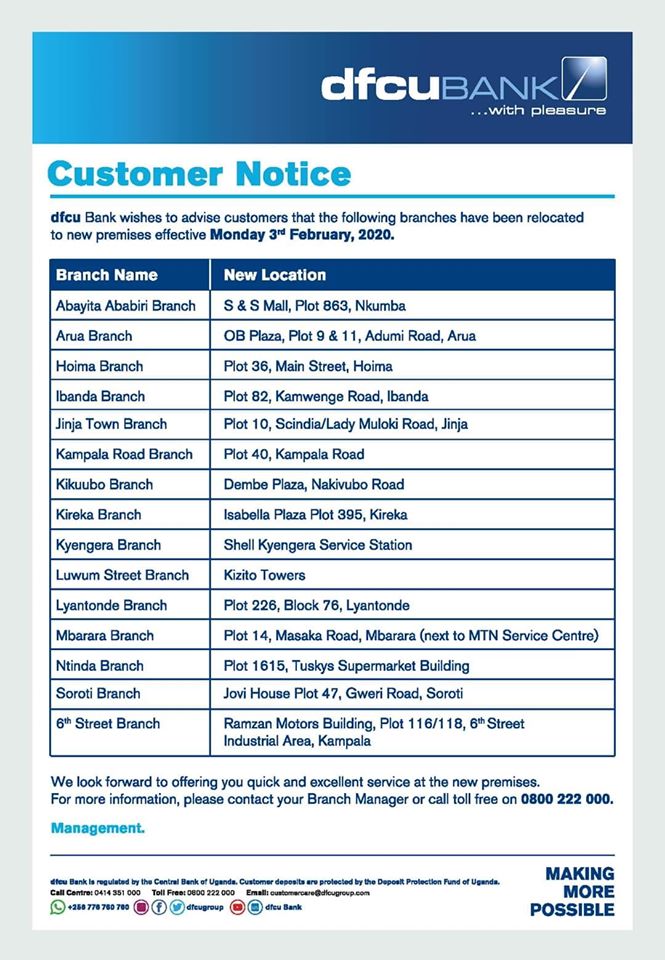

Dfcu Bank has started vacating the disputed properties owned by Meera Investments Ltd, a company co-owned by property mogul, Sudhir Ruparelia.

A notice from dfcu bank shows that the bank will vacate Sudhir’s 15 buildings and relocate the branches to new locations.

It should be noted that late last year dfcu reversed its decision to acquire 48 disputed properties sold to it by Bank of Uganda following the controversial sale of Crane Bank.

The properties in question were held under a Ruparelia Group subsidiary – Meera Investments Limited (MIL).

In its letter dated 12 September 2019 to BoU, dfcu rescinded the purchase of the MIL Properties pursuant to clause 8.7 of the Purchase of Assets and Assumption of Liabilities Agreement dated 25 January 2017 (the “Agreement”) pursuant to which dfcu Bank Limited (the Bank) acquired certain assets and assumed certain liabilities of Crane Bank Limited (in Receivership) (CBL).

dfcu expressed interest to return to BOU the certificates of titles for the MIL Properties duly re-transferred into the name of Crane Bank Limited.

“Upon receipt of vacant possession of the MIL Properties, BOU will pay to the Bank the net book value of the MIL Properties included in Note 2.3.11 of the PwC Assets and Inventory compilation (as at 20’n October 2016. under “Land and Buildings”) subject to: (i) depreciation in relation to the period from 20 October 2016 to the date of delivery of vacant possession as specified herein: and (ii) the ground rent that the Bonk would have paid for the MIL Properties from the Completion Date (25 January 2017) up to the rescission date,” the letter read in part.

It should be noted that BoU had filed HCCS No. 493 of 2017 against Sudhir Ruparelia and MIL seeking among other things the return of the reversion, but the case was dismissed.

This informed dfcu’s decision to return the properties to BoU.

“Having realized that it was unlikely that the reversion would be recovered within the 24 months, BOU requested the Bank for an extension of the contract timelines which the Bank was amenable to. Albeit subject to certain conditions which are reflected in the Bank’s letters dated 26” September 2018 and 13″, August 2019, to date BoU and the Bank have not reached any agreement on the extension,” the letter further read.

It added: “Following Court’s dismissal of HCCS No 493 of 2017 on 26th August 2019, it is unclear how long it will take BOU to recover the reversion from MIL. This state of affairs creates uncertainty for the Bank which is prejudicial to its business interests. In line with its strategic interests and risk management framework. the Board has resolved that it is in the best interest of the Bank to exercise the option to rescind the purchase of the MIL Properties.”