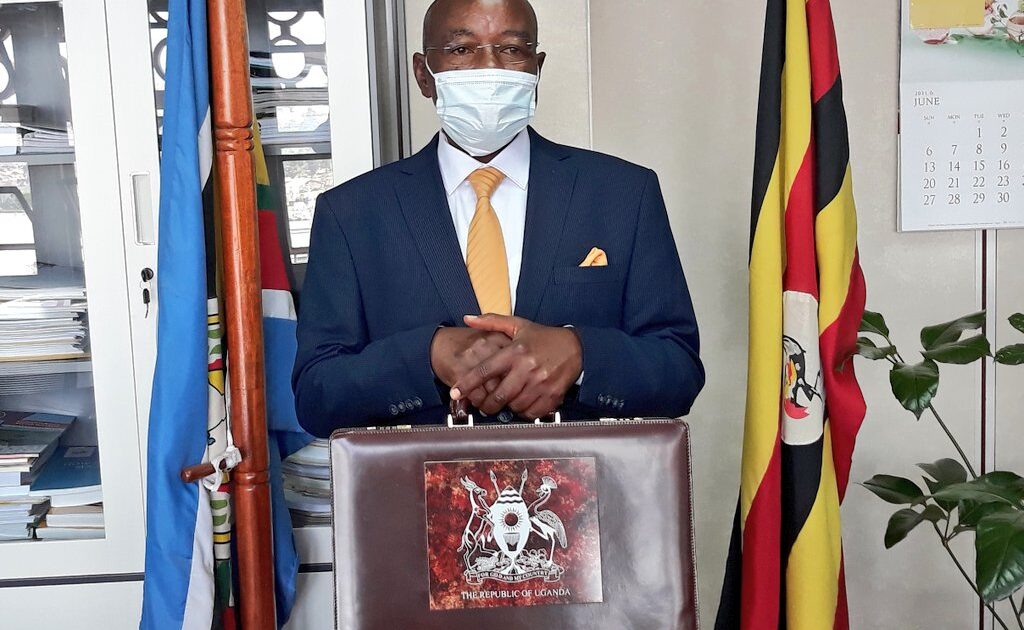

State Minister for Planning (Designate) Amos Lugoloobi read the budget on behalf of President Yoweri Museveni.

Government will next financial year spend a big chunk of the budget on interventions for human capital development, security and integrated transport infrastructure among others.

The 2021/2022 financial year budget set to come into effect on 1st July 2021 was on Thursday afternoon presented to parliament by Ntenjeru North MP Amos Lugoloobi on behalf of President Yoweri Museveni.

The budget totaling 44.7 trillion Shillings is under the theme ‘Industrialisation for Inclusive Growth, Employment and Wealth Creation.’

Under the budget, 7.7 trillion Shillings has been earmarked for Human Capital Development; 6.9 trillion for peace, security and good governance interventions; 5.1 trillion for development of integrated transport infrastructure and others.

The other provisions are 1.6 trillion for Agro-Industrialization; 49 billion Shillings for mineral development interventions; 560 billion for procurement of Covid-19 vaccines, 376.9 billion for the Judiciary; 134.9 billion to enhance digitisation of the economy.

Budget Financing

The coming financial year budget will be financed through domestic revenue amounting 22.42 trillion of which 20.83 trillion will be tax revenue and 1.58 trillion Non-Tax Revenue.

The other sources of budget financing are domestic borrowing amounting to 2.94 trillion, Petroleum Fund 200 billion, Budget Support 3.58 trillion, external financing for projects 6.86 trillion of which 5.51 trillion is from loans, and 1.34 trillion is from grants.

Appropriation in Aid, collected by Local Governments amounts to 212.4 billion and Domestic Debt Refinancing will amount to 8.547 trillion.

Amos Lugoloobi said: “The fiscal strategy for Financial Year 2021/22 and the medium-term aims to create resources to finance priority interventions, while maintaining fiscal and debt sustainability. It is premised on mobilizing a higher level of domestic revenue and enhancing returns from public investment. The Government will also undertake a review of public expenditure to improve efficiency.”

According to Lugoloobi, the Minister of State for Planning says that the local revenue will be raised from several tax measures set by government.

“The increase in tax collections will be realized from an improvement in the level of economic activity, increased efficiency in tax collection by Uganda Revenue Authority- URA through strengthening compliance and enforcement, as well as new tax measures and administration reforms,” Lugoloobi said.

Some of the tax policy interventions which will be implemented in coming Financial Year 2021/2022 are reforming taxation of rental income to remove the incentive for non-individual rental taxpayers to claim unrestricted deductions which significantly reduce their tax contribution, reduce rates of depreciation for some classes of assets, discontinue the concurrent deduction of initial allowances and depreciation in the first year of use of qualifying assets and others.

The others are reviewing the capital gains tax regime by allowing for the effect of inflation and providing tax relief for venture capital investments, broaden the scope of taxation of plastics to cover all plastics, rationalize the Excise Duty regime on telecommunication services by scrapping the excise duty on Over the Top -OTT and introduce a harmonized excise duty rate of 12.0% on airtime, value-added services and internet data excluding data for provision of medical services and the provision of education services.

The others are the introduction of an export levy of 7% on the value of fish maw exports, export levy of 5% and 10% on processed and unprocessed gold and other minerals respectively.

Tax Administration Measures

Lugoloobi told MPs that Uganda Revenue Authority- URA will implement administrative interventions to boost revenue collection by among others strengthening tax arrears management and recovery, enhance data analysis through interfaces with other Government information systems to enhance taxpayer compliance, enforce tax compliance using the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) and Digital Tax Stamps.

The others are enforcing enhanced licensing requirements for clearing and tax agents, and bond operators, improve detection of smugglers using non-intrusive inspection equipment, and close all bonded houses for imported sugar for re-export to avoid undeclaration and misclassification.

“These administrative measures will generate about 800 billion Shillings in revenue collections, and the capacity of local governments to collect revenue will be enhanced through training and ICT infrastructure,” Lugoloobi added.