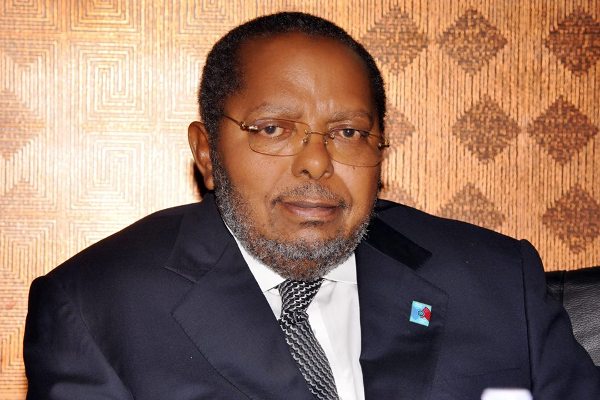

Prof. Emmanuel Tumusiime-Mutebile, the Governor, Bank of Uganda (BoU) has revealed that infrastructure investment without corresponding human capital development will not transform Uganda’s economy.

“…Public investment in infrastructure at the cost of human capital development will not support Uganda’s economic transformation. Uganda’s prosperity in the years ahead will largely depend on its skilled human capital, which is useful for innovating and has a stronger effect on economic growth,” Mutebile said.

He made the remarks at Kampala Serena Conference Centre on Friday 4 October 2019 during a conference themed “Infrastructure and Human Capital Investment for Growth and Development in Uganda.”

His statement was read by Deputy Governor, Dr. Louis Kasekende.

Mutebile noted that Uganda still faces infrastructure gaps, and there is no doubt that infrastructure bottlenecks hamper economic development.

“Public investments provide a near-term boost to economic growth and there is an enormous amount of economic evidence demonstrating that public investment is a significant long-run driver of productivity growth, and hence, growth in average living standards,” he said, adding: “In addition, well-executed high-yielding public investment programs can substantially raise output and consumption and be self-financing in the long run. However, for infrastructure to result in economic transformation, this must be combined with a skilled labour force.”

He however, noted that public investments in higher education and skills may be more growth-enhancing and strengthen the case for additional public expenditures on education.

“Expanding public investment in human capital and skills raises the question of funding sources such as taxes or changes in the composition of public spending. This, therefore, points to the need for the right mix of public infrastructure investment and social spending. I hope this conference will come up with the right mix,” he said.

He added that even if public investments spur long term growth, Uganda faces challenges regarding public investment management and financing these investments.

“Concessional financing has substantially declined but access to international financial markets has eased. Therefore, the opportunity to borrow non- concessionally to meet infrastructure needs has become very tempting, especially in anticipation of oil revenues, which serve as collateral for borrowing from international markets,” he revealed.

Mutebile added that public investments financed by public borrowing against future oil revenue is a precursor for a resource curse.

“Moreover, Uganda has a low public investment efficiency of about 0.3,” he said, adding: “If public investment is scaled up quickly, absorption capacity constraints could drive public investment costs further.

Whereas Uganda’s total public debt remains at a low refinancing risk, Mutebile added that public debt has risen sharply since financial year (FY) 2009/10, with nominal debt to GDP ratio increasing from 19.2 percent in FY 2009/10 to 42.2 percent in FY 2018/19.

“And given the current commitments on infrastructure projects, it is projected to increase further to around 45.7 percent of GDP in FY 2019/20. There are risks to the rapidly rising public debt, especially the external debt, which has risen on an annual basis at an average of about 18 percent in the four financial years to 2018/19. Therefore, it is important for Uganda to strike a balance between the need for public investments and managing public finances,” Mutebile said.