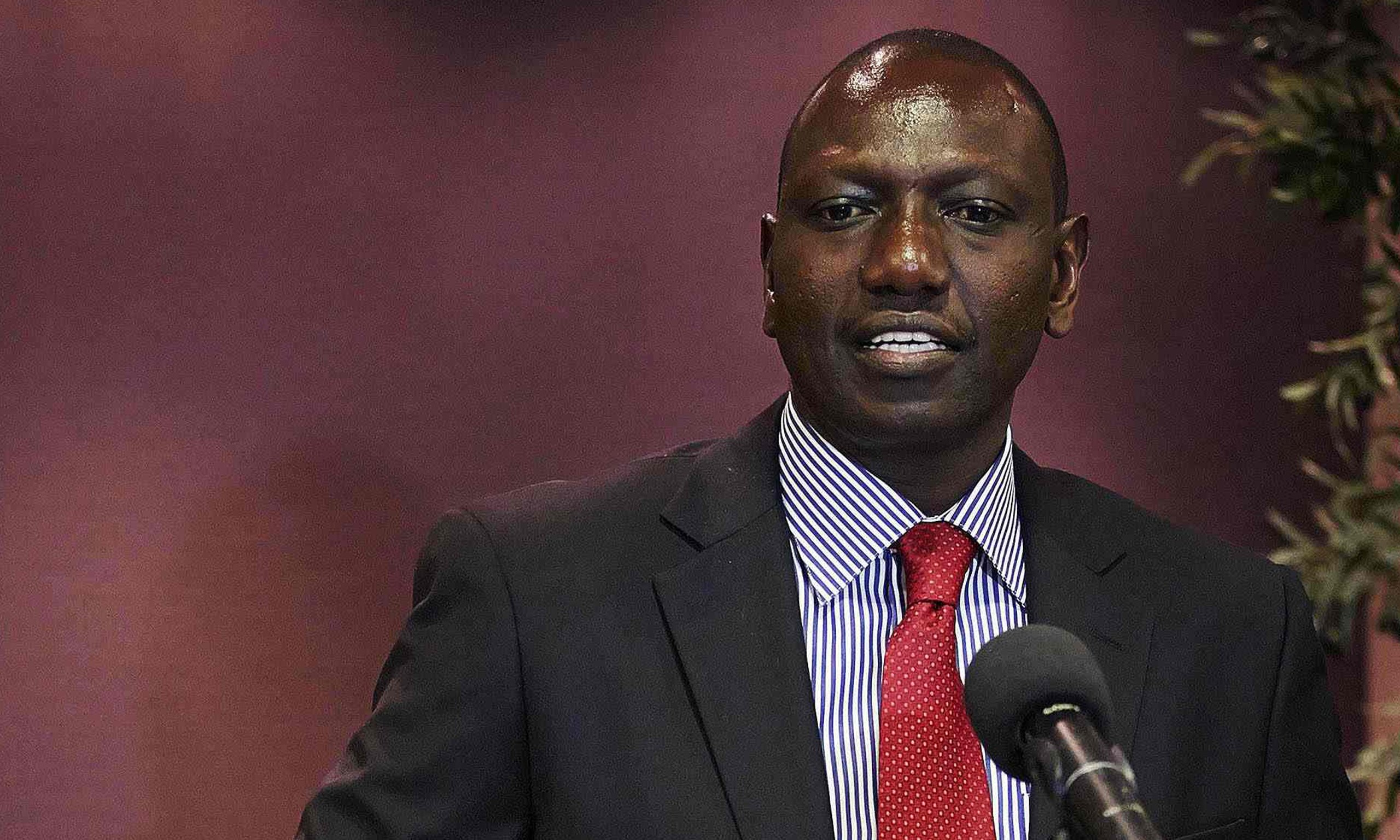

John B. Kaweesi, the Head Mortgages & Consumer Banking At Housing Finance Bank

This interview highlights Housing Finance Bank’s Remote Account Opening ‘Bwepwa’, the latest addition to their digital innovations in line with the strategy to drive customer experience through operational efficiency.

We would like to commend the Bank on its digital transformation journey. John B. Kaweesi, the Head Mortgages & Consumer Banking At Housing Finance Bank (HFB) answers the various questions about ‘Bwepwa’ Account Opening Campaign.

Q: Tell us about this Digital Account Opening

A: The HFB Mobile Banking App is a self-service platform which enables customers to send and receive money, track bank account activity, pay bills, load airtime and now, open a Housing Finance Bank account without visiting the branch. This offers the customer a faster, more convenient way to start banking with Housing Finance Bank, hence the name “Bwepwa”. The app can be downloaded from app store on any smartphone and is available for both new and existing customers.

Q: Why Remote Account Opening Bwepwa?

A: We are ever improving our customers’ banking experience. This is yet another stride on this journey through the launch of our new account opening service. Customers can now open an account with us from wherever they are, whenever they want by simply downloading the HFB Mobile Banking App

Q: How do I open an account online?

A: To get started, you need to download the HFB mobile app via the Google play store /IOS app store, open the app, and select the account opening option. You will need to have a valid National ID and phone number as one of the key requirements for this process.

Q: How many accounts can I open online at one time?

A: You can open one account type at each submission.

Q: How can I make my initial deposit to keep my account active?

A: You can deposit the money by using the options listed below;

- HFB and ABC Agent banking

- Mobile money

- Funds transfers (EFT, RTGS &TT)

- Money remittances

- HFB Branch network.

Q: What can I expect after my account is opened online?

A: It takes approximately 5 minutes to complete and submit a request which will be subjected to internal assessments. Your account number will then be sent via SMS.

One will be requested to collect their MasterCard from any of our nearest branches at should they require one.

Q: Whom do I contact if I need help?

A: If you need any help, call us on 0800211082, send us WhatsApp on 0771888755, or visit any of our nearest branch.

Q: What does the future look like for Housing Finance Bank?

A: Our strategy is consistent with that our customers’ preference, aspirations, convenience, and financial independence. This is achieved through initiatives like this one which increases the uptake of the financial services. We foresee an empowered Ugandan that has access to an array of banking and financial options that will foster financial independence.

Thanks for the information.

What could be the minimum balance for the account?