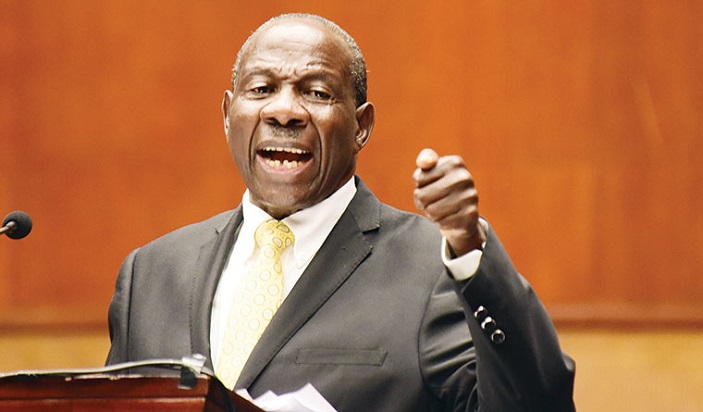

Finance Minister Matia Kasaija

Speaker Jacob Oulanyah has given Parliament’s Committee on Gender, Labour and Social Development 10 days to process the NSSF amendment bill 2021 and report back to parliament.

This is as the government Wednesday tabled six bills before parliament for assessment including the landlord and tenants bill, supplementary bill , the fisheries and aquaculture bill 2021, the Physical planners registration bill 2021

The NSSF bill was tabled by the minister of state for the Elderly Gidudu Mafwabi and after retabling the bill, the speaker directed the committee to handle the bill expeditiously and only look at the clauses that the president wants parliament to address as indicated in his letter when he returned the bill.

The president advised parliament to among others, amend the clause on the mid-term access to 20 per cent of the benefits, and allow access for those who had saved for at 10 years and clocked 45 years of age, and not either of the two. He also called for the deletion of clauses that allow a member with a disability who ceases to be employed for a period not less than one year, to withdraw 75 per cent of their benefits, saying this will put the savers at great risk of poverty in old age.

In a related development, the National Social Security Fund is anxiously awaiting the enactment of the NSSF Amendment Bill which was recently returned to Parliament by President Yoweri Museveni.

NSSF Managing Director, Richard Byarugaba believes that the new law will give the Fund management more opportunities to invest and increase the value of members’ savings. Byarugaba says while the public debate is mainly on the mid-term access clauses, the Fund has a number of interests in the proposed law, which, he says will enhance its performance, and give new and better products to savers.

Finance Minister Matia Kasaija, also pledged to fast-track the legislation because, he says it has many advantages to both the savers and the management, including increasing the number of employers enrolled, innovation in new products and protection of members’ savings.

In a bid to expand the base of the membership, the fund has put in place measures to take on small scale employers and this will be strengthened by the proposed law.

Other measures include a voluntary saving scheme and the mobile-based platform for both remittances and monitoring of one’s savings, as well as online processing of application platform that no longer requires one to go to the offices.

Byarugaba also says they have been piloting the Agro-desk Platform to help farmers mainly in the informal sector, which is aimed at helping farmers increase production and incomes by accessing them with information and helping them expand their market. Then the Fund will be able to add them onto the saver’s register.