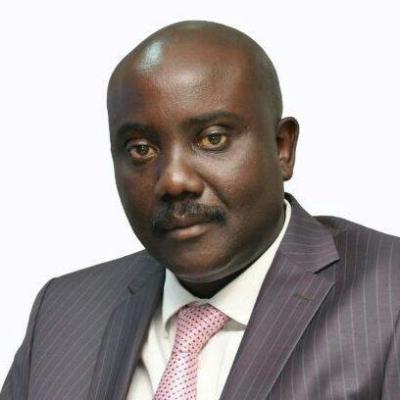

KCB Group CEO, Joshua Oigara

KCB Group will pay $40 million (UShs147.8bn) to acquire two banks in Tanzania and Rwanda in the race to deepen its presence in East Africa and rev up the contribution of subsidiaries to its profits.

The lender announced on Thursday that it will acquire a 62.06 per cent stake in Banque Populaire Du Rwanda (BPR) and a 100 per cent stake in African Banking Corporation Tanzania Limited (BancABC).

KCB, which already has a presence in the two markets, said it had signed a share purchase agreement with London-based Atlas Mara Limited and the acquisition is expected to be completed within six months.

Kenyan commercial banks are looking beyond their borders for acquisitions, seeking to tap opportunities in East Africa which are driven by rapid economic growth and trade integration.

KCB, with operations in Rwanda, Burundi, Tanzania, Uganda and South Sudan already, wants to strengthen its position in those markets and beyond, CEO Joshua Oigara told an online news conference after the deal was announced.

“When you build transactions growth through business combinations and acquisitions, you don’t stop,” he said.

“The transaction fits within the group’s expansion strategy and will see us increase our market share and distribution network across Rwanda and Tanzania and improve our operating leverage by enabling us to deliver our existing product offerings to a wider base of customers.”

KCB’s rival Equity Group had initially bid for the two banks alongside African Banking Corporation of Zambia and African Banking Corporation Mozambique but the deal was cancelled after 14 months.

Equity had agreed to pay for the four Atlas Mara banks by issuing the London-based firm a 6.72 per cent stake valued at about Sh10 billion.

The Kenyan bank, however, proceeded with the purchase of a controlling 66.5 per cent stake in Banque Commerciale Du Congo (BCDC) in a KSh10.3 billion cash transaction that was completed in August.

KCB will pay $32 million (UShs118.2bn) for the shares in the Rwandan bank and $8 million (UShs29.5bn) to fully acquire ABC Tanzania.

‘It is a cash transaction and our balance sheet is able to support. So that is how we are going to fund it,” Lawrence Kimathi, the group’s chief financial officer, told the news conference.

KCB says it intends to make an offer to acquire the remaining shareholders of the Rwandan bank who have a combined stake of 37.94 per cent.

Mr Oigara said the acquisition of BPR will see KCB double its market share to become the second largest from the current sixth position.

In Tanzania, he expects the bank to break into top 10 from the current position 13.

KCB, which requires regulatory approvals for the transaction, plans to increase the contribution to its income from regional subsidiaries to 20-25 per cent, from 10 per cent currently, in the next three to five years, Mr Oigara said.

Rwanda and Tanzania have been the most profitable of KCB subsidiaries.

-Business Daily