NSSF MD Richard Byarugaba makes a presentation during the Media Dialogue on Monday 7th March 2022

The National Social Security Fund (NSSF) will commence payments to eligible members for the Mid-term access in respect to Section 20A (1), (2) of the the National Social Security Act (2022), effective March 17th.

1 trillion Uganda Shillings has been earmarked for this exercise for this year, estimating that UGX50 billion will be paid out weekly over the next five months to eligible members who have applied for the benefit.

Speaking at a media dialogue at the Kampala Serena Hotel, the NSSF Managing Director, Mr. Richard Byarugaba emphasized to the media that payment systems have been put in place to enable the payments.

“Today we have started receiving applications for qualifying members of the mid-term Benefit and I want to assure all NSSF members and Ugandans that we are more than ready to start paying out money to eligible members,” Byarugaba said.

He added: “As of March 1st 2022, we had 41,174 members eligible for these payments and in accordance with the regulations – stipulated by the Minister of Gender, Labour and Social Development last week, a National ID, Verifiable mobile phone number, verifiable Bank Account, NSSF Number, 1 e-photo is all that is required to finalise the verification and application process.”

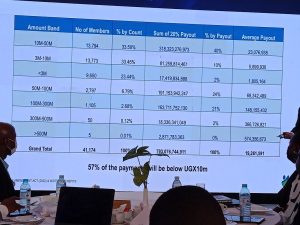

The NSSF boss revealed that the average payout for the 41,174 eligible members is UGX19.26m.

According to Byarugaba, 13,794 eligible members representing 33.50% of the eligible members will receive an average payout of UGX23.07m.

NSSF adds that an estimated 13,773 representing 33.45% of the eligible members will receive an average payout of UGX5.89m.

9,650 savers representing 23.44% of the eligible members will receive an average payout of UGX1.8m, while 2,797 members (6.79% of the eligible members) will receive an average payout of UGX68.34M.

Byarugaba further revealed that only 1,105 members representing 2.68% will receive an average payout of UGX148.155M, while 50 members (0.12% of the eligible members) will smile to the bank with an average payout of UGX366.72m.

He noted that only five (05) members (0.01 of the eligible members) qualify to receive an average payout of UGX574.35m.

“57% of the payment will be below UGX10m,” Byarugaba said.

To streamline the process, the Fund has announced that applications can be made through mobile phone (on MTN and Airtel networks), online web platform and at different physical locations that include NSSF branches, selected employer premises and at Kololo Airstrip.

Payments will then be made either through a member’s bank account or mobile money channels. Withdrawals of less than UGX 3 million will be by mobile money, as per the National Payments Systems Act, 2020, and the National Payments Systems Regulations, 2021 and a Verifiable Bank Account for those with payments above 3 million Shillings.

Eligible members for the Mid-term benefit as per section 20A of the National Social Security Fund Act, 2022 are defined as;

- A member who is forty-five years of age and above and who has made contributions to the fund for at least ten years, will be eligible to midterm access to his or her benefits, of a sum not exceeding 20 percent of his or her accrued benefits; and

- A member who is a person with disability is forty years of age and above, and has made contributions to the fund for at least ten years, will be eligible to midterm access, of a sum of 50 percent of his or her accrued benefits.

Furthermore, in line with the regulations for the National Social Security Fund (Midterm Access to Benefits) Regulations 2022, gazetted last week, eligible members for the benefit must have at least 120 monthly contributions with the Fund and may opt to apply for his benefits in installments agreed upon with the fund.

“Beyond the support to ensure that members successfully withdraw their savings, we have also boosted our financial wellness program to enable our members to continue making the best decisions regarding investment of their hard-earned money. This is advised by our research that shows that only 2% of savers who withdraw their money go on to invest it in long term projects while others fall back on hard times. We aim to ensure that we remain relevant to our savers at any stage of their journey with us,” said Richard.

The NSSF Act 2022 was first presented to parliament in May 2018 and after various revisions was passed by parliament in November 2021, assented to by the President in January 2022 and gazetted as law in January 2022.