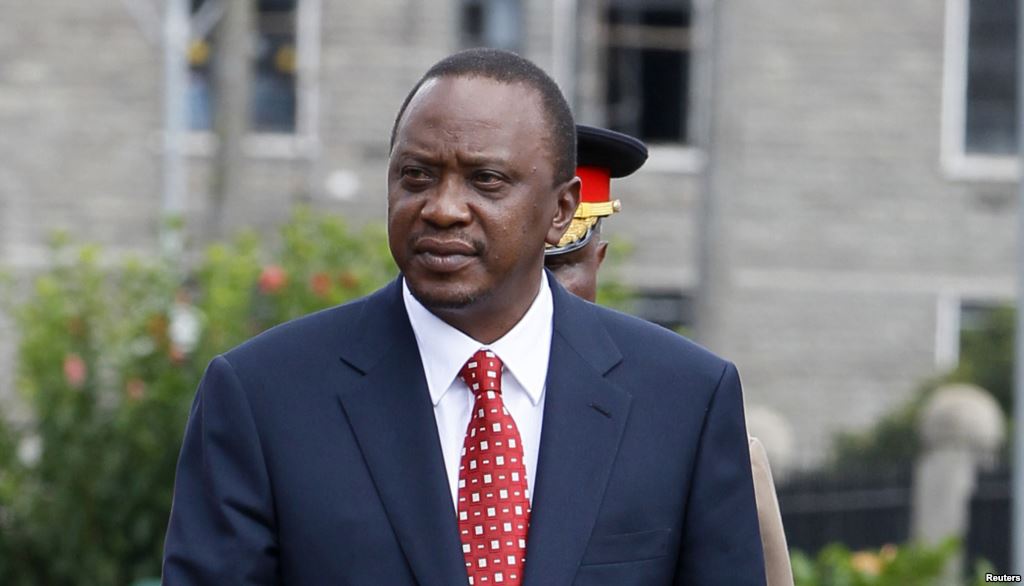

John Musinguzi Rujoki, the URA Commissioner General

Uganda Revenue Authority (URA) started the calendar year 2023 with explanations regarding the new plan for the taxation of the incomes of artistes in the entertainment industry.

This is one of the revenue measures being put in place for the financial year 2023/2024 which begins in July, with the aim of widening the tax base and increasing the Tax-to-GDP ratio which has increased from 6.83 per cent 20 years ago to 13 per cent in 2021/22, according to URA.

This means that for every 100 Shillings that Ugandans make through their economic activities, the government gets only 13 Shillings in taxes, which John Musinguzi Rujoki, the URA Commissioner General says is the lowest in Africa.

While the revenue collections by URA have grown steadily over time, save for the COVID-19 pandemic period where there was a decline, the amounts collected, relative to the value of the economy have remained stagnant.

The Domestic Revenue Mobilisation Strategy launched in 2019/2020 and running to 2023/2024 sets a target of increasing revenue collection to at least 16 shillings for every 100 shillings made by the country.

The Ministry of Finance, Planning and Economic Development now say the achievable target is increasing the ratio by 0.5 per cent year over the next five years.

This will require new efforts to widen the tax base, and going for artistes is part of them. Under the arrangement, URA directed all people in the public entertainment business like artistes, performers, DJs, VJs, authors, producers, promoters, comedians, bar owners, hotels, event managers, recreational space owners, bar owners and hotels owners to get Tax Identification Numbers (TINs), to facilitate tax collection.

A three million Shilling penalty or a jail term will apply to those who fail to comply, according to the tax body.

Taxes that are charged on the industry include withholding tax by event holders deducted from the performer, value-added tax and income or corporation tax payable by the artiste.

However, most of them have not been paying the tax due to the informal nature of the sector.

The easiest way for URA was to camp at the entrance of the concert venue and note the number of people entering, then charge the tax according to the estimated revenue.

A number of people in the industry have said they are ready to pay the tax provided the rates will be ‘within acceptable levels’, while others call for sensitisation on the whole taxation business especially the different tax categories and when they are supposed to be paid.

“We know it is an obligation for every Ugandan to pay taxes, but we need to understand more about the system. For example, how will our musicians know what VAT is,” said Abbey Musinguzi, President Federation of Uganda Promoters Association, ahead of his ill-fated New Year concert that saw a fireworks stampede lead to deaths.

Crispus Mugabi, from the Medium Taxpayers office, explains that an event organizer is a primary person in regard to payment of taxes.

However, the performer, according to Domestic Tax Officer Samuel Mukobe, also has obligations to pay taxes at the end of the day because they also generate income for themselves.

URA Commissioner General, John Rujoki Musinguzi said URA has listened to different submissions and concerns and is ready to keep negotiating and sensitizing the public on this development.

“It is important that we recognize that it is a civic duty for every eligible income earner to contribute their fair share of tax towards the development of our country. We value good stakeholder relations and we are lined up to engage this sector to understand and appreciate everyone’s role in our nation’s journey to self-reliance,” said CG Musinguzi.

The promoter’s association on Wednesday morning commenced the negotiations with URA, according to a brief statement issued after the first meeting.

“We held a successful meeting with URA in regard to the Taxation of our industry. A lot was discussed and talks into the matter are ongoing with lots of meetings lined up. We mutually agreed that there is a need for Tax sensitization within the Artistes as a top priority,” said the statement on social media.

URA says a TIN number will help in monitoring the compliance of the taxpayers and also include those that have not been paying, so as to ensure more people are in the taxpayer net. At least 147,892 new taxpayers were added to the taxpayer register during the quarter from July to September 2022, representing a growth of 5.65 per cent, and bringing the total number to 2,765,900 taxpayers. Of these, 174,020 are non-individuals like companies, NGOs and agencies.

“This means there are very few Ugandans contributing to the tax basket, yet our expectations are high, hence the need to expand the tax base so that we bring more Ugandans to contribute to national development,” says Ibrahim Bbosa, the Assistant Commissioner, Public and Corporate Affairs at URA. He reasons that there is no developed country in the world collecting taxes at a rate of less than 20 per cent of GDP.

The Commissioner General says URA wants to have at least five million taxpayers on the register by 2024/2025 if tax revenues are to help boost economic growth.

One of the measures they have put in to enhance sensitization is the introduction of the mobile tax office dubbed ‘Tujenge (Let’s Build) Bus’, which features the URA bus going to remote and other hard-to-reach areas.

“We have also increased the number of tax offices to the major towns, and one-stop shops to 44 to take our services closer to the people,” he says in a statement to taxpayers this year.

The last year has seen an improvement in revenue collections as the country’s economy continued to recover from the effects of the COVID-19 pandemic which were at their worst in 2020 and earlier 2021.

In the Quarter to September 30, 2022, URA surpassed its 5.132 trillion-Shilling target to collect 5.418 trillion Shillings. This was also 21.5 per cent higher than what was collected in the same period of the previous year.

The recovery was however threatened by the sharp rise in inflation rates in Uganda and globally mainly driven by high fuel prices, especially in the second and third quarters of the year.

Sarah Chelangat, URA Commissioner of Domestic Taxes, one of the main achievements in the last year has been to simplify the process of acquiring the TIN which is now a mandatory requirement. URA rolled out the instant TIN, a web-based TIN application procedure and in turn removed the tedious complicated processes that usually resulted in errors by taxpayers.

“These complications forced many clients to resort to the tax agents and internet cafes for help which charged exorbitant fees, and for those who could not afford, acquiring a TIN became long, tedious and sometimes intolerable,” says Chelangat.

Currently, a taxpayer only needs a National ID or, for companies, a Certificate of Incorporation and access the URA web portal for the services which can take five minutes, according to her. URA has also made efforts to ease the return filing procedures through the web-based return template for presumptive business taxpayers, or those whose turnover does not exceed 150 million Shillings a year.

-URN