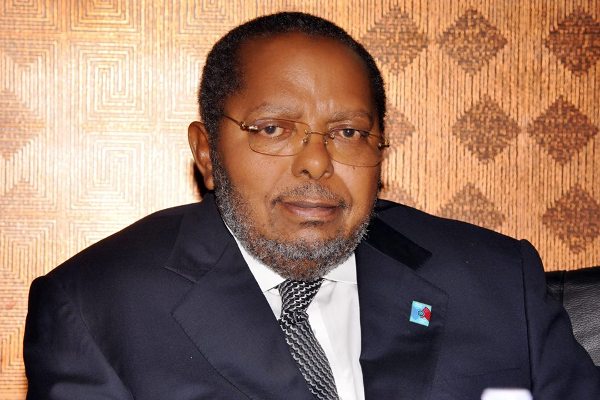

The Bank of Uganda Governor, Prof. Emmanuel Tumusiime-Mutebile has hailed the introduction of mobile money in 2009 as a game-changer in Uganda’s financial sector.

Speaking on Financial Sector Deepening Uganda Breakfast Discussion on “Redefining Financial Inclusion” held at Kampala Serena Hotel on Wednesday, July 10, 2019, Mutebile acknowledged the unprecedented impact of the supply side of financial inclusion to date as a foundation for future initiatives on the demand side.

“The introduction of mobile money services in Uganda during March 2009 revolutionalised the formal financial services sector. After several years of stagnation in the uptake of formal financial services, mobile money pushed formal usage from 28 percent in 2009 to 58 percent in 2018,” Mutebile said.

He added: “Mobile money and other supply-side technological developments have redefined financial inclusion through reduction of transaction costs, counterparty risk, and information asymmetry.”

He however noted that the technology-driven financial infrastructure of today and tomorrow will count fully when it is made accessible to consumers with knowledge, skills, and confidence to constructively engage with the financial system.

“… I must say that regulators favour empowered financial consumers who contribute to financial stability through effective management of personal financial risk. Indeed, the Bank of Uganda (BoU) in partnership with the Ministry of Finance Planning and Economic Development as well as friendly donors are is championing effective financial inclusion through a multipronged approach that prioritises financial literacy among other initiatives that are elaborated in the National Financial Inclusion Strategy,” he said.

He added that the BoU also has a duty to ensure that the regulated financial institutions fruitfully balance risk mitigation and innovation, by championing smart regulation while supporting financial sector deepening.

“It is in this vein that we championed the amendment of the Financial Institutions Act to support agency banking, bancassurance, and Islamic finance, which are expected to enhance financial intermediation and extend access to financial services in a rationalised manner,” he said, adding:”A particular challenge that remains for all the stakeholders in fostering financial inclusion is the derisking of the agricultural sector, which employs the majority of our people.”