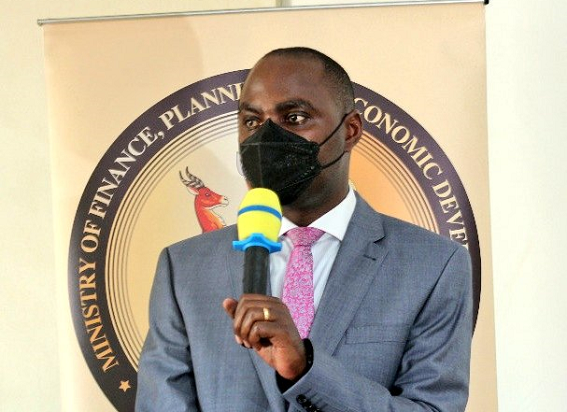

Henry Musasizi, State for Finance– General Duties

The Ministry of Finance, Planning and Economic Development has said that in the coming 2022/2023 Financial Year, there will be no new taxes introduced.

Government will instead the focus will be put on improving tax administration.

The revelation was made by Henry Musasizi (State for Finance General Duties) while speaking to journalists after the tabling a cocktail of tax bills and the 2022/2023 appropriation bill.

Musasizi said that the latest tax measures will basically streamline tax administration and bring more revenue, but they aren’t new taxes at all.

“This financial year (2022/23), we aren’t introducing any new taxes; the tax bills we have presented largely focus on streamlining revenue administration in order to get much more revenue. We have been having challenges in some provisions making it inefficient and ineffective for URA to collect taxes,” he said.

During the plenary sitting, Government tabled 11 tax bills including; The Excise Duty Amendment Bill 2022, The Value Added Tax Amendment Bill 2022, The Tax Procedures Code Amendment Bill 2022, The Income Tax Amendment Bill 2022, The Stamp Duty Amendment Bill 2022 and The Uganda Revenue Authority (Amendment) Bill 2022.

The others include; The Tax Appeals Tribunal (Amendment) Bill 2022, The Finance (Amendment) Bill 2022 and The Traffic And Road Safety (Amendment) Bill 2022.

Minister Musasizi explained that the amendment in the Traffic And Road Safety (Amendment) Bill 2022, Government is seeking to clarify on the cars that are banned from importation into the country from the proposed 15years and reduce them, although didn’t reveal the years agreed upon.

It should be recalled that in the 2018/2019 Financial Year, Parliament approved a proposal by Government to amend the Traffic and Road Safety Act varying motor vehicle registration fees provided for in the Finance Act, 2013, Varying the environmental levy on motor vehicles provided for in the Finance Act, 2006 and to ban importation of motor vehicles that are eight years old or more from the date of manufacture.

Parliament however approved the request reducing period from 8years and instead 15 years for all vehicles.

Musasizi said that the new changes seek to define the particular vehicles and specify the number of years, but not introduce new taxes.

The Minister also rejected claims that the skyrocketing prices are a result of high taxes saying, “The cause of these general prices have got nothing to do with taxation. Most of these products attract VAT at 18% and this VAT isn’t changing, it remains the same and the tax element on bar of soap doesn’t go beyond Shs1,200 and the general rise in commodity prices is result of rise in prices of raw materials and fuel for transportation.”

According to Amos Lugoloobi (State Minister for Planning), the 2022/2023 national budget is worth Shs47Trn and Uganda Revenue Authority is expected to collect Shs25Trn in taxes.

He asked Ugandans to brace for more borrowing in order to finance the budget.

He explained that whereas in the Budget Framework paper, we had about Shs44Trn and the time we came back here, the budget is reading Shs47Trn and that has been necessitated by the recommendation we had by Parliament recommending the Executive to enhance and change other provisions.

“So we couldn’t avoid raising the budget ceiling to Shs47Trn. But it is also important to recognize that this is an investment like budget because the intent of this budget is to fully monetize the economy and ensure that nobody is left behind. And the implication of that is to take money to the people not to consume but invest,” said Lugoloobi.

The Minister said that the next budget will focus on development infrastructure for the oil sector, like constriction of oil pipeline, oil refinery and Kabaale airport.

“As you heard, we have now achieved the full investment decision and all the stakeholders involved in this industry have now gone on ground. We have to deliver the oil pipeline, we have to deliver the oil refinery, we have to deliver the crude oil processing and we have to complete the airport,” said Lugoloobi.

The Minister also said that Shs400Bn has been set aside to enhance salary of scientists.

CSOs Welcome Gov’t Move

Meanwhile, Civil Society Organizations (CSOs) have welcomed the government decision not to introduce new taxes in the coming financial year, saying that introducing new taxes is not the only solution to growing the revenue base.

Regina Navuga, a Tax Expert at SEATINI Uganda, says taxes should be introduced on foreign digital companies who are not paying their fair share of taxes.

“Government needs to review the already existing taxes to understand what is working, where the gaps are and come up with key strategic interventions on how to close the tax loopholes,” Navuga says, adding: “At the moment, the cost of living is high, so we need to use tax policy as a tool to address some of these challenges.”

She adds that Tax Justice Alliance Uganda members will review the tax bills and come up with a position which will be presented to Parliament.