The Chairperson of Gukwatamanzi Farmers’ Cooperative Society in Bokwe, Masindi showing off the tractor the group got through dfcu foundation linkages.

Agriculture remains one of the eight priority sectors for dfcu Bank. Over the years, the financial institution has supported millions of farmers by offering flexible, affordable, and tailored financial products/services. Through the dfcu Foundation, formerly known as the Agribusiness Development Centre (ADC), the bank continues to empower small and medium-scale farmers with training and capacity-building initiatives. As Uganda gears up for the planting season amid the recent prolonged drought, Business Focus sat down with Alex Madolo, the Sector Head for Agriculture at dfcu Bank, to discuss the bank’s agribusiness financing solutions and why farmers and other stakeholders should choose dfcu as their banking partner.

Below are the highlights from the interview:

Q: After a prolonged drought, the first planting season of 2025 is approaching. What agribusiness solutions does dfcu Bank offer to existing and potential customers?

A: We provide a wide range of agribusiness solutions tailored to meet the diverse needs of farmers and other value chain actors. These include bespoke financing options for agricultural production loans, input access loans, and asset financing for purchasing tractors and other equipment. We also offer working capital for grain stocking and savings solutions. Beyond financing, we support farmers through on-farm training, insurance partnerships, and collaborations with various stakeholders, including the dfcu Foundation. Our financing options are affordable, thanks to our partnership with the Bank of Uganda under the Agricultural Credit Facility (ACF), which offers some of the lowest interest rates in the market for farmers and agribusinesses.

Q: Who qualifies to benefit from dfcu’s agribusiness solutions?

A: To qualify, one must have been banking for at least 12 months, even if not with dfcu. Additionally, for production-related loans, the applicant must have been in production for at least three productive seasons, which equates to about a year. Depending on the specific product, further requirements may apply, but the primary condition is a year of banking history.

Q: Farmers operate at different scales—small, medium, and large—with small-scale farmers forming the majority. How does dfcu Bank support them?

A: dfcu Bank supports farmers across all scales. Through the dfcu Foundation, we provide capacity-building programs for micro, small, and medium enterprises, including those in agriculture. Financial inclusion is a key priority for us, and we emphasize financial literacy. We have a product called Baraka, designed for farmers who may not have land titles. Instead, we assess loans based on sales agreements. Additionally, we offer Mobi loans starting from as low as Shs100,000, which are ideal for small-scale farmers. We also support small enterprises by collaborating with larger customers who recommend their suppliers for financing. Furthermore, we provide uncollateralized loan products specifically for small-scale farmers.

Q: What specific financing solutions do you offer for cooperatives, farmer groups, associations, and large-scale farmers?

A: We support cooperatives and organized farmer groups with tailored financial solutions. For cooperatives, we offer unsecured loans of up to Shs5 billion. We also provide group farmer loans as well as special accounts for farmer groups, associations, and clubs. These accounts have no monthly maintenance fees, helping groups stay financially cohesive. Additionally, we offer insurance support and advisory services for both life and non-life insurance, ensuring comprehensive protection for our clients.

Q: Farming in Uganda is largely seasonal, which can affect loan repayments. How flexible are your repayment terms, and how do your interest rates compare to the market?

A: We strive to offer the most affordable financing to our farmers. All our loans operate on a reducing balance basis, meaning interest is only charged on the outstanding amount. We also allow farmers to repay their loans early without penalties. For instance, if you have a six-year loan, you can pay it off early without incurring additional charges. Through our partnership with the Bank of Uganda’s Agricultural Credit Facility, we offer loans at interest rates as low as 12% per annum. We also provide special interest rates for women in agriculture, further reducing their financial burden. Our repayment schedules are flexible and tailored to the farmer’s cash flow. For example, maize farmers may not be expected to make monthly payments, while broiler chicken farmers can. We also offer grace periods based on individual agreements with our customers.

Q: There are many agriculture-related financial products on the market. What sets dfcu’s offerings apart? Why should farmers and other value chain actors choose dfcu?

A: At dfcu, we aim to build long-term, sustainable relationships with our customers. With over 60 years of experience in Uganda, we have a proven track record and a deep understanding of the agricultural sector. Our extensive network of branches, agents, and digital tools ensures that we are accessible to farmers across the country. The dfcu Foundation equips farmers with essential skills, while our shareholders, such as Rabobank, bring global expertise in agriculture. We listen to our customers and offer flexible repayment terms, flexible collateral requirements, and even collateral-free loan products. Our goal is to remove limitations for farmers and support them in building sustainable businesses. With specialized expertise in agriculture, we are committed to addressing the unique challenges and opportunities in this sector.

Q: Agriculture is one of dfcu Bank’s key focus areas, yet many consider it a risky sector. What motivated dfcu to prioritize agriculture?

A: Agriculture is central to Uganda’s economy, contributing 25% of GDP, employing over 70% of the population, and accounting for 67% of export earnings. With 80% of Uganda’s land being arable and 60% of East Africa’s freshwater resources, the sector has immense potential. Agriculture also contributes 40% of Uganda’s manufactured products. As a bank, we recognize the transformative impact of agriculture on the economy. One of our shareholders, Rabobank, is a global leader in food and agriculture financing, and we draw on their expertise to support Ugandan farmers. Our presence in remote areas like Abim and Pallisa reflects our commitment to serving the agricultural sector, which is the backbone of Uganda’s economy.

Q: There is ongoing debate about agriculture’s limited contribution to tax revenue despite its economic significance. What is your perspective on this?

A: The notion that agriculture contributes little to tax revenue is misleading. Coffee alone generates billions in export earnings, with taxes levied on every export. Similarly, flower exports attract export levies. While some agricultural imports are zero-rated, this indirectly supports other sectors, such as hospitality, where VAT is charged on food grown by farmers. Additionally, withholding taxes apply to commodity traders. The manufacturing sector, which contributes significantly to tax revenue, relies heavily on agricultural raw materials. Without these raw materials, many factories would not exist. Therefore, agriculture’s contribution to tax revenue must be viewed holistically, considering its role in supporting other sectors.

Q: How have dfcu’s interventions and agriculture-related products impacted the sector and the broader economy?

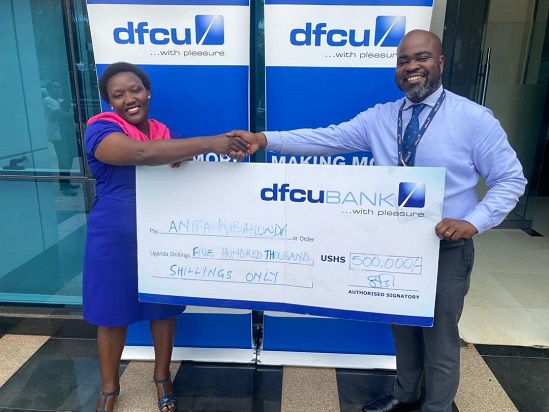

A: dfcu and agriculture are inseparable. Over the past decade, we have supported the Best Farmer Competition, benefiting over 150 winners who have received specialized training in the Netherlands. Additionally, over 3,000 farmers have been directly or indirectly impacted by this initiative. Thousands more have participated in training programs offered by the dfcu Foundation. As one of Uganda’s top lenders to the agriculture sector, we are fully committed to supporting farmers at all levels, from small-scale producers to large enterprises. Our Board, management, and shareholders are united in their support for agriculture.

Q: From your experience, what untapped investment opportunities exist in Uganda’s agriculture sector?

A: Uganda’s agriculture is predominantly small-scale, but there is growing consumer demand for transparency and quality, creating opportunities in organic farming. Agri-tech solutions, such as precision farming and drone technology, are also areas ripe for investment. Value addition and export-oriented businesses are critical, as most agricultural exports are currently in raw form. Additionally, there is potential in de-risking agriculture through insurance, accurate weather forecasting, and precision farming. Local production of agricultural inputs, which are currently imported, presents another significant opportunity.

Q: Climate change is a global challenge requiring sustainable solutions. How does dfcu Bank support farmers in mitigating its adverse effects?

A: Climate change is a pressing concern, and we are actively working with partners to support farmers in adopting climate-smart practices. We offer rebates for green ventures and provide technical assistance for sustainable projects.

Insurance is embedded in most of our production facilities to mitigate unforeseen risks. Our staff are trained in climate-smart agri-financing, enabling them to guide farmers effectively. We encourage farmers to seek information from dfcu and our officers to benefit from our green financing programs.

Q: What is your final message to farmers and stakeholders in the agriculture sector?

A: Agriculture is the lifeblood of Uganda’s economy. If you ate today, you must thank a farmer. The sector’s importance cannot be overstated, and dfcu Bank is committed to supporting farmers and other value chain actors in building a sustainable and prosperous future. Together, we can overcome challenges and unlock the immense potential of Uganda’s agriculture sector.