The telecommunications sector is one of the most dynamic segments of the economy both domestically and globally.

The technological advancements of the Third Industrial Revolution have changed the way our global society operates and interacts with the advent of electronics, Information Technology and, of course, the Internet.

Now we stand on the cusp of a 4th Industrial Revolution, and already in the early years of the 21st Century it is apparent that one of the main drivers of the latest stage of human industrial development is data.

Just as steam- powered the productive technologies of the 1st Industrial Revolution, data fuels the engines of change in the digital age. Many core socioeconomic activities such as banking and commerce have been digitised, resulting in a wealth of data generated by consumers daily.

These digital trails have huge economic potential, but are also recipe for abuse. The past few years have seen ‘data giants’ come under fire for a host of privacy violations. The Cambridge Analytica scandal was a lesson in the harm that can stem from the misuse of data, and it emphasised the need for companies to safeguard their sensitive information which can be a powerful tool.

As a regulator, one of the Uganda Communications Commission’s core mandates is to foster competition in the industry, protect the interests of consumers and promote their welfare with regard to communication services. This extends to data, which is information communicated through electronic channels. The transactional, geo-spatial and bio-data Ugandans produce can be translated into real economic gains for consumers for increased choice, quality assurance and access to services that were previously out of reach.

Locally, we have seen an exciting upsurge of digitally powered innovations in a wide variety of sectors, from financial services to retail and transport. Retail has seen the emergence of e-commerce actor Jumia, whose platform allows merchants to expand their customer base. In the transport market, mobile-based ride-hailing apps such as SafeBoda and Bolt (formerly Taxify) have emerged to offer consumers safe, reliable, traceable transport.

Furthermore, companies such as JUMO have fostered cross-industry partnerships between Mobile Network Operators (MNOs) – who hold the transactional data that can be used to assess risk – and traditional banks with the financial infrastructure to extend credit. This collaboration allows JUMO to offer loans to those citizens too poor to access traditional credit, but who nonetheless have digital footprints through their mobile money accounts.

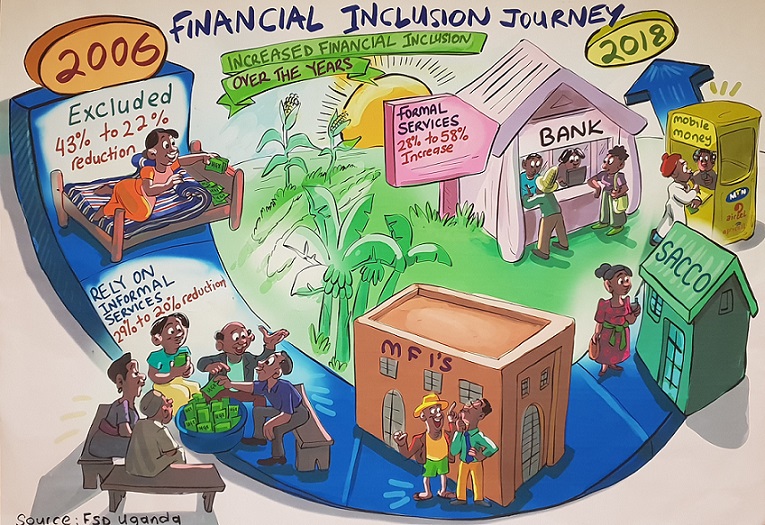

The central theme in all of these innovations can be summed up in one term: inclusivity. The Commission is interested in maximising consumer welfare so that all consumers can enjoy the same range of goods, the same safe transport and the same access to credit. The 2019 Financial Inclusion Week provides a good opportunity to reflect on the progress made so far, as well as the opportunities that exist to protect and empower consumers –information is power.

The Financial Inclusion Week offers stakeholders throughout the economy a unique opportunity to share knowledge, disseminate information and lay strategies to deepen financial inclusion. For the Commission, the ultimate objective is to achieve ‘Communication for all’ and to build a truly inclusive digital economy. It was in recognition of this goal that UCC partnered with Financial Sector Deepening Uganda (FSDU) to undertake a Data Ecosystem Inquiry.

The purpose of this scoping inquiry was to ascertain current data sharing practices by telecommunications providers, ISPs, ecommerce actors as well as other ancillary users of consumer digital trails. Consultations were carried out with various stakeholders; discussions were held on not just how firms handle and share the data they have, but also which data they would wish to access to improve their product or service. The goal of this project was to facilitate the safe, consented sharing of data between firms in such a way that deepens the links in our ecosystem without compromising user protection and privacy.

The findings and recommendations of this inquiry will help us to build a roadmap that shows where we need to go as a country. One of the most salient issues is the need for disclosure, transparency and clarity in consent terms. The Data Protection & Privacy Act (DPPA) 2019 laid excellent groundwork by clearly defining consent and making it a prerequisite for data collection, processing and third-party access. In our inquiry, we used this foundation to get to the key issue – whether consumers are able to make informed decisions regarding their privacy and how the data is used.

We asked questions like: are firms informing consumers about the data they collect, and which third parties they are sharing it with? Is consent being treated as an on-going process? Our inquiry into privacy practices in the ecosystem suggests that consent is seen primarily as an on-boarding activity, with 41% of surveyed firms acquiring consent manually at account opening. We further found limited evidence of specification of purpose or naming of third-party data sharers. Consent terms in our ecosystem appear to be both broad and opaque, which grants firms the freedom to share the data they collected at their discretion.

While this may seem disheartening, it elucidates the path to success and provides the Commission with a basis for developing standards in compliance with new Data Protection Law. These standards will aim to give consumers control over who collects what with regard to their data, and who they in turn are able to share it with. It is also important to develop guidelines for the sharing of this data, in order to keep our ecosystem competitive and encourage further innovation.

How we define privacy, the rights we ascribe to consumers with respect to their data, and the resolution of these fundamental issues, will shape the digital economy of the future. It may be difficult to achieve an ideal like data sovereignty – the principle that generators of data should have the right to access, amend and determine who can use their data – but it is in that direction that we must head. The true measure of success would be a vibrant, interactive digital economy in which consumers are truly empowered to make informed decisions about the use of their data.

By Godfrey Mutabazi, The Executive Director, Uganda Communications Commission (UCC)

This article was written to mark the 2019 Financial Inclusion Week (October 21-25).