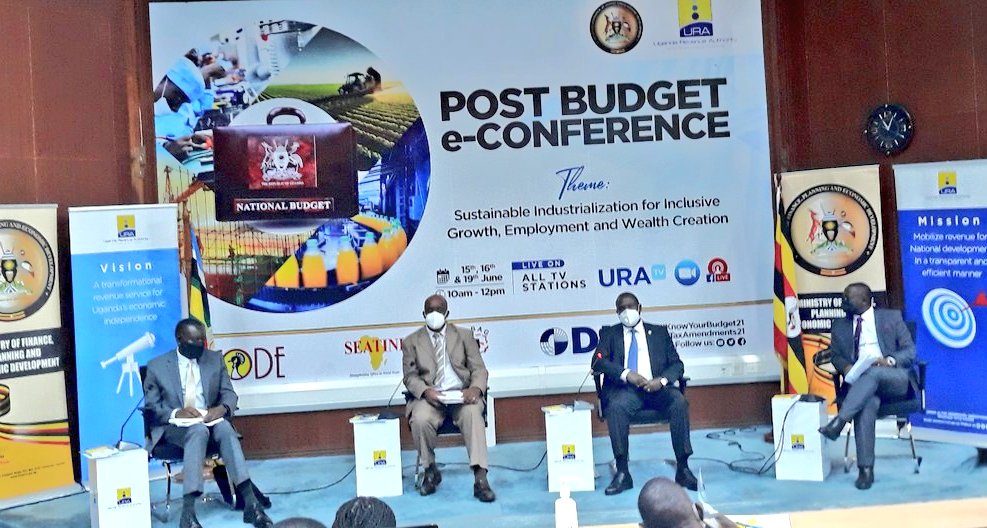

Atingi-Ego (L), Mukunda and Ocailap (2nd R) during the discussion.

Program based budgeting as adopted by the government ahead of the Financial Year 2021/22 is expected to among others, deliver the country to quick recovery from the Covid-19 stress on the economy.

This discussion formed part of Tuesday’s Post-budget e-Conference 2021 engagement at the Statistics House in Kampala held under the theme: Industrialization for Inclusive Growth, Employment and Wealth Creation.

The conference is organized by Uganda Revenue Authority in partnership with Ministry of Finance.

Panelists including Ag. Permanent Secretary, Ministry of Finance, Planning and Economic Development, Patrick Ocailap and Deputy Governor, Bank of Uganda, Michael Atingi-Ego agree that the program-based budgeting is the way to go.

They argue that with program based budgeting, Parish Development Model which was introduced will deliver services at the Parish level which is the lowest planning unit thus creating income and generating opportunities at the 10,594 parishes in the country.

Julius Mukunda, the Executive Director, the Civil Society Budget Advocacy Group (CSBAG) says whereas the program is good, he is concerned about the cost at which the government will deliver the program.

Mukunda’s worry comes from a background that a lot of the country’s money goes into administration of actual projects.

Now, ahead of the 2021/22 FY, sector players are still concerned about how the country recovers from the Covid-19 shock.

However, Ocailap says the government has put in place measures such as speeding up procurement of vaccines so that at least 22 million people are vaccinated to facilitate full reopening of the economy.

According to Atingi-Ego, the issue right now is, how do we save lives, stabilize businesses as well as the economy.

He says the Central Bank has maintained the key lending rate at 7%. This, he says, will encourage borrowing but also give commercial banks access to credit.

Atingi-Ego says there is still uncertainty about what will happen after the 42 days of partial lockdown.

“We are yet to understand the impact of this partial lockdown. There is that uncertainty,” Atingi-Ego said.

But Ocailap says to sustain the economy, the answer lies in three areas of vaccinating teachers (as schools employ many), put up isolation centres at least 5 kilometers from the school and link them to a health facility.

“There should be health workers competent enough to handle the isolation centre,” he said.

This, he says, will help the schools to open up. Secondly, he argues that there should be a deliberate measure to expand the country’s capacity to produce oxygen. He says this should go hand-in-hand with expanding the capacity of hospitals to manage Covid-19 cases. SOPs (Standard Operating Procedures), he says, should be extended to schools.

According to Mukunda, the country’s intervention to stabilize the economy through the central bank has almost reached its limit. He says the government should extend relief to particular sectors.

“It’s not only education but probably all these small businesses,” Mukunda says.

He suggests that the government should register all businesses in the country so that it is easy to track in times when businesses have to be given relief. Above all, he says where to spend some money and still recoup some is important at this stage.

“Stop asking for what requires resources. Where can we spend money and still recover it, and where can’t we? Ensure that what we spend, we are able to account for it. We need transparency and accountability even in situations like this,” he says.

Speaking virtually during the engagement, National Planning Authority (NPA) Executive Director, Dr. Joseph Muvawala said whereas he is not impressed by allocations in terms of budgeting, the country is operating under abnormal situations.

“I don’t think we have done justice, not because we don’t want it but because the situation is abnormal,” he said.

Responding to this, Ocailap said “we are getting our priorities right except the resource envelope is very limited.”

According to Mukunda, there should be targeted policy actions. “Is UDB ready to do that?” he says. He says UDB (Uganda Development Bank) is for ‘big guys’ in business and not for grain millers.

But to deal with UDB, Ocailap says, “We owe a duty to encourage traders to keep books of accounts for institutions that may need access to credit.”

He says businesses should go formal. The issue of the country’s debt also emerged amidst the discussion.

The Finance Ministry says that whereas debt is projected to rise to 51.9% of GDP in FY 2021/22 on account of borrowing for infrastructure projects, this debt will decline on account of increased domestic revenue.

Atingi-Ego is optimistic that with the recently signed oil deal and the program-based budgeting, the debt to GDP is likely to drop below 50%.

Already, Ocailap says the ministry is not looking at wastage. For instance, he says accounting officers who will not put money to use will be punished.

“Finance Ministry will, in September 2021, come up with recommendations targeting sectors which have failed to absorb borrowed funds to finance development projects,” he said.

He noted, Accounting Officers will have to explain why these funds cannot be used which makes the loans expensive.

PRIVATE SECTOR

The private sector says there is not much to expect from the budget.

KACITA Uganda Chairman, Everest Kayondo says the government has never come to the rescue of businessmen and women ever since Covid-19 hit the sector. “So, we don’t expect much,” he said.

According to Uganda Manufacturers Association (UMA), even if the government pumps money in UDB, accessing the money is a challenge. “100 billion is little money. When I go to UDB, I am not going for 100 million. I am going for 3 billion, 4 billion or 5 billion,” Deo Kayemba said.

He said even if the government cannot support businesses, they can still do without the money. “There should be other better ways of supporting SMEs, maybe through fair tax policies to make SMEs more profitable,” he said.

Daniel Joloba, the Co-founder of Rwaboni Group, an agro-processing firm agrees with Kayemba. He says the government does not need physical incentives to support businesses. Kayondo thinks that businesses need financing for the entire value chain.