Taxi bodies in East Africa have resolved to introduce digital service tax.

The resolution was taken at the 50th East Africa Revenue Commissioners-General meeting (EARACGs) at Serena Hotel Kigo, Wakiso District.

Kenya has been the only country in the region with the tax and having given its experience, other member states decided to benchmark Kenya and adopt the tax too, in an effort to grow revenue collection.

Kenya is also still learning about the performance of the tax charges 1.5% but members proposed a 5% levy. As businesses become more technologically innovative in doing business, the tax administrators had remained behind, leaving the digital economy outside the tax bracket.

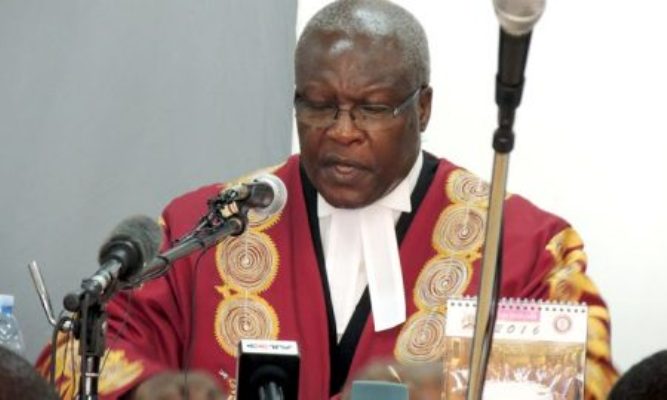

Uganda Revenue Authority Commissioner General John Musinguzi said it was important for the region’s member countries to grow revenues to help their countries become self-sustaining in development funding.

Musinguzi explained that among the resolutions carried from the forum was harmonizing tax administration and data systems in the region with a special focus on technology in “tax management for today and the future.” The overall goal is to improve efficiency and grow revenue.

However, Musingiuzi highlighted three areas that also included taking measures to address cross-border smuggling, which remains a big problem among neighbors Uganda, Kenya, South Sudan, Tanzania, Rwanda Burundi, and the Democratic Republic of Congo (DRC).

Among the strategies agreed upon to address smuggling are instituting electronic cargo registration and tracking system where cargo is registered at the point of entry and tracked up to the supposed exit.

Kenya Revenue Authority Commissioner General Githi Mburu explained that electronic “smart” gates at points of entry and exit would be installed in this effort. These will register cargo vehicle numbers, and record cargo weight, which similar data should collaborate at the point of exit. Any discrepancy would be ground for questioning the cargo handler.

Drones will also be introduced to monitor cargo movement. Kenya has already introduced these and is in the process of procuring many more to do cargo surveillance. Members also agreed to adequate staffing at the points of entry and exit.

At a policy level, regulators agreed to implore policymakers to harmonize tax rates in the respective countries to “kill motivation for smuggling,” according to Mburu.

Member states are also expected to institute measures to plug loopholes where taxpayers exploit one country against another to avoid tax.

The Permanent Secretary and Secretary to the Treasury, Ramathan Goobi underscored the need to develop innovative technology-driven approaches to “sustainably facilitate taxpayer compliance in a user-friendly, accessible and understandable manner.”

He urged tax administrators to comprehensively engage in research and studies to inform and facilitate policy formulation to address issues of effective tax rates, simplicity of tax regimes enhancing compliance, revenue growth, and appropriate tax structures.

He observed that though there had been sustained revenue growth for the last ten years, member states still fell far below the sub-Saharan average tax-to-GDP ratio of 18%, calling for more work to be done to meet development challenges.

He called on tax administrators from the region to leverage themselves as a vanguard for tax policy domestically and regionally.

The East Africa Revenue Commissioners-General meeting is a bi-annual event and the next meeting is scheduled to take place in Tanzania on August 25th and 26th, 2023.

-URN